The November 2023 CreditorWatch Business Risk Index (BRI) has revealed the industries with the biggest increases in external administration rates over the past 12 months with some surprising results.

Industries with a high proportion of government organisations: Public Administration and Safety, and Healthcare and Social Assistance have come in at positions one and two respectively. Despite heavy government involvement in both industries, it is private businesses such as those in the private security sector in Public Administration and Safety that have contributed to a doubling of the rate of external administrations.

Healthcare and Social Assistance has seen a 71 per cent increase in the rate of external administrations in the past year due to the failure of a number of small private businesses with National Disability Insurance Scheme (NDIS) contracts.

The construction industry had the third largest increase in the rate of external administrations over the past 12 months (59 per cent) due to ongoing problems with project delays, cost blowouts, labour shortages and supply chain disruptions.

On the positive side, Arts and Recreation Services was the only industry to see a drop in the rate of external administrations (-23%) thanks, largely, to activity in the entertainment industry normalising post-COVID. It is yet to be seen if this positivity continues as cost-of-living pressures force consumers, particularly young renters, to reduce discretionary spending.

Positive news also for the Food and Beverage Services industry, which saw just an eight per cent increase in the rate of external administrations from November 2022 to November 2023.

CreditorWatch CEO, Patrick Coghlan, says the Business Risk Index data on the rates of external administrations over the past 12 months illustrates the extreme stress that almost all sectors of the economy have been under this year.

“The fact that almost every sector has seen double-digit increases in the rates of business failures across 2023 is truly shocking,” he says.

“When this is viewed in the context of our other key business risk indicators, such as the steep decline in the average value of invoices and the rise in B2B payment defaults, it is shaping up to be a very challenging 2024 for Australian businesses.”

- Average value of invoices for Australian businesses has dropped 34 per cent over the past 12 months.

- B2B trade payment defaults continue to trend upward, with a 57 per cent increase since January.

- External administrations continue to rise, with a 26 per cent year-on-year increase.

- Credit enquiries are trending down as business activity and credit/loan applications decline.

- Court actions are up around 10 per cent over the last quarter and are up 18 per cent year on year.

- CreditorWatch’s national business failure rate prediction for the next 12 months is for an increase from the current rate of 4.18% to 5.80%.

- Businesses in the food and beverage services sector remain the most at risk of payment defaults (6.70%) by a considerable margin. Transport, Postal and Warehousing is the next riskiest industry at 4.47%, followed by Financial and Insurance Services (4.33%)

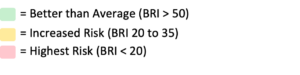

- Ballarat in Victoria is the region with the lowest risk of business failure (across regions with more than 5,000 businesses), followed by Unley and Norwood-Payneham-St Peters in South Australia.

- On a yearly basis, the most improved region is Townsville in Queensland, which has moved 15.4 points up the Business Risk Index, followed by Brunswick-Coburg in inner-city Melbourne.

- The regions with the highest risk of business failure are around Western Sydney and South-East Queensland, with Merrylands-Guildford (NSW) the top ranked region, followed by Canterbury (NSW) and Bankstown (NSW). The 10 worst performing regions are all in Western Sydney and SE Queensland.

- The worst performing region in Australia on a yearly basis is Gosford in NSW, which has slid 18.7 points down the index, followed by Leichhardt in inner-west Sydney.

CreditorWatch Chief Economist, Anneke Thompson, says the steep rise in interest rates and plummeting consumer confidence have driven down the average value of invoices.

“The velocity of the drop is very large, and indicates that business activity is seriously slowing down, particularly among small businesses,’ she says.

“Very large migration numbers have potentially masked some of the slowdown in spending by consumers, as migrants have added to the overall pool of consumers. The Federal Government has said it is going to stem the large inflow of migrants, which will put added pressure on the retail sector. On the flip side, slowing migration is likely to help reduce inflation faster than if current rates of migration were maintained.”

The average value of invoices is roughly half of what it was in November 2020, which is a massive decline in business activity. It could be due to the fact that larger projects, particularly in the construction sector, have been replaced by smaller ones. On the retail and wholesale trade side, overall stock orders are likely to be reduced from 2020 levels due to much lower levels of consumer demand.

The fact that there is a high level of trade payment defaults at a time when the average value of invoices is very low, highlights just how short of cash some businesses are. With the benefit of hindsight, significant government help during the COVID-19 pandemic helped many businesses with their cash flow, and potentially masked some ongoing issues that have revealed themselves once emergency government financial assistance measures were removed, and the ATO moved back into its normal collection mode.

We expect a large increase in the business failure rate over the course of 2024, as many businesses trading at a loss will not be able to sustain another six to nine months of high interest rates and low consumer confidence.

Business failure rates have been unusually low for some time now, however, there has now been a significant increase in the number of tax defaults lodged against businesses by the ATO. This is generally a good forward indicator that business failure rates will start to rise significantly, especially given that the avenues to source cash to pay these tax debts are diminished.

The best performing regions continue to be those that are more regionally based, with low commercial rents, or have an older and wealthier overall population. There is no particular stand out state in terms of best performing areas, indicating that demographics and very local factors play a key role in the overall performance of businesses in those regions.

The worst regions, on the other hand, have a very clear state trend, with regions in NSW and Queensland making up all the bottom 10 positions. In these areas, poorer performing industries feature heavily, such as transport, postal & warehousing (Western Sydney) and retail food and beverage services (SE Queensland). The overall population in these areas also tends to be quite young, with high levels of debt relative to lower than average incomes.

The industries with the highest probability of business failure over the next 12 months are:

- Food and Beverage Services: 6.70%

- Transport, Postal and Warehousing: 4.47%

- Financial and Insurance Services: 4.33%

The industries with the lowest probability of default over the next 12 months are:

- Health Care and Social Assistance: 3.10%

- Wholesale Trade: 3.32%

- Agriculture, Forestry and Fishing: 3.41%

Source: CreditorWatch risk score credit rating average probability of default by industry. Default defined as external administration, strike-off or deregistration in the next 12 months

There is still a significant difference in the likelihood of business failure across industries. The agriculture and healthcare industries are quite insulated from higher interest rates and are driven by other factors such as an ageing population and, in the case of agriculture, weather patterns and crop growing conditions.

The financial and insurance services sector is now in the top three riskiest, and this is likely driven by slowing levels of work for mortgage brokers but also high insurance premiums driving many individuals and businesses to forgo insurance if they deem it unaffordable or uneconomic.

While late 2023 has proved a challenging time for businesses in Australia, overall business confidence has remained relatively good, except for the retail sector. This is likely to change in the new year, especially once Christmas trade data comes in and we get to see just how tightly Australian consumers have been closing their wallets.

The good news is that at some stage in 2024, the RBA should announce a cut to the cash rate, but until such time, consumers will be cautious, home owners will be treading water just paying their bills, and business activity across most industries will be subdued.

Get started with CreditorWatch today

Take your credit management to the next level with a 14-day free trial.