This month’s data showed some reasonably surprising insights into the state of business activity in Australia. While we usually see a run up in trade receivables as Christmas approaches, this key indicator of business activity has been flat since July and declining since September. It appears the bounce back in activity that many businesses felt in the early stages of 2022 after a difficult 2021 is starting to wane. A few months ago we were expecting a strong run up to Christmas before consumers started to shut their wallets, with businesses closely following. This scenario appears to have happened a bit earlier than expected.

That being said, employment is still very strong, and by and large, consumers still have money to spend. The difference is this year excess cash is now going straight on to higher home loan repayments, energy, food and other essentials.

The latest GDP figures show that the economy grew by just 0.6% in the September quarter, which equates to around 2.5% on an annualised basis. The reason that annual GDP growth in the year to September 2022 was so high was the 3.8% growth recorded in the December quarter last year as most of the eastern seaboard was emerging from 2021 lockdowns. Since then, the rate of growth has slowed dramatically. While a slowing economy is usually a cause for concern, in this case the GDP numbers are moving as expected, given the monetary policy tightening cycle we are on.

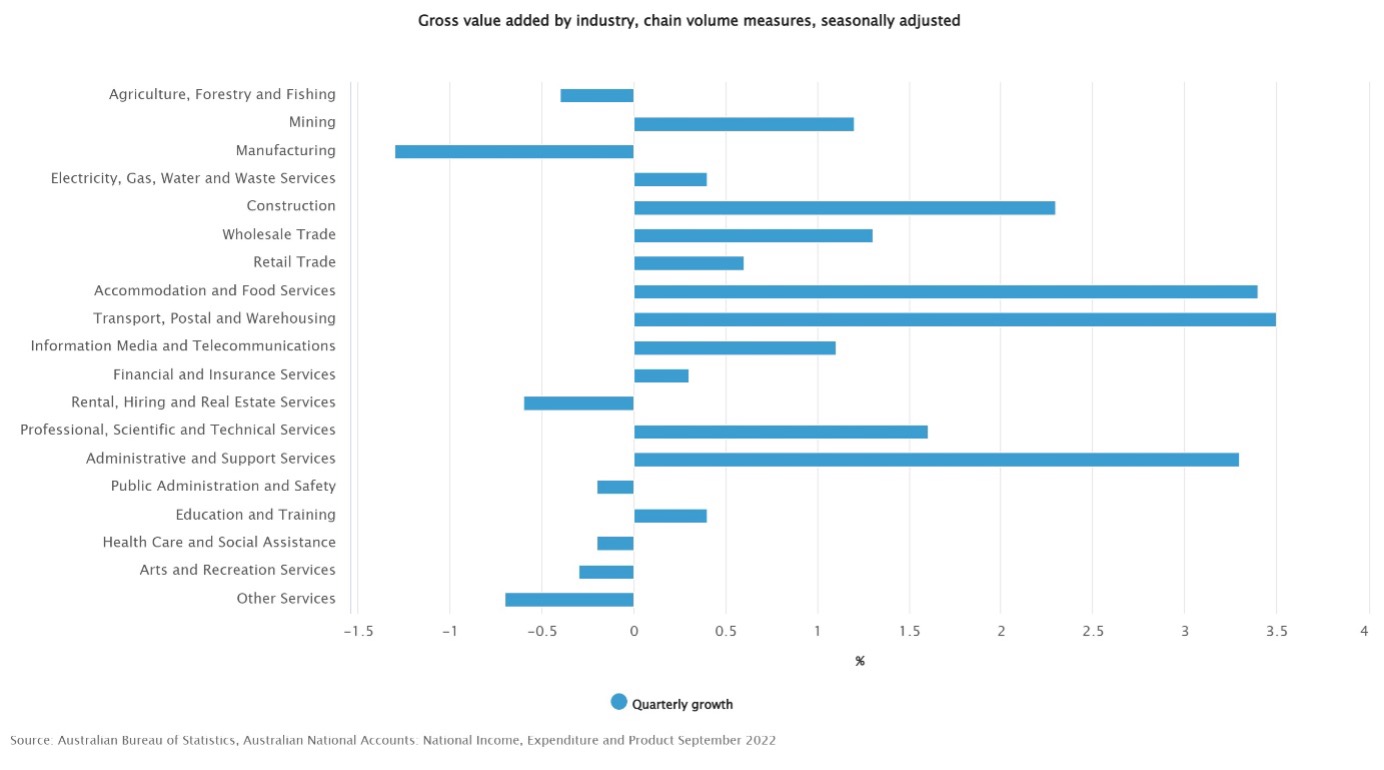

The biggest contributors to gross value added were the hospitality, transport and other services industries. This is unsurprising given those sectors were so negatively impacted by lockdowns in 2021. Other sectors recording good growth were construction, which was less impacted this quarter by poor weather and benefited from supply chains gradually improving, and retail and wholesale trade.

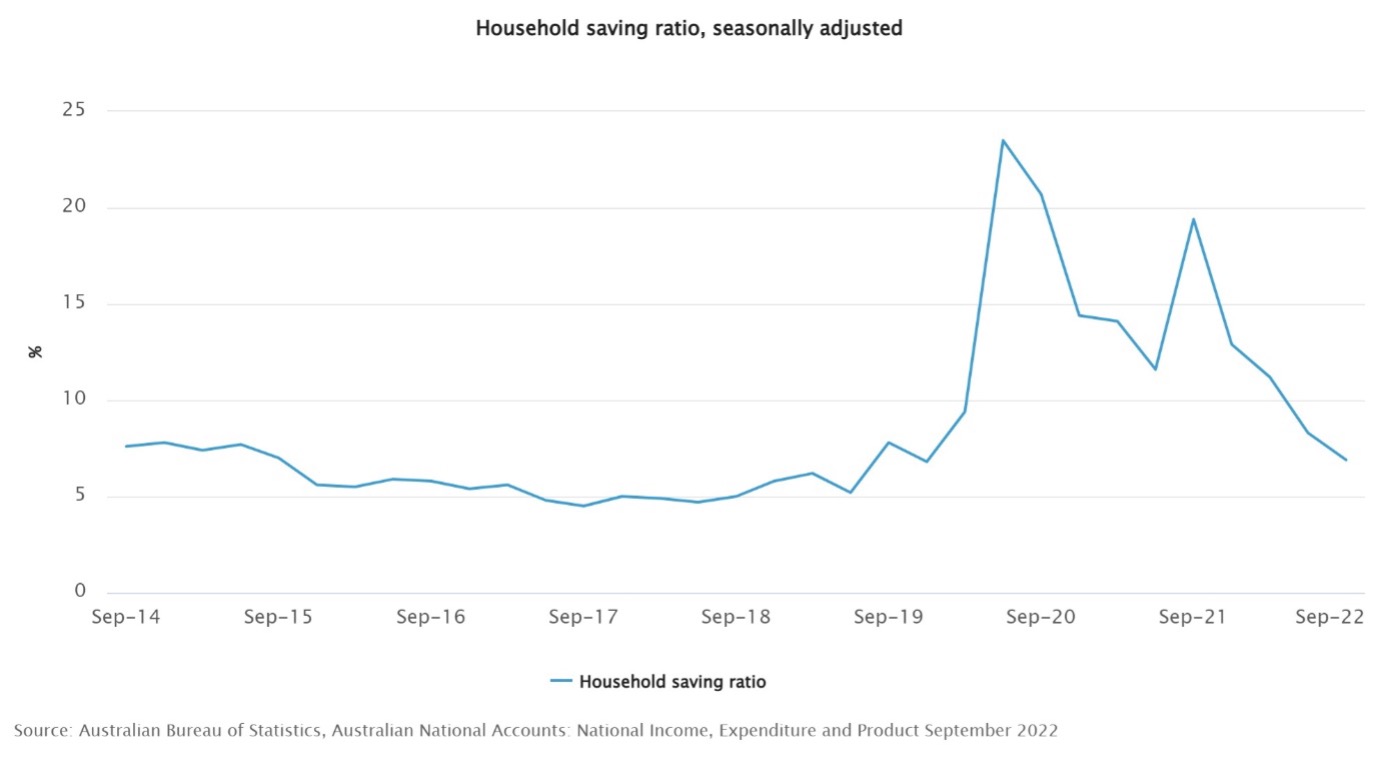

Even though retail and wholesale trade performed strongly in September, changing conditions are very close on the horizon, if not already here. The household saving ratio has plummeted. Firstly, this was as a result of the Federal Government ending JobKeeper in late 2021, which drove down additional income that many people had squirrelled away as savings. Following this was the re-opening of services and tourism industries (so more places to spend our savings), and later high inflation and high interest rates that are quickly driving down the disposable income of Australians. Unfortunately for many sectors, including retail trade, arts and recreation and food services, this all means lower spending on the horizon in 2023.

Get started with CreditorWatch today

Take your credit management to the next level with a 14-day free trial.