Sign of the times – trade receivables point to subdued December trading period

The November 2022 CreditorWatch Business Risk Index (BRI) reveals that the usual trade momentum going into December has failed to materialise and businesses should brace for a more subdued Christmas trading period.

On the positive side, a number of economic commentators have noted that the RBA’s ‘hard and fast’ approach to interest rate rises is having an effect and October’s below-expectation headline inflation figure of 6.9% indicates we are at or near the peak. Australia has also been one of the better performing economies internationally and, unlike the US and the UK, seems likely to avoid recession.

Employment and GDP growth also remain strong and consumers are still sitting on high levels of savings, albeit lower since interest rates began rising.

According to the NAB Monthly Business Survey for November, “There was a slight softening across a number of industries but the level of business conditions really still remains elevated across the board including in key consumer-facing sectors such as retail and recreation & personal services, and across the states.”

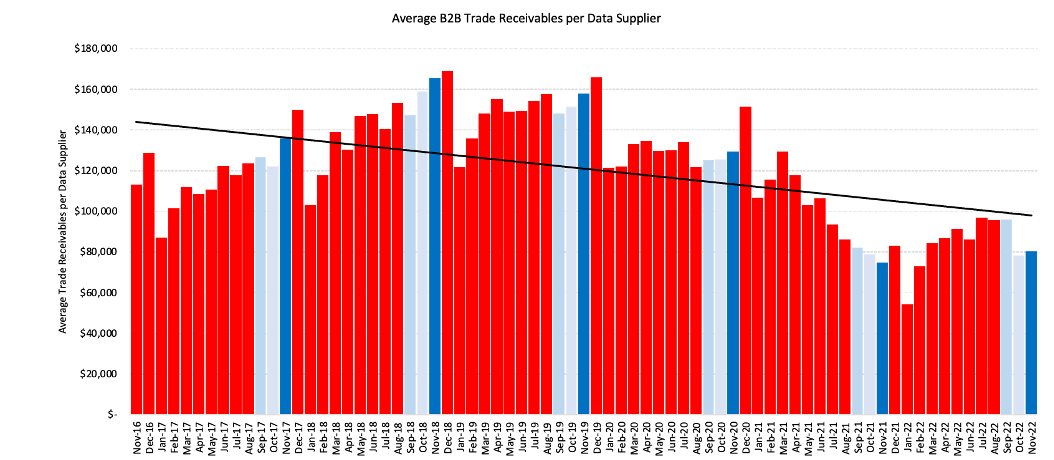

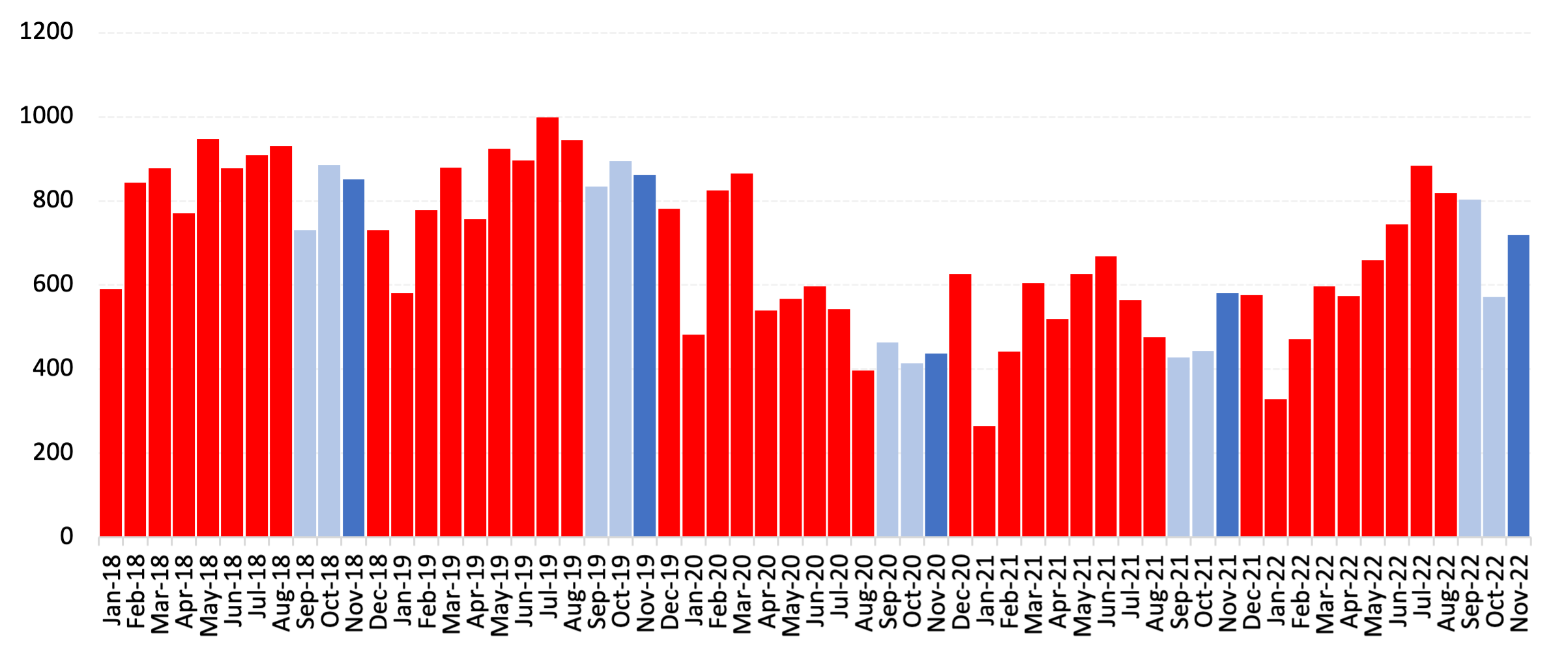

Nevertheless, CreditorWatch’s key trade indicator, trade receivables, continues to trend downwards while external administrations leapt 26% from October to November, and are up 24% year-on-year.

The number of credit enquiries undertaken by businesses have increased by a massive 87% year-on-year and are up 61% since last month, reflecting increased caution among businesses and consistent with declining business confidence reported by the NAB Business Confidence Index.

A lack of trade momentum in November is a strong indicator of a muted Christmas period for Australian businesses.

Key Business Risk Index insights for November:

- B2B trade receivables are down 16% quarter-on-quarter.

- Credit enquiries are up 87% YoY and are up 61% since last month.

- External administrations increased 26% since last month and are up 24% year-on-year.

- Month on month B2B payment defaults continue to show a high degree of volatility decreasing by 25% from last month, whilst following a generally increasing trend.

- Court actions are down 6% year on year.

- Yarra Ranges in Victoria is the region with the lowest insolvency risk (across regions with more than 5,000 businesses), followed by Cottesloe-Claremont in Western Australia.

- The Western Sydney regions of Merrylands–Guildford and Canterbury are the regions at highest risk of default across Australia (for regions with more than 5,000 businesses).

CreditorWatch CEO Patrick Coghlan says businesses are right to take a cautious approach ahead of the Christmas/New Year period.

“Flat year-on-year trade growth in the month of November points to subdued trade activity in December, however, it appears that the RBA’s rate rises this year are beginning to bite and having the desired impact on inflation. There are still a lot of challenges out there for businesses but bringing inflation down would bode well for 2023.”

Data Sources: CreditorWatch trade receivables data (accounting software integration)

Data Sources: CreditorWatch trade receivables data (accounting software integration)

CreditorWatch Chief Economist, Anneke Thompson, says that while the November BRI data covers businesses across all industries, the subdued trade receivables data does mirror October’s Retail Trade data.

“Monthly turnover fell across all the major retail trade categories, with the exception of food retailing. Department stores recorded the biggest drop in turnover, at 2.4% followed by clothing, footwear and personal accessory retailing, which dropped by 0.6%.

“While we are likely to see a bump up in retail trade activity when November data is released due to Black Friday sales, it seems that interest rate rises and a general higher cost of living are now starting to be felt by both consumers and businesses. This will be positive news for the RBA, whose board members will be closely watching for all signs of a slowdown in the economy, and hopefully, a fall in the inflation rate.

“If the RBA Board sees good evidence of a slowdown in both the economy and inflation by their next meeting on the first Tuesday of February, we may just see a pause in cash rate movements. However, a lot can happen between now and then, with the decision effectively in the hands of Australian consumers.”

This month’s Westpac Consumer Sentiment Index, has shown some improvement in consumer sentiment which is positive news for the economy. Anneke said, “Westpac consumer sentiment implies that at least some consumers feel the worst of interest rises are behind us. Importantly, consumers are more confident in the job market. High employment rates are very important for overall economic stability and consumer spending, particularly in times of high inflation.”

Probability of default by region

The five regions* at least risk of default over the next 12 months are:

1. Yarra Ranges (VIC): 4.80% |

2. Cottesloe-Claremont (WA): 4.90% |

3. Adelaide City (SA): 4.95% |

4. Geelong (VIC): 5.01% |

5. Ku-ring-gai (NSW): 5.03% |

The five regions* most at risk of default over the next 12 months are:

1. Merrylands-Guildford (NSW): 7.79% |

2. Canterbury (NSW): 7.56% |

3. Auburn (NSW): 7.45% |

4. Surfers Paradise (NSW): 7.44% |

5. Ormeau-Oxenford (QLD): 7.40% |

* Regions with more than 5,000 registered businesses

Once again, areas with high levels of personal insolvency are most exposed to business insolvency. These areas also have a lot of self-employed people, whose personal and business expenses are more closely linked.

The areas with the lowest risk of insolvency tend to be those that are either experiencing a high level of both business and infrastructure investment (such as Adelaide City and Geelong), or are seen as very desirable places to live and visit (Yarra Ranges, Cottlesloe-Claremont, Ku-ring-gai).

Probability of default by industry

The industries with the highest probability of default over the next 12 months are:

- Food and Beverage Services: 7.2%

- Arts and Recreation Services: 4.6%

- Transport, Postal and Warehousing: 4.5%

The industries with the lowest probability of default over the next 12 months are:

- Health Care and Social Assistance: 3.2%

- Agriculture, Forestry and Fishing: 3.5%

- Manufacturing: 3.5%

Source: CreditorWatch risk score credit rating average probability of default by industry

Outlook

The November Business Risk Index data illustrates almost conclusively that Australian businesses will experience far more challenging conditions in 2023. We are seeing a clear rise in businesses recording trade defaults against another business, with no commensurate rise in trade activity.

Coupled with slowing retail trade data, near record-low consumer confidence and falling business confidence, the signs are all there that the RBA’s monetary policy tightening cycle is now having its desired impact. It is too early to say how hard the landing will be for the Australian economy in 2023, although conditions here certainly look brighter than in other parts of the world, which is something Australian businesses should be mindful of.

Employment is still very strong, although we are now seeing a plateau, or fall in some cases, of jobs available, and more people applying for jobs that do come up. Nevertheless, most people who want a job at the moment can get one, and incomes are rising, albeit at levels far below that of the rate of inflation.

Anecdotally, businesses are not yet in a position where they are having to laying off workers (as is happening in some parts of the world – particularly the tech sector in the US), however, it is likely, and we are hearing of businesses pausing hiring activity at least for the next few months until a clearer picture of economic conditions in 2023 materialises.

Contacts

Mitchy Koper

GM Communications and Marketing, CreditorWatch

mitchy.koper@creditorwatch.com.au

0417 771 778

Laura Sanford

Senior Account Director, Herd MSL

laura.sanford@herdmsl.com.au

0455 145 164

ABOUT THE BUSINESS RISK INDEX

The Business Risk Index is a predictive economic indicator to help guide businesses when making future growth plans and inform public policy. It is a new credit rating that ranks more than 300 Australian geographies by relative insolvency risk, providing unique insights into the health of Australian businesses by region.

Each region is ranked from best to worst in terms of the potential for businesses in it to become insolvent. The index can also measure the potential for insolvency risk at a national, state and individual business level.

Regions are ranked on a scale from zero to 100, where 100 represents the best credit quality regions, that is, the lowest risk of insolvency, and zero represents the weakest credit quality regions, that is, the highest insolvency risk.

The index is calibrated by data from approximately 1.1 million ASIC-registered, credit-active businesses. It combines these insights with CreditorWatch’s proprietary data, previously published as the monthly Business Risk Review.

Subscribe to the Business Risk Index to be the first to receive our monthly updates.

Get started with CreditorWatch today

Take your credit management to the next level with a 14-day free trial.

You might also like

Subscribe to our newsletter

You’ll never miss our latest news, webinars, podcasts, etc. Our newsletter is sent out regularly, so don’t miss out.