CreditorWatch’s industry data for March revealed the strongest bounce back in trade receivables data on record. This is an 86% increase on the previous month’s trade receivables data, but still 5.6% below trade receivables recorded in March 2021 and March 2020.

What is clear is that this result is the antithesis of the weak month-on-month data that has been recorded since September 2022. However, given it is only one month’s worth of data, it is too early to draw any conclusions as to a definitive change in trend trade receivables.

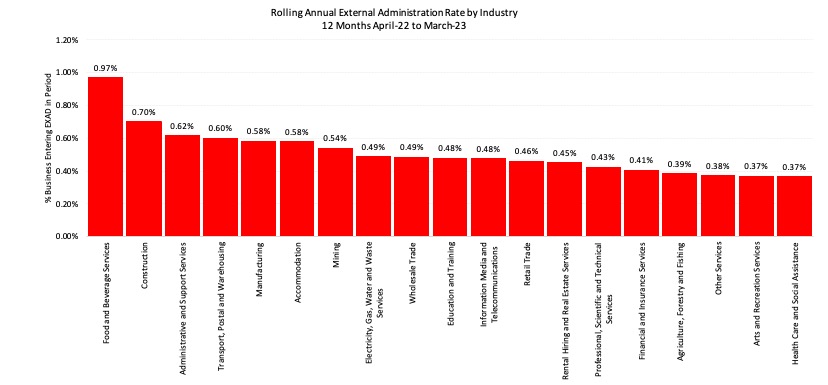

Actual insolvency data recorded this month shows that the food and beverage sector still sits at the highest risk in terms of industry insolvency, with 0.97% of businesses going into insolvency on a rolling annual basis in March 2023. The construction sector was next, at 0.70% of businesses going into insolvency.

While the food and beverage sector has always been at higher risk of insolvency according to CreditorWatch data, the construction sector ranking second does highlight that the wash on impacts of insolvency are quite large. For every construction sector insolvency, there are is a large number of companies, individuals, and banks that are impacted, as the construction sector is such an important cog in the wheel of the wider property/development industry.

Data Sources: CreditorWatch Business Risk Index 2023

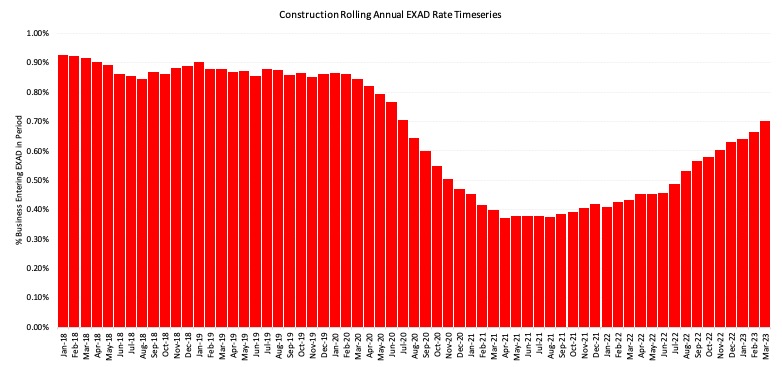

Unfortunately, insolvencies in the construction sector continue to rise, and are yet to reach pre-COVID levels. The very low levels of insolvencies in the construction sector during the COVID-19 lockdowns suggest that a number of businesses remained in business that otherwise would not have, all else being equal.

The huge amount of government stimulus showered upon the wider economy, and in particular the construction sector, allowed many businesses that were not viable to stagger through. These businesses were nicknamed of ‘zombie businesses’ during COVID-19, and much higher supply costs, interest rates, labour costs and reducing demand and government incentives are now exposing these companies.

Data Sources: CreditorWatch Business Risk Index 2023

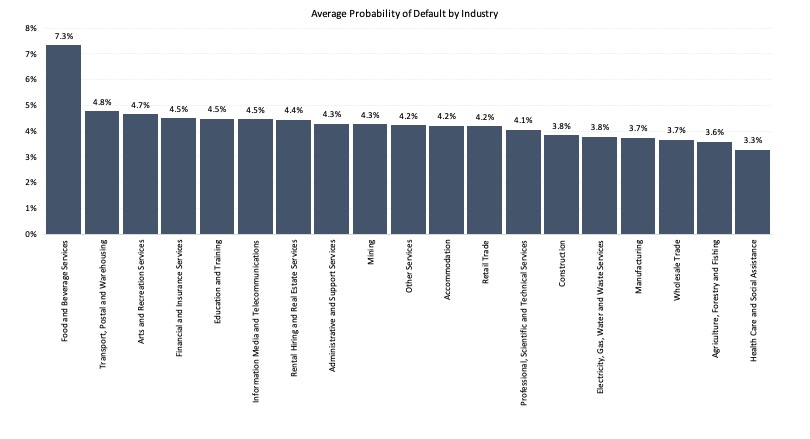

Overall, we expect that the pressure on discretionary spending in Australian households is approaching its peak, as a large proportion of fixed rate home loans move to variable rate loans over the next few months. While some larger non-discretionary related businesses will remain relatively immune to this spending risk, the food and beverage sector is particularly exposed, and it is just a matter of time before Australians begin to spend less (per capita) at restaurants and cafes than they did in 2022.

Data Sources: CreditorWatch Business Risk Index 2023

Get started with CreditorWatch today

Take your credit management to the next level with a 14-day free trial.