The outlook for the Australian economy in 2023 is one with much uncertainty. While monetary policy easing appears to be working on flattening the growth in prices of goods, rising services prices continue to be a problem both in Australia and globally.

In good news for borrowers, the Reserve Bank of Australia (RBA) has indicated that it is now close to pausing further cash rate rises, although any pause will very dependent on data coming in.

One dataset that will now be very closely watched is labour force. Given the RBA has a dual mandate to keep inflation within the 2-3% target band as well as keeping Australia in full employment, this data will absolutely feed into future decision making at the monthly board meetings.

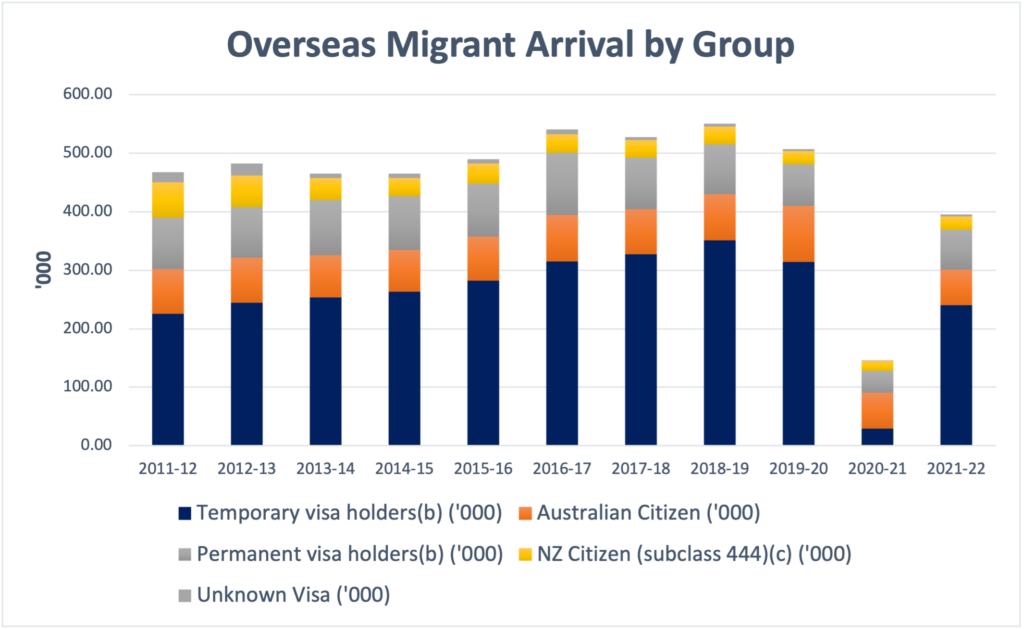

To give some indication of what might happen to unemployment going forward, we need to look at both the supply and demand for labour. On the labour supply side, migration has bounced back quickly in FYE 2022 (with September data due out next week), and while not quite up to pre-COVID levels, Australia is now topping up labour supply through migration more quickly than a year ago.

On the demand side, the demand for jobs appears to be waning. The SEEK employment dashboard for January 2023 shows that the number of jobs being advertised is down year-on-year in nearly all the major categories. In Information and Communication Technology, Job Advertisements are down 24.1%. Given a very large proportion of jobs in Australia are advertised on SEEK, this gives us a good indication that the demand for labour is slowing significantly.

SEEK Employment Dashboard, January 2023

| Y-o-Y % change | |

|---|---|

| Trades & Services | -5.2 |

| Healthcare & Medical | -0.6 |

| Manufacturing, Transport & Logistics | -7.5 |

| Hosp & Tourism | -13.8 |

| Info & Communication Technology | -24.1 |

| Admin & Office Support | -2.4 |

| Education & Training | 0.5 |

| Community Services & Development | 1 |

| Retail & Consumer | -3.3 |

| Accounting | 3.7 |

Consumer confidence remains at very low levels, with consumer reporting significant pessimism since August last year. As many borrowers come off fixed rate loans in the next few months, and have to contend with much higher servicing costs, this could get even lower.

For now, business conditions and confidence are holding up well, although as we approach the end of financial year and many firms look to their annual revenue forecasts, this is likely to change on the downside.

Get started with CreditorWatch today

Take your credit management to the next level with a 14-day free trial.