Data released over May 2023 continues to point to slowing in retail spending by Australian consumers as well as continued pessimism on future spending intentions. Business confidence has also registered a below average result with business conditions deteriorating, although still well above long term averages. There are also early signs that the jobs market is about to get more difficult for employees, as the seasonally adjusted unemployment rate rose from 3.5% to 3.7%.

Still hot spots for inflation

While it is highly likely that we have moved past the inflation peak, there are still important areas where inflation is proving sticky and will be cause for worry for the RBA. In monthly inflation data released in late April, inflation increased in the alcohol and tobacco, rents, electricity, furnishing, household equipment and services, health, education and insurance and financial services categories, compared to two months prior.

Food and non-alcoholic beverage and clothing and footwear inflation remained roughly steady, while new dwelling purchases by owner-occupiers, automotive fuel and holiday travel and accommodation saw good falls in their inflation rates. Overall, all groups monthly CPI inflation was down to 6.3% cent in March 2023, from 6.8% in February. Supply side impacts, particularly with regard to rental properties and electricity will be difficult to control with merely monetary policy intervention and are likely to remain ingrained in the economy for some time.

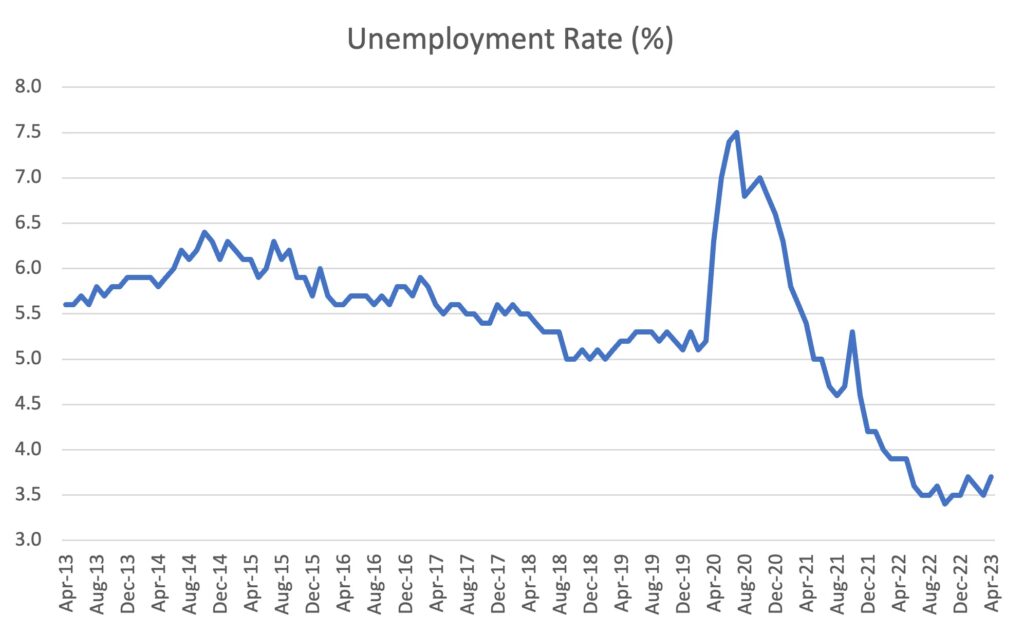

Labour force

The unemployment rate appears to have passed its trough and, as mentioned, a noticeable 0.2 percentage point increase to 3.7% cent in the seasonally adjusted rate was recorded in April 2023. A further 18,400 people were recorded as unemployed, while employment dropped by 4,300. Given the speed at which the cash rate has risen since May 2022, it was expected that the unemployment rate would eventually rise. A more sustainable rate of unemployment will help tame inflation further, as consumers will be become more concerned about their future earning capacity.

Source: ABS Labour Force, April 2023

Retail trade

There was no growth in retail trade over the month of April, and in current pricing, is at the same level as it was in October 2022. Consumers continue to reduce spending in household goods retailing, and over April the first drop in food retailing was recorded since February 2022. Australians also spent less at cafes, restaurants and takeaway food services over April 2023. It appears that the continued growth in spend in this area is finally levelling off, and it is likely to fall further over the upcoming winter months.

Business and consumer sentiment

Consumer sentiment fell again in May 2023, and consumers remain steadfast in their pessimism. Business confidence remains below long run average conditions, and business conditions have now started to deteriorate, albeit off a very high base. There has been a clear separation in confidence and conditions now since early 2022. The new financial year beginning July 1 may see many firms resetting their revenue, hiring, investment and profit expectations, and we are likely to see conditions fall to meet the lower confidence levels.

Interest rates on hold for now

The RBA took a dim view of increasing services inflation and raised the cash rate at the May board meeting as a result. The monthly reads of inflation are still cause for concern (see above), however increasing unemployment, and subdued retail sales should give the board some confidence that we are on the right path to reducing inflation.

The big worry now is the upcoming minimum wage increase decision by the Fair Work Commission (FWC). This is likely to come in higher than the RBA would like it to be, and if this decision feeds through to higher wages in the broader economy, it may make taming inflation harder, and force the RBA’s hand again in the next few months.

However, it is unlikely the June board meeting will result in an increase, as another month’s worth of data as well as the FWC’s decision, will be critical to understand before any future decision to increase the cash rate.

Global outlook

The big global event to watch out for in June 2023 will be the US debt ceiling negotiations. Any threat to the US Government being able to pay its bills is a serious cause for concern for global financial stability. While most observers believe it unthinkable that the US will ever allow itself to get in such a position, the discourse in US politics is such that the threat can’t be discounted.

Get started with CreditorWatch today

Take your credit management to the next level with a 14-day free trial.