SYDNEY, Thursday 13 October

By Anneke Thompson, Chief Economist, CreditorWatch

Our Business Risk Index (BRI) data for September 2022 was broadly consistent with data trends we have recorded over the preceding months. Trade Receivables continue to increase year on year, indicating that businesses are still feeling relatively confident and that supply and labour bottlenecks are slowly clearing up.

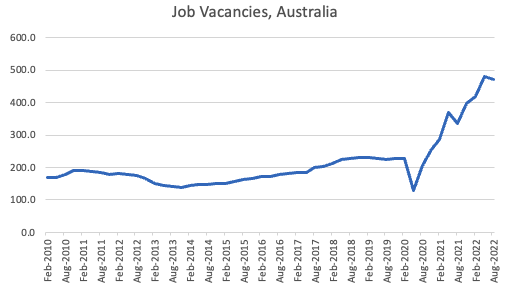

This month we also saw the Reserve Bank of Australia (RBA) start to move more cautiously through their monetary policy tightening cycle, with only a 25 bps increase in the cash rate. Both monthly Labour Force and quarterly Job Vacancy data that was released recently suggested that the unemployment rate may have reached its trough. The unemployment rate increased very slightly to 3.5%, from 3.4% the month prior, while the number of jobs available decreased by 2% (or 10,000 jobs) over the 3 months to August. This will be welcome news for business owners, most of whom have been struggling to find workers to meet demand. It will also take some pressure off wage increases. Still, job vacancies are at extraordinarily high levels on long term measures, and it will take many months to normalise.

source: ABS

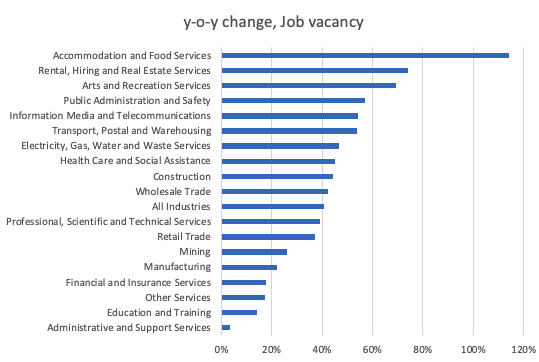

Heading in to the Christmas period and summer months, the accommodation and food sectors have recorded the greatest increase (114%) in workers needed compared to this time last year. Coming out of lockdowns last year, many food and tourist businesses were shocked at the level of demand last summer, and as a result businesses are trying to prepare this time with more workers. There are almost 60,000 hospitality jobs available currently, the second highest behind the healthcare sector, which has 74,000 job openings. Reflecting the changing demand conditions in the industry, jobs available in the construction sector have started to recede, and there were less jobs available in August (33,500) than there were in May (39,900) and February (35,200). Again, this is an early sign that conditions in the construction sector will be quieter in 2023 than this year.

source: ABS

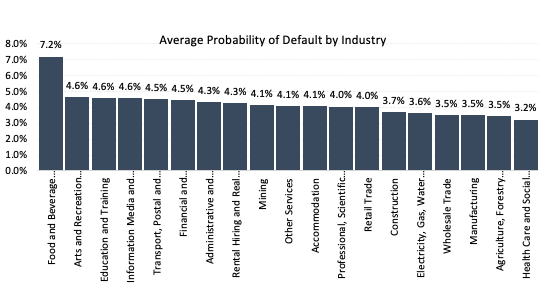

The probability of default by Industry is still led by the food and beverage sector, followed by arts and recreation. Higher rents in CBD locations, as well as increasing costs and strong reliance on human capital are the biggest drivers of this. While demand is still very good, a very high cost environment will be challenging for many hospitality businesses.

source: ABS

Get started with CreditorWatch today

Take your credit management to the next level with a 14-day free trial.