The Australian economy is in the early throes of its necessary slowdown. The risk of the slowdown getting out of the RBA’s control was heightened this month by news of liquidity issues in some US and European banks. With the US Fed and ECB holding their resolve and continuing to increase their rates, the outlook for the global economy gets cloudier every day.

Inflation appears to be stickier in the US than first thought and the US consumer is still spending while the labour market remains strong. However, if/when job shedding begins to spread beyond the tech sector, the slowdown will accelerate and recession becomes a real threat. The good news is that Australian banks are incredibly safe and well regulated, and while issues overseas will tighten credit supply, there is next to no threat to Australian bank deposits.

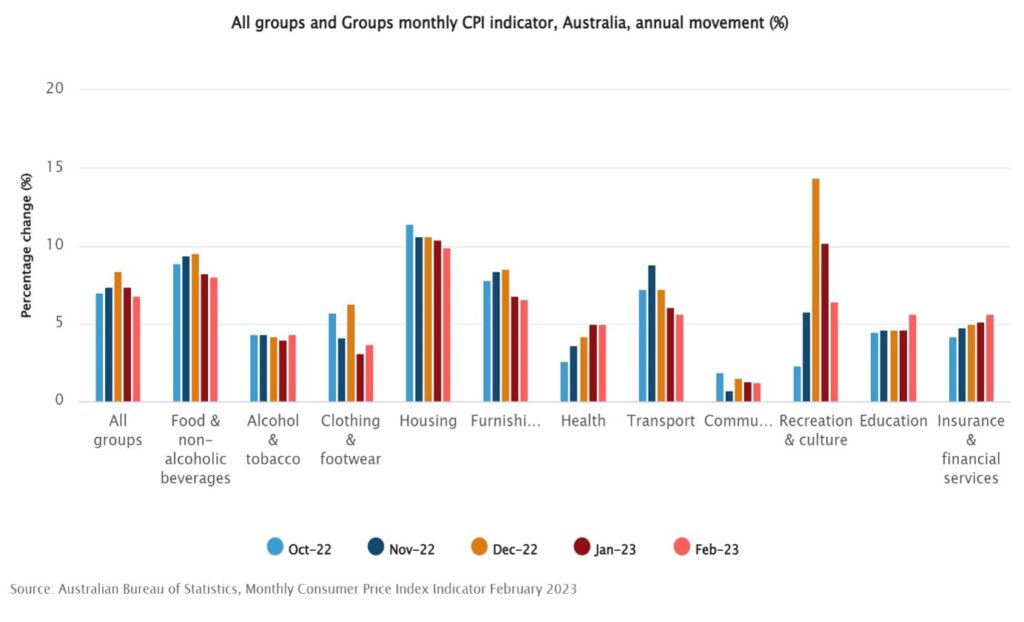

Inflation eases

The inflation rate in February reduced to 6.8%, down from 7.4% in January and 8.4% in December. However, a few categories continue to show elevated price increases, including rent, some food categories and electricity. It is not expected that rents will reduce any time soon, as there is no fix to supply side issues in the short term.

Electricity price increases will remain high until at least the middle of this year, and possibly beyond that. Most discretionary items recorded reductions in the rate of price growth, with holiday travel and accommodation inflation reducing from 29.3% in December to 14.9% in February. Overall, inflation is moderating as well as can be expected, and the RBA will be keenly aware that monetary policy tightening is ineffective against rent rises (indeed – it contributes to rent inflation) and the cost of electricity.

Employment past the peak

Australia’s unemployment rate is holding down near record low levels at 3.5 per cent, although any further falls are now highly unlikely. Job vacancies over the three months to February 2023 were down 1.5%, although still up 3.6% year on year. Combined with monthly data from employment marketplace SEEK, it does appear that we are well and truly past the peak in the employment market.

Aussies tightening their belts

Steeply rising home loan repayments, rents, food, electricity and other costs are now showing through in retail trade figures. While spend data was understandably lumpy over the Christmas/summer period, February data reveals that spend levels are the same as they were in September last year. Given very high migration levels, and rising costs, it appears that Australians are now purchasing far less, particularly on household and discretionary items.

Business and consumer sentiment

Consumer sentiment remains near recessionary levels and has been this low for some time. Business confidence, however, is still reasonably strong, and businesses are reporting conditions are at very good levels. This is likely to change over the next six months though, as the impact of lower consumer spending flows through the economy, and also as record levels of construction activity start to tail off towards the end of the year.

Interest rates close to peak

We appear to be close to the peak of the monetary policy tightening cycle, although the RBA will still be wary of very tight labour market conditions and business sentiment remaining strong. Inflation and retail trade, however, are moving in the direction that the RBA wants them to, which is good news for borrowers. The most likely scenario is that the RBA holds the cash rate at restrictive levels for a number of months at least until they are certain we are past full employment and inflation is on a steady march downwards.

Global economic conditions

Uncertainty in global liquidity markets is now a real threat to economic stability. While Australian banks are deemed amongst the safest in the world, some smaller, regional banks in the USA with large commercial property loan books are being sounded out as the next big risk. Even if bank liquidity is solid, the very threat of it can cause bottlenecks in credit markets and distrust amongst banks. However, slowing credit does act as a further handbrake on inflation, and assuming we don’t see widespread panic, may actually help central banks in their war against inflation.

Get started with CreditorWatch today

Take your credit management to the next level with a 14-day free trial.