SYDNEY, Wednesday 10 August – The July 2022 CreditorWatch Business Risk Index (BRI) has revealed that external administrations and court actions are on the rise as the era of cheap credit comes to an end and businesses with depleted cash reserves and thinning margins confront yet more challenges.

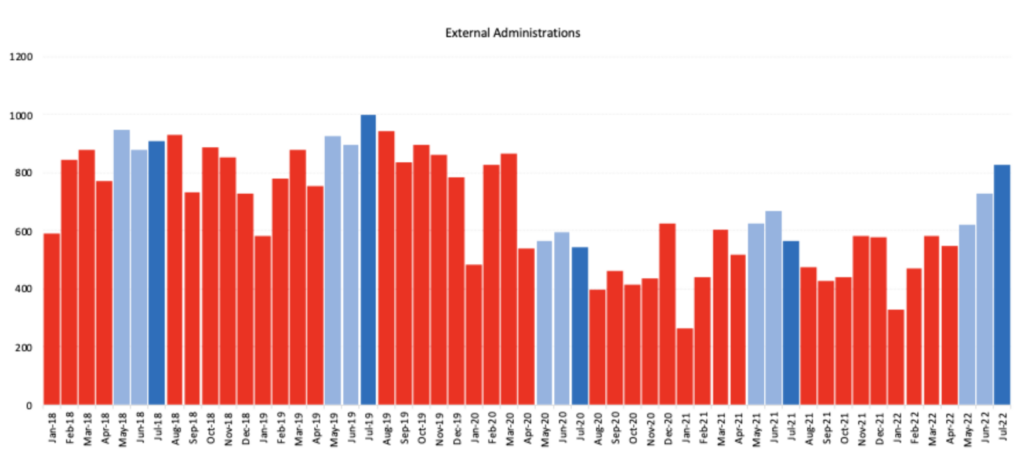

CreditorWatch’s Business Risk Index data for July shows external administrations have risen 50 per cent since April and are up 46 per cent year-on-year, while court actions are up 54 per cent year on year.

This is consistent with the ATO’s decision to ramp up activities such as garnishees, director penalty notices and legal actions.

CreditorWatch continues to forecast a rise in business insolvencies across H2 2022 as multiple impacts batter the economy.

On the positive side, trade receivables are at their highest point since June 2021 and up 3.4% year-on-year, however, we note NSW and Victoria were heavily impacted by lockdowns in July 2021.

Key Business Risk Index insights for July:

- External administrations are surging – up 46 per cent year-on-year in July.

- Court actions are up 54 per cent year-on-year and will continue to rise as the ATO ramps up legal actions.

- Average trade receivables for July are at their highest point since June 2021.

- Our three industries with the highest probability of default are all reliant on solid discretionary spending growth, which is fast disappearing.

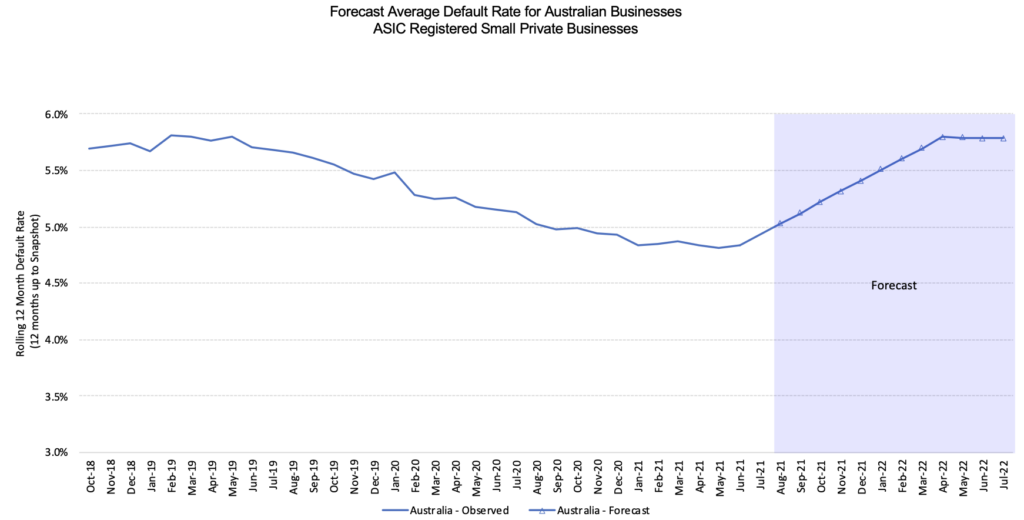

- The Business Risk Index national default rate remained flat at 5.8 per cent in July. We note that it is likely that our forecast default rates will climb, given the deteriorating economic outlook.

- CreditorWatch continues to forecast a rise in business insolvencies across 2022 as multiple adverse impacts continue to batter the economy.

- Cottesloe-Claremont is WA is the lowest insolvency risk region with greater than 5,000 businesses.

- The Western Sydney regions of Merrylands–Guildford and Canterbury are the highest risk regions in the country with greater than 5,000 businesses.

Source: CreditorWatch trade receivables data (accounting software integration)

CreditorWatch CEO Patrick Coghlan says that the ‘hands off’ approach to debt collection adopted by the ATO and many lenders during the pandemic is clearly over.

“The massive rise in external administrations is certainly a disturbing trend – now up 50 per cent since April,” he says. “Our data shows that court actions are back to pre-COVID levels and the ATO has also stated that it is ramping up legal action for outstanding debts.

“With business and consumer confidence declining and inflation and interest rates on the rise, this doesn’t bode well for businesses, particularly SMEs whose cash reserves were depleted during the pandemic and are now operating on much tighter margins.”

According to CreditorWatch Chief Economist Anneke Thompson, those businesses that in the capital intensive growth phase are particularly at risk in the current environment.

“When interest rates were low and the world was awash with cash, investors were hungry for investment opportunities, and willing to move up the risk curve to find good returns,” she says.

“Now that cash is being consumed by ever increasing prices and debt costs a lot more, the appetite for risk is dropping. Start up businesses or those in the growth phase are always deemed more risky. We have already seen this phenomenon hit the tech sector, and many well known companies are being repriced to reflect this.

Small business default forecast

The small business default rate remains unchanged from last month. However, we still expect that this default rate outlook will increase, especially when we start to see a real slowdown in consumer spending.

Source: CreditorWatch Business Risk Index – Business defaults defined as entering external administration or strike-off.

Probability of default by region

The five regions* at least risk of default over the next 12 months are:

1. Cottesloe-Claremont (WA): 4.91 per cent |

2. Adelaide City (SA): 4.99 per cent |

3. Yarra Ranges (VIC): 5.00 per cent |

4. Ku-ring-gai (NSW): 5.00 per cent |

5. Toowoomba (QLD): 5.08 per cent |

The five regions* most at risk of default over the next 12 months are:

1. Merrylands-Guildford (NSW): 7.79 per cent |

2. Canterbury (NSW): 7.53 per cent |

3. Surfers Paradise (QLD): 7.49 per cent |

4. Auburn (NSW): 7.39 per cent |

5. Ormeau-Oxenford (QLD): 7.36 per cent |

* Regions with more than 5,000 registered businesses

There continues to be a wide variance in the likelihood of default across the country. Once again, those areas that have a high proportion of households with a mortgage as well as lower incomes are among the regions with the highest probability of default.

These areas also have a large number of current housing subdivision activity, also increasing the risk as owners in these areas, on average, have owned their houses for a shorter period of time, putting them at greatest risk of breaching LVR covenants. Conversely, the areas with the lowest risk of default tend to have longer term home owners.

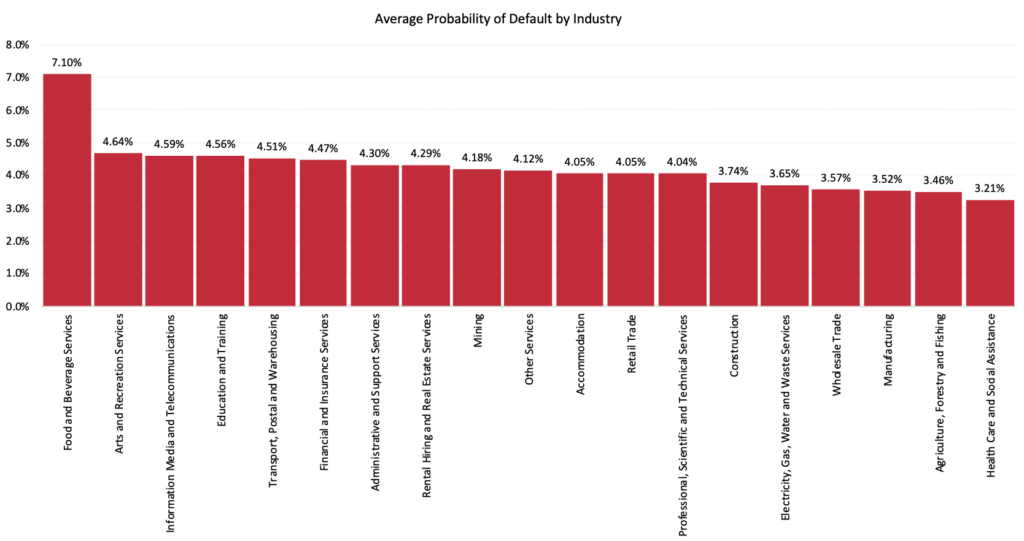

Probability of default by industry

The industries with the highest probability of default over the next 12 months are:

- Food & Beverage Services: 7.10 per cent

- Arts and Recreation Services: 4.64 per cent

- Information, media and telecommunications: 4.59 per cent

The sectors where demand is most likely to fall when consumer spending eventually falters continue to have the highest likelihood of default. The food and beverage and arts and recreation services sectors also have a large number of relatively inexperienced, smaller operators, which further increases their risk profile.

The industries with the lowest probability of default over the next 12 months are:

- Health Care and Social Assistance: 3.21 per cent

- Agriculture, Forestry and Fishing: 3.46 per cent

- Manufacturing: 3.52 per cent

The healthcare sector continues to experience huge demand as COVID and other respiratory illnesses affect Australians in huge numbers. While this is a short term impact, long term, our ageing demographic will mean that healthcare will be a sector operating at close to capacity for the foreseeable future.

Source: CreditorWatch Business Risk Index

Outlook

Given that the Reserve Bank of Australia (RBA) does not expect high inflation to abate until 2023, businesses will have to expect worsening cost pressures going forward.

When this is met with reducing demand in the industries most exposed to discretionary spending or the housing market, it can result in real financial pressures. Right now, spending is holding up, and this helping businesses deal with cost increases.

The RBA, however, is making it a priority to reduce demand, so businesses need to be prepared.

Get started with CreditorWatch today

Take your credit management to the next level with a 14-day free trial.