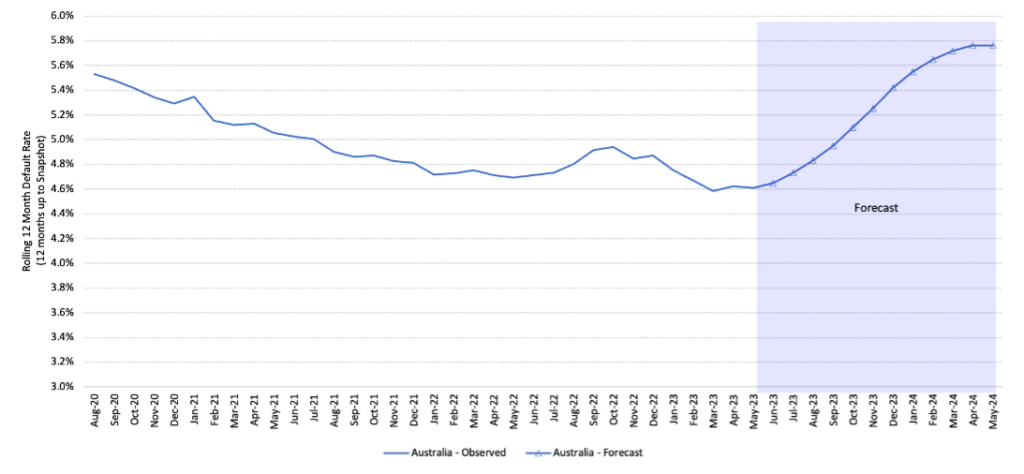

Several leading indicators in the May 2023 CreditorWatch Business Risk Index (BRI) show Australian businesses are coming under increasing pressure.

External administrations, B2B trade payment defaults, court actions and credit enquiries are all trending sharply upward as Australian businesses grapple with rising interest rates, high inflation, decreasing demand and declining forward orders.

CreditorWatch Chief Economist, Anneke Thompson’s view is that the RBA is unlikely to consider lowering interest rates until at least mid-2024, given core inflation remains stubbornly high.

The index results are consistent with other economic indicators such as the NAB Business Confidence Index, which is showing an accelerating decline in trading conditions.

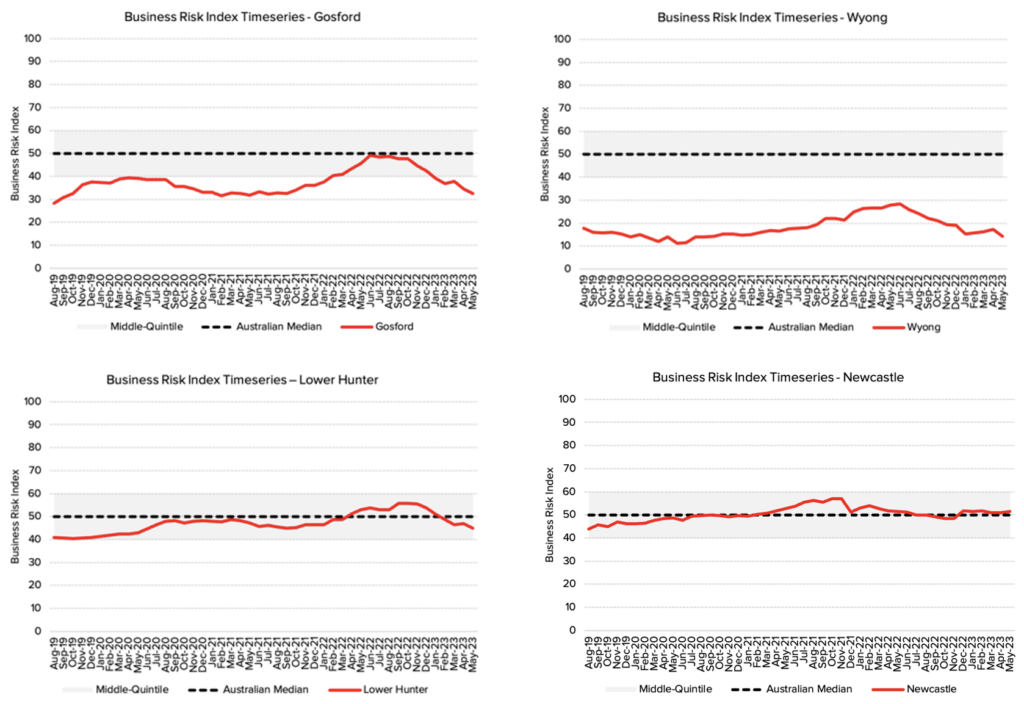

On a regional level, the Business Risk Index data for the past 12 months has revealed that three of the five biggest movers down the index are all adjoining – Wyong, Gosford and Lower Hunter.

Key Business Risk Index insights for May:

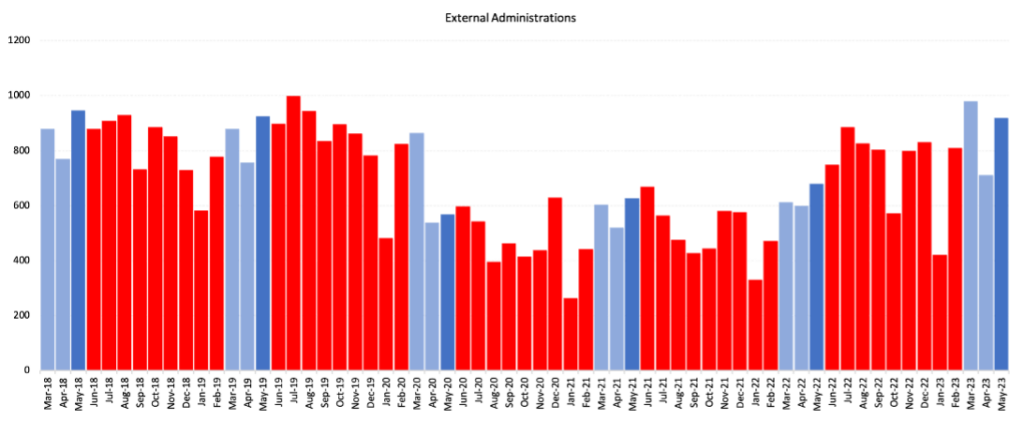

- External administrations dipped from March to April due to seasonality but are now up 35% YoY.

- Court actions also dropped in March due to seasonality are now up a 50% YoY.

- Credit enquiries are up a massive 85% year-on-year as businesses become more nervous about the health of their trading partners and tighten credit policies.

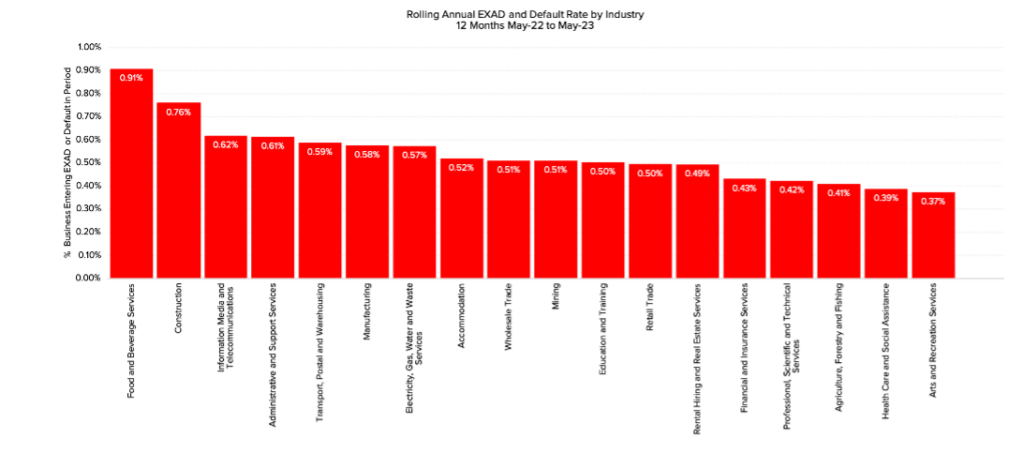

- B2B trade payment defaults up 31% YoY, with Food and Beverage Services the number one ranked industry for probability of default by a considerable margin.

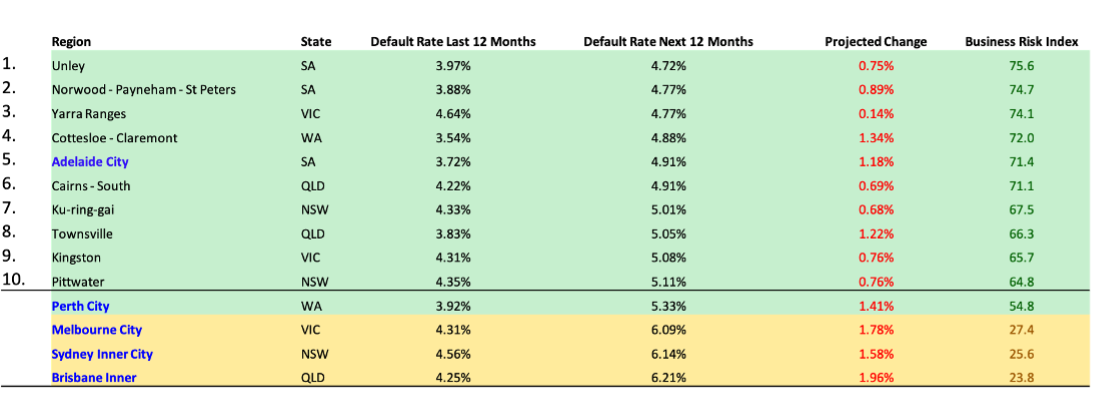

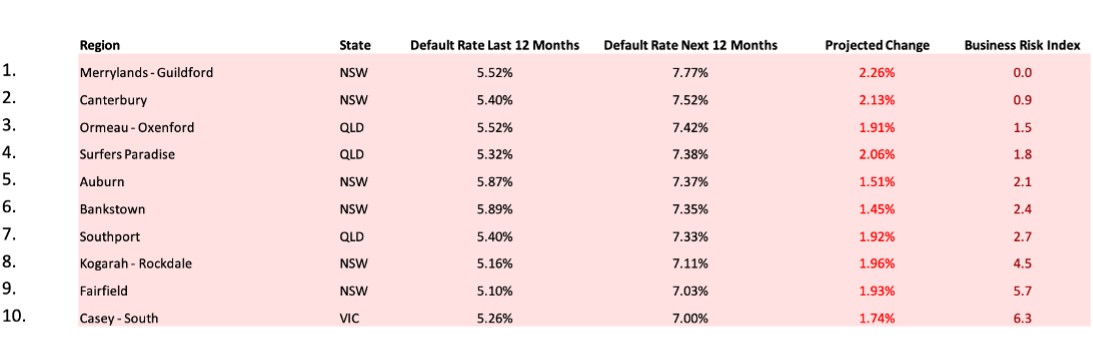

- Merrylands-Guildford and Canterbury, in Western Sydney, remain the worst performing regions in Australia for default rates.

- Casey-South in Victoria has entered the top 10 worst performing regions for the first time with a projected default rate of 7.00% over the next 12 months.

- Unley in South Australia is the region with the lowest insolvency risk (across regions with more than 5,000 businesses), followed by Norwood-Payneham-St Peters, also in SA.

- The rate of external administrations in the construction industry continue to trend upward – sitting at their highest point since June 2020.

- The rate of external administrations in the Healthcare and Social Assistance sector, while still low, has more than doubled over the past 12 months.

CreditorWatch CEO, Patrick Coghlan, says pressures are mounting on businesses across almost all industries.

“Our Business Risk Index data is showing a clear upward trend in the rate of external administrations across almost all sectors, with mining being one of the few exceptions,” he says.

“With economic conditions forecast to decline further, we encourage all businesses to perform proper due diligence on their trading partners and monitor them on an ongoing basis to ensure they don’t become an unfortunate statistic.”

CreditorWatch Chief Economist, Anneke Thompson, says trading conditions for businesses in Australia are clearly becoming more challenging.

“The latest monthly Inflation and unemployment data suggests that we will be hit with more rate rises in the coming months, adding to the challenge,” she says. “Sentiment in the business community has shifted down now that it is clear that core inflation is proving hard to tame. It is now unlikely we will see any downward movement in the cash rate until mid 2024 at the earliest.”

Sources: CreditorWatch Business Risk Index and ABS

The best performing regions in Australia, in terms of probability of business insolvency, continue to be areas that have an older median age of residents. People with little to no debt remain mostly unaffected by the RBA’s monetary policy tightening. In contrast, the worst performing locations have a lower median age and people in these areas are more likely to be in the earlier stages of their debt ‘journey’. Interest rate rises will be weighing heavily on these business owners.

Data Sources: CreditorWatch trade receivables data (accounting software integration)

Unsurprisingly, external administration numbers continue to rise, both as a result of the challenging trading conditions and the fact that we saw lower than usual numbers during the pandemic.

The new financial year will be a very challenging one for Australian businesses, particularly those in food and accommodation, tourism and retail. Overseas visitor numbers are well down on pre-COVID levels and are unlikely to recover soon as most countries around the world are trying to tame inflation through interest rate rises. The Christmas period ahead, usually a boom time for the retail sector, is shaping up to be one of the weakest on record. While unemployment remains at near historic lows, it is likely that businesses will start to trim headcount in the coming months as trade slows and costs increase.

The industries with the highest probability of default over the next 12 months are:

- Food and Beverage Services: 7.10%

- Arts and Recreation Services: 4.59%

- Transport, Postal and Warehousing: 4.59%

The industries with the lowest probability of default over the next 12 months are:

- Health Care and Social Assistance: 3.25%

- Agriculture, Forestry and Fishing: 3.51%

- Wholesale Trade: 3.56%

Source: CreditorWatch risk score credit rating average probability of default by industry. Default defined as external administration, strike-off or deregistration in the next 12 months

Source: CreditorWatch Business Risk Index 2023

While the construction sector continues to gain the most media attention due to insolvencies, the food and beverage sector has the worse insolvency rate in the country. These businesses tend to be smaller so get less attention, but there are clearly challenging conditions as supply and labour costs are still high, and customers are tightening their belts.

Our year-on-year analysis of the worst performing regions in Australia revealed that three of the top five – Gosford, Wyong and Lower Hunter – were adjoining. All three regions feature very high levels of personal insolvency, and Wyong and Lower Hunter, in particular, score poorly on the ABS Index of Economic Opportunity.

Residents in these areas also appear to have relatively high levels of debt, meaning that rising interest rates are going to disproportionately impact them. These areas also have less variety in their employment opportunities than metropolitan regions, making it harder for workers to access pay rises compared to the more mobile city-based workers. The closest major city to these regions, Newcastle, has also been struggling with very high commercial rental and property costs.

Source: CreditorWatch Business Risk Index April 2023

We expect that insolvency levels will continue to rise, particularly as we enter the new financial year, and many businesses confront a reduced revenue forecast in their new budgets. We already know that there are now fewer jobs being advertised than this time a year ago, and this trend is likely to continue. So far, most Australian employees have felt quite comfortable in their employment and therefore have been more confident to continue to spend and book holidays and tables at restaurants. As the unemployment rate inevitably moves higher however, this trend will reverse, and a lot more belt tightening will occur.

Note: CreditorWatch’s inputs for trade receivables data are currently being upgraded. Therefore, reference to that metric and the publishing of associated charts have been omitted from this month’s Business Risk Index commentary. Reporting of trade receivables data will resume in the June results commentary, released next month.

Subscribe for free here to receive the monthly Business Risk Index results in your inbox on the morning of release. No spam.

Get started with CreditorWatch today

Take your credit management to the next level with a 14-day free trial.