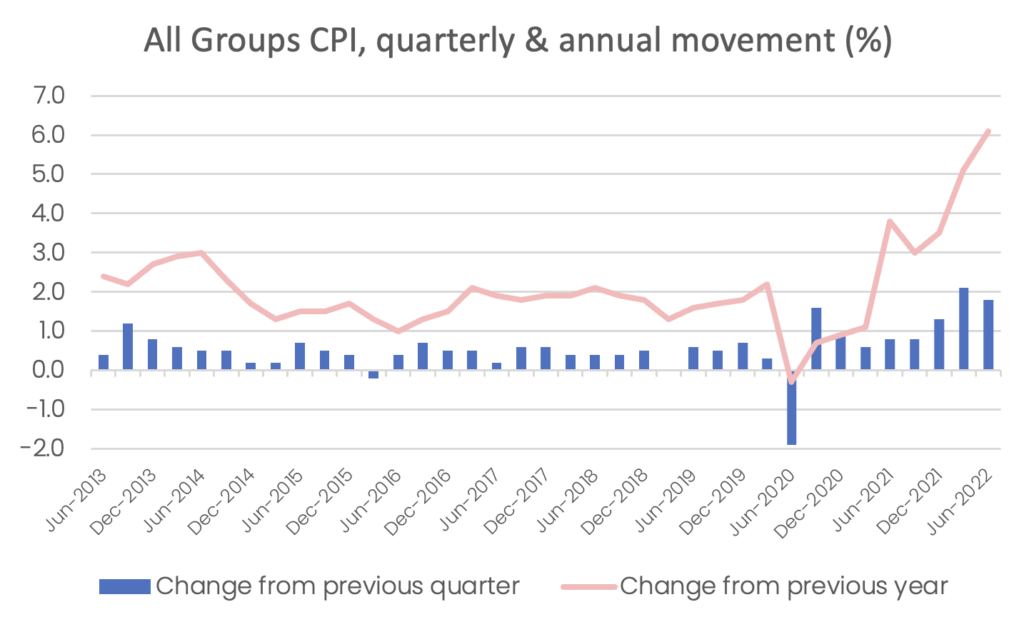

Not surprisingly, inflation rose by 6.1 per cent over the year to June 2022. This was up from 5.1 per cent over the year to March. The high inflation rate was heavily impacted by supply side factors (war in Ukraine, supply chain bottlenecks and adverse weather events) as well as very strong demand in the housing construction sector. Demand for new home starts will likely be taken care of by higher prices (both credit and input costs), reduced availability to credit and the impact of demand being brought forward during the pandemic due to government incentives. The supply side factors are much harder to control, or forecast, nor can they be dealt with via rising interest rates. The RBA’s reaction in the first week of Augustwill be interesting.

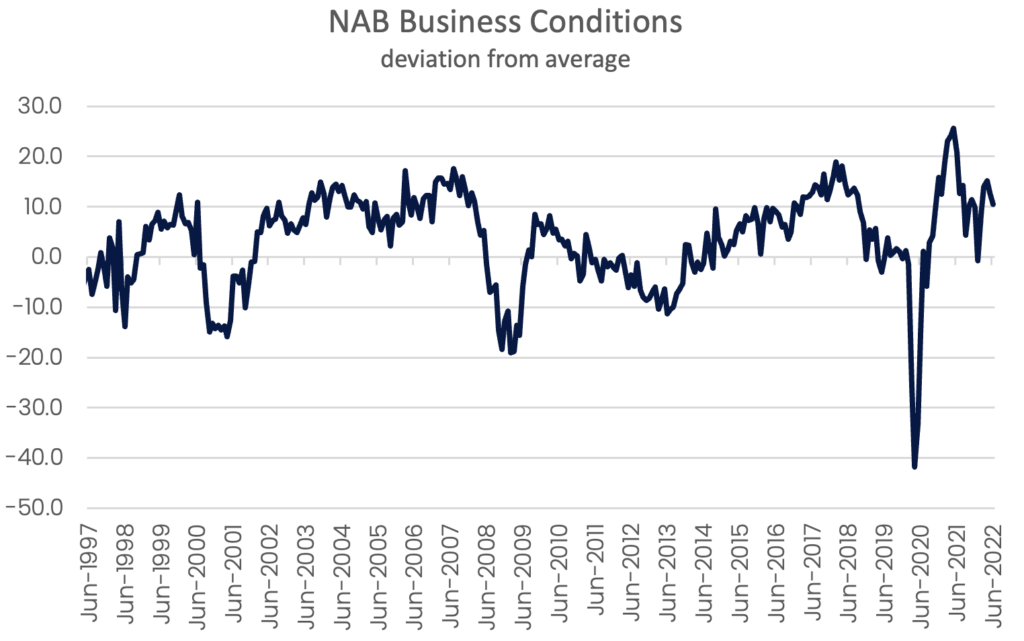

We continue to see downward momentum in consumer and business sentiment. So far, this hasn’t crossed over in to reduced spending, however we caveat this by noting that the increase in retail trade may have much to do with an increase in prices rather than increasing demand for goods and services. Unfortunately, it is difficult to split the two causes. Labour Force data revealed that the unemployment rate is the lowest it has been since the 1970s, which is helping to keep consumer spending elevated. We may not see consumers act on their pessimistic outlook on spending until the unemployment rate starts to move in the opposite direction. Despite rising inflation and interest rates, many consumers have large cash buffers built up throughout the lockdown years, and confidence in their job security. Of the latter two factors, both of these will be whittled down as we move through the difficult next 12 months.

In July we have also seen small, early signs that businesses may have moved their operating capacity peak. NAB’s capacity utilisation data was down slightly, as was business conditions. CreditorWatch June BRI data showed that B2B small businesses trade receivables data was down in June, reversing a trend where trade activity had been increasing since January. We also note that nearly all industry categories recorded a rise in the proportion of businesses more than 60 days in payment arrears. This indicates that more and more businesses are starting to preserve cash and may be finding it more difficult to pay bills on time.

Labour Force

The June 2022 unemployment rate dropped to 3.5 per cent, the lowest rate recorded since 1974. There are an extraordinary 88,400 more people employed now than there was in May. The very high levels of employment reflect businesses capacity utilisation levels, which according to NAB are 84.8 per cent. This level has been fairly consistent for months now, and correlates strongly with the unemployment rate. It is likely we won’t see any negative movement in unemployment until capacity utilisation starts to decline.

While these Labour Force figures are very positive for employees, headwinds still abound in the economy. A strong increase in youth employment – 23,000 people or around a 1.1 per cent increase – accounted for almost a quarter of the increase in employment. This indicates that young people may be starting to see the effects of the lack of COVID support payments, coupled with higher costs of living and are therefore increasing their employment activity in a strong job market. This may end up providing employers with some much needed slack in the employment market, although we have a long way to go before we reach equilibrium in the labour force (where the jobs market favours neither employers or employees).

The ’employed persons’ chart below shows there are 600,000 more employed people in June 2022 compared to March 2020 (the month prior to lockdowns). This is 4.6 per cent increase in employment. While there is no doubt the jobs market is incredibly strong right now, it must be noted that the labour force survey has never included short term residents. In March 2020 we had many more short-term residents working than we now have in June 2022, therefore it is important to understand that jobs haven’t increased by 4.6 per cent, just employment of Australian citizens and permanent residents. The lack of overseas students, backpackers and working holiday makers is very pronounced, but hard to measure in the official ABS data.

Source: ABS

Inflation

Inflation continues to rise all over the world, however, Australia’s June 2022 inflation rate of 6.1 per cent is relatively low compared to other developed nations. Nevertheless, the June quarter CPI showed prices have risen at the second largest rate over a quarter since the introduction of the GST in 2001. The biggest contributors to the growth in the CPI was new dwelling construction (+5.6 per cent) and fuel (+4.2 per cent). The prices of vegetables (+7.3 per cent) and fruit (+3.7 per cent) were also notable for their strong increases.

This CPI data, while coming in at about the expected rate, shows that the largest contributors to inflation are supply side issues, with the one exception of huge demand in the new home build space. There are well known bottlenecks in the construction sector, fuel prices are high because of geo-political factors, and fruit and vegetables were strongly impacted by recent adverse weather effects. The rising cash rate is clearly already having an impact on the housing sector, and new housing starts will fall with increasing speed following a fall in approvals. This should, over time, help reduce the inflationary impacts for dwelling construction.

The RBA will now need to consider carefully how much of an impact it thinks its future cash rate rises can have on inflation, as some of the biggest contributors to inflation can really only be resolved on the supply side.

Source: ABS

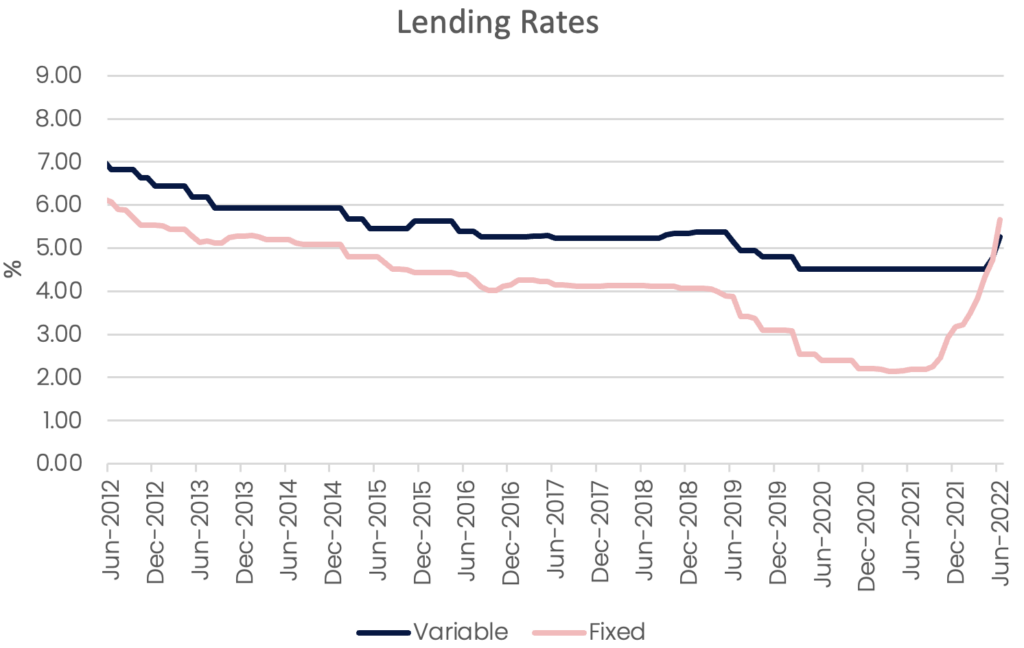

Interest Rates

The Reserve Bank of Australia (RBA) once again increased the cash rate in an effort to reign in inflation before a ‘spiral’ sets in. Given inflation expectations amongst consumers, unions and business leaders continues to remain high, this outcome is unsurprising. It is highly likely that further increases in the cash rate will be announced as the RBA is probably beyond taking a ‘wait and see’ approach to the impact of their cash rate rises, and will need to continue raising rates until they get comfortable that inflation is starting to move down. Continued dialogue with major retailers, wholesalers, logistics groups and construction companies will be essential to gain an understanding as early as possible as to the direction of price movements. This will be particularly important given a large proportion of inflationary pressure is coming from the supply side. This was reinforced in the June 2022 inflation data. Notably, Australian bond markets dropped sharply upon the announcement of June 2022 inflation, which means the data points to less pressure on interest rates than before the announcement.

Source: RBA

NOTE: data is for owner occupier standard loan, fixed term is 3 years

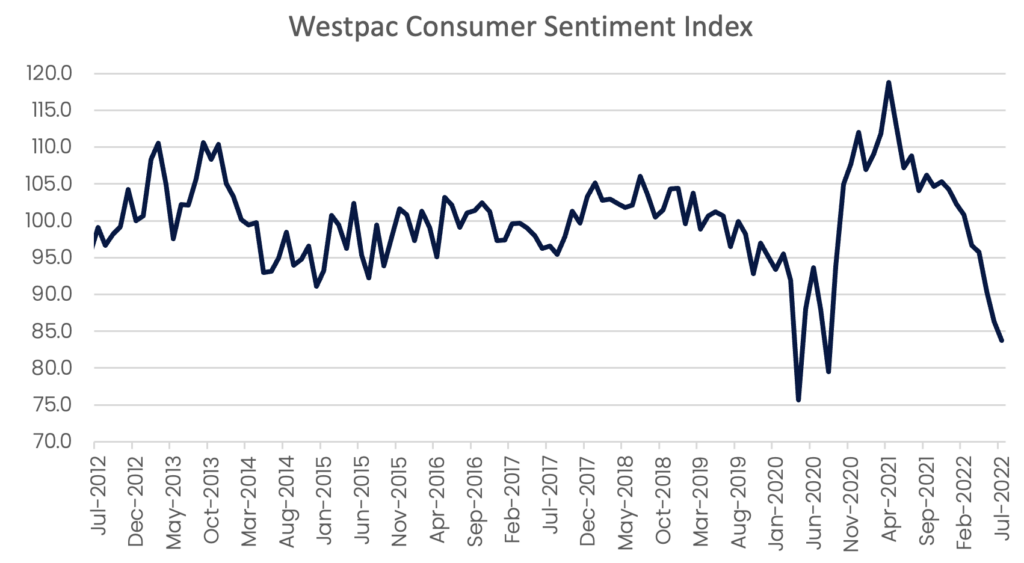

Consumer Sentiment

Consumer Sentiment continues its downward trend, and has now fallen by almost 20 per cent since December 2021. Continued negative economic headlines means the index is now producing the same negativity as it did in periods of economic shock, the three most recent being the Covid-19, the GFC, early 1990s recession. While sentiment is at close to all time lows, spending is remaining relatively robust. This is likely due to a combination of factors, being high savings rates, strong job security, ‘revenge’ spending post the lockdown-era and the high number of house/renovation completions that are still occurring. All of these factors, however, will deteriorate or change over the next year, and combined with much higher interest rates, retail spending volumes (if not dollars due to inflation) will start to move in the same direction as sentiment, likely by mid to late 2022.

Source: Westpac Melbourne Institute Consumer Sentiment Index

Business Conditions

Business conditions still remain well above average, although NAB’s data did ease by 2 basis points to sit at +13 index points, well above the long term average. While this is a strong result, Business confidence has now fallen to be just below average, meaning businesses expect conditions to worsen. Capacity utilisation is a key measure to watch, as it correlates strongly with unemployment. While it is still at extremely high levels (84.8 in June 2022), it is down ever so slightly on May’s result, and has stopped it’s march upwards. This indicates that business conditions may have reached their peak in May, and we may start to see a little more slack appear in the labour market, although this is likely to be very gradual and not across the all industries.

Source: NAB Business Conditions Survey, June 2022

Retail Sales

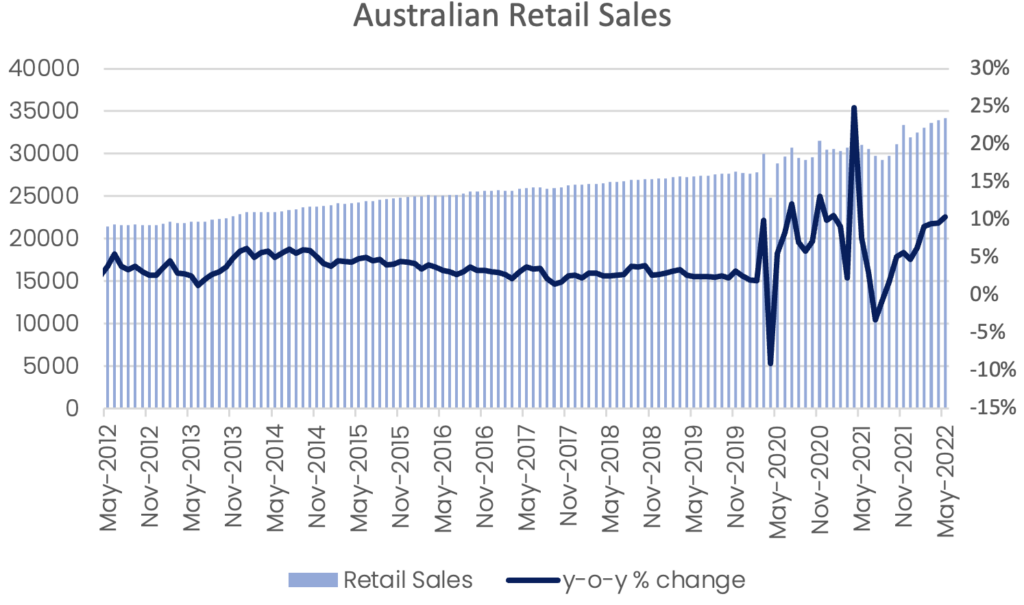

Retail sales continued to grow over May at the same rate as April, which was 10 per cent year on year. Once again, the current y-o-y percentage increases are still being impacted by spending decreases as we went in to lockdowns last year (meaning they appear very large but are recorded against an extraordinary month last year), the overall level of spending is still well above where they were even before Covid. Retail spending in total dollars spent is also being impacted by inflation, with most items costing more than they did this time last year as well. This was most evident in cafes, restaurants and takeaway food services and food retailing.

Source: ABS

Westpac-MI Leading Index

The Westpac-MI Leading Index, which provides a forecast as to likely pace of economic activity 3 to 9 months in to the future, continued to slow. This data is reflective of CreditorWatch’s June 2022 Business Risk Index (BRI) data, which showed a decline in Trade Activity, and also an increase in the proportion of businesses that are more than 60 days in arrears across most industries. Combined with declining Consumer and Business Sentiment, it appears that we are seeing the early signs of businesses starting to slowdown economic activity, and conserve cash. This is unsurprising, given businesses were operating at near record capacity levels, and interest rates are rising.

The question now is does the slowdown gain momentum, and start to impact businesses hiring intentions? It is likely that we will see some pressure taken off the very tight labour market later in the year, as economic slows and businesses become more conservative about growth.

Get started with CreditorWatch today

Take your credit management to the next level with a 14-day free trial.