SYDNEY, Wednesday 11 May – The April 2022 CreditorWatch Business Risk Index (BRI) shows the Australian economy may have reached a turning point, with trade payment defaults and credit enquiries continuing to trend upwards for the quarter.

Average trade receivables continued to rise in April, to their highest level since July last year, while credit enquiries were up 30 per cent quarter-on-quarter.

However, a raft of factors such as inflationary pressures, rising interest rates, negative real wage growth, labour shortages, supply chain disruptions and high fuel prices will temper these positive impacts to a large degree. There is also a degree of uncertainty around the outcome of the Federal Election on 21 May with a hung parliament a real possibility. CreditorWatch maintains its position that the road to recovery will be an uneven one, and company insolvencies will continue to rise across 2022.

Key Business Risk Index insights for April:

- Trade receivables and credit enquiries continue to trend upwards, indicating the broader economy many have reached an inflection point.

- Average trade receivables for April were at their highest level since July last year.

- Credit enquiries decreased from March to April but are still up 30 per cent quarter-on-quarter.

- Multiple adverse impacts will likely temper this positive data over the coming months.

- The Business Risk Index national default rate remained flat at 5.8 per cent in April, however CreditorWatch forecasts a continued rise across 2022.

- There was stabilisation across industry default rates in April.

- Court actions decreased from March to April but are still up 12 per cent year-on-year.

- Victorian Grampians is the lowest insolvency risk region with greater than 1,000 businesses.

- Western Australian wheat belt is the new lowest insolvency risk region in the country overall.

- The Western Sydney regions of Bringelly – Green Valley and Merrylands – Guildford are the highest risk regions in the country.

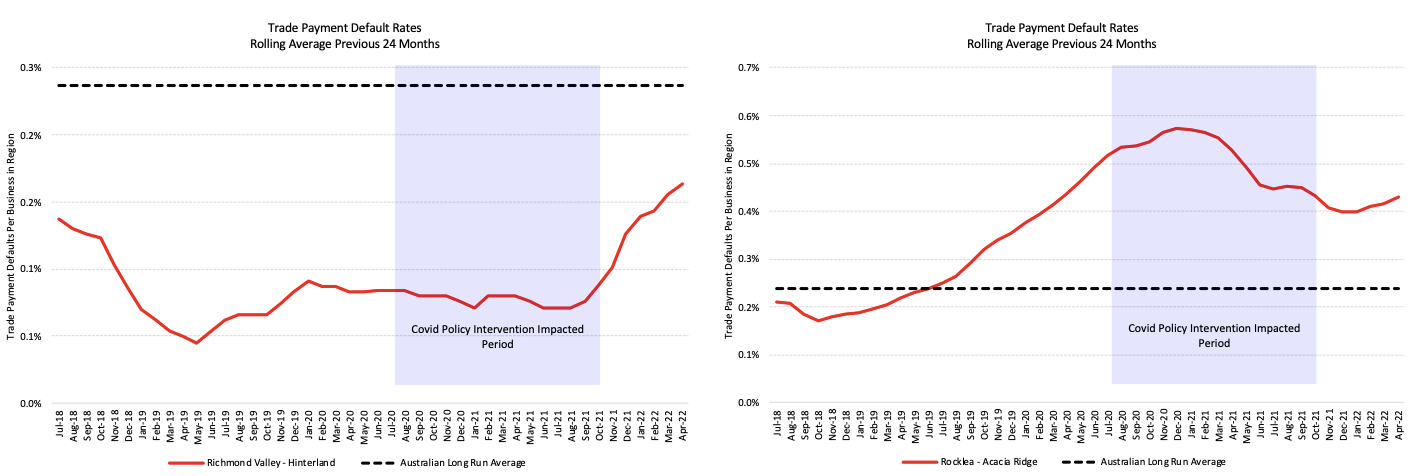

- Insolvency rates in areas heavily affected by the recent floods are forecast to rise significantly over the next 12 months – 36 per cent in the Lismore area (Richmond Valley – Hinterland) and 14.5 per cent for Brisbane’s Rocklea – Acacia Ridge area.

CreditorWatch’s data for April also shows a dramatic increase in the expected insolvency rate for the areas in Northern New South Wales and Southern Queensland most heavily affected by the recent floods.

The Lismore area (Richmond Valley – Hinterland) is forecast to record a 36 per cent rise in business insolvencies over the next 12 months and one of the most heavily affected areas in Brisbane, Rocklea – Acacia Ridge, is expected to record an increase of 14.5 per cent over the same period.

The Gympie and Maryborough regions of Queensland are forecast to experience increases of 0.6 per cent and 1.5 per cent respectively.

Source: CreditorWatch Business Risk Index

CreditorWatch CEO Patrick Coghlan says that while there are some green shoots emerging, the outlook for the Australian business community is far from certain.

“It’s great to see trade receivables and credit enquiries trending up, in line with increasing business confidence, however, rising interest rates and inflation will undoubtedly slow this down to some degree. Consumer spending is on the rise – up 6.3 per cent in the March quarter according to Westpac – but household savings remain high and will probably remain that way as rates rise further and people expect to pay more for their mortgages going forward.”

According to CreditorWatch Chief Economist Anneke Thompson, there are promising signs in the data that businesses are continuing to make a return to pre-COVID levels of activity. However, as nearly all central banks around the world have noted, there is still a great degree of uncertainty in economic conditions going forward.

“In his speech following the announcement of a 25 basis point lift in the cash rate after the May board meeting, Governor Philip Lowe paid particular attention to outlining just how much uncertainty the RBA is currently dealing with.

“Of course, global issues are a concern, particularly the ongoing war in the Ukraine and associated supply chain issues, however, domestically, Governor Lowe pointed out that we have no evidence in Australia as to how wages growth will respond when unemployment falls below four per cent.

“He also noted the high levels of debt that Australians now have, compared to the last monetary policy tightening cycle. These statements suggest that the RBA won’t be too trigger happy with cash rate increases and will be carefully trying to steer inflation down without causing too much pain to Australian workers and mortgagors in the process.”

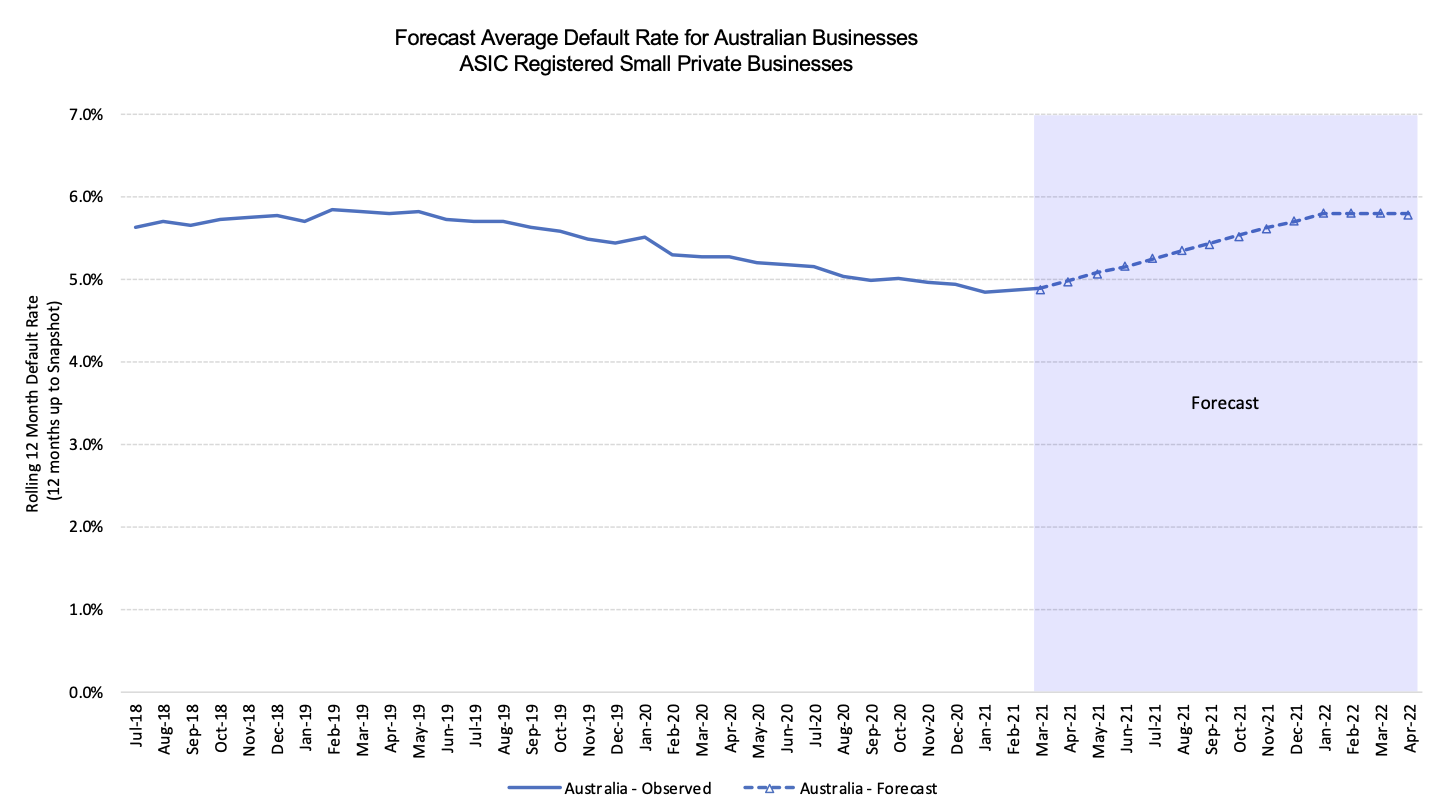

Small business default forecast

Business default rates are rising on average in Australia, and we expect to them peak at around 5.8 per cent over the next 12 months.

The risks of higher than forecast default rates persist given the looming impacts of inflation and interest rate rises. We also note that many small businesses secure their business loans against their home, so any downside movement in house prices will have a flow on impact to small business default risk.

Source: CreditorWatch Business Risk Index

Probability of default by region

The five regions at least risk of default over the next 12 months are:

| 1. Grampians (VIC): 3.68 per cent |

| 2. Murray River – Swan Hill (VIC): 3.68 per cent |

| 3. Limestone Coast (SA): 3.81 per cent |

| 4. Lachlan Valley (NSW): 3.85 per cent |

| 5. Moree – Narrabri (NSW): 3.89 per cent |

The five regions most at risk of default over the next 12 months are:

| 1. Bringelly – Green Valley (NSW): 7.82 per cent |

| 2. Merrylands – Guildford (NSW): 7.78 per cent |

| 3. Gold Coast – North (QLD): 7.62 per cent |

| 4. Canterbury (NSW): 7.56 per cent |

| 5. Surfers Paradise (QLD): 7.48 per cent |

Once again, regional areas where a high proportion of businesses are linked to agricultural production are the lowest risk areas. Agricultural land values have seen extraordinary rises over the past few years as offshore groups have moved in to compete with local producers.

Agriculture is also an inflation hedge, as the sector produces non-discretionary food items that households cannot do without. On the flip side, the highest risk areas are those with many small businesses linked to construction, retail and professional services.

Many of these businesses will have loans secured against homes in the area and given the relatively strong levels of supply of homes in growth areas, house price growth tends to be more muted than in land deprived inner-city locations. We will be closely monitoring the performance of the Australian housing market, as the impact on default risk in these locations will be outsized.

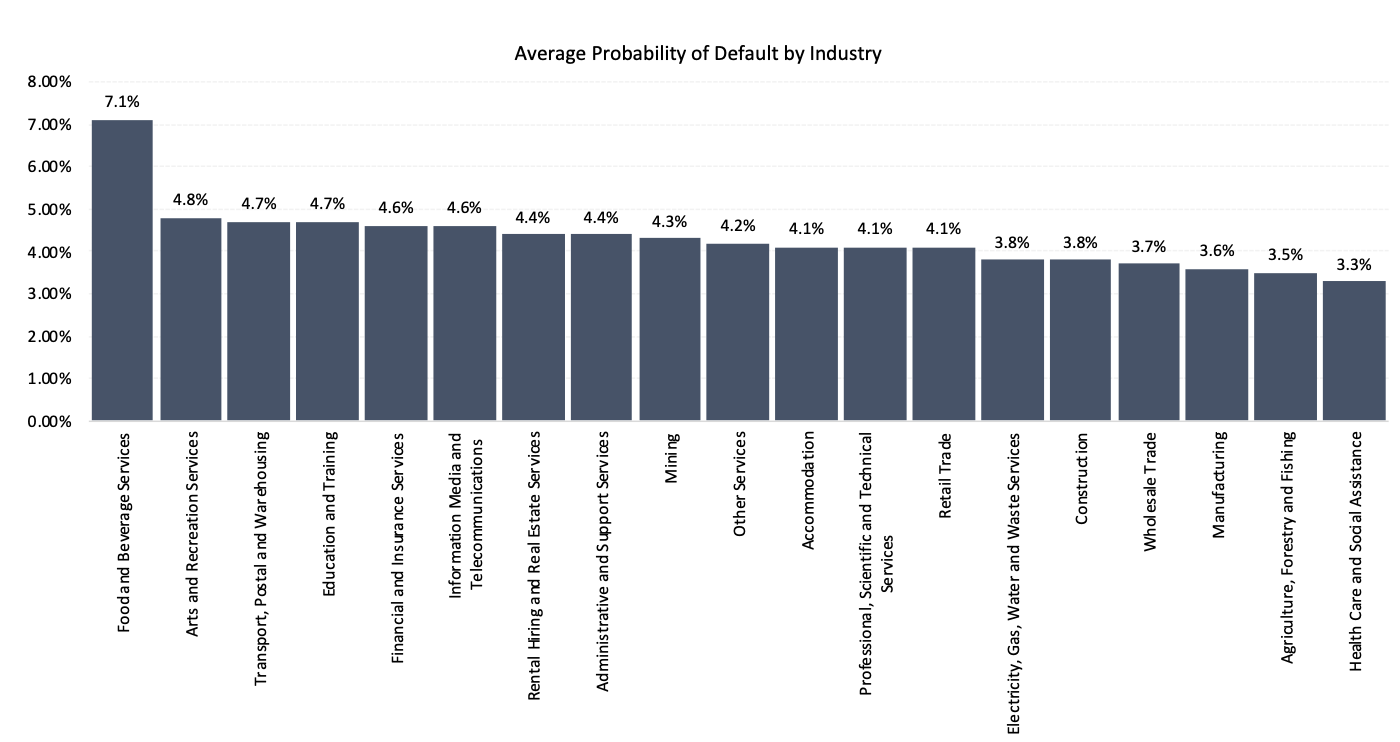

Probability of default by industry

The industries with the highest probability of default over the next 12 months are: –

- Food & Beverage Services: 7.1 per cent

- Arts and Recreation Services: 4.8 per cent

- Transport, Postal and Warehousing: 4.7 per cent

These industries are all highly susceptible to declining demand as a result in inflation and rising interest rates. Once the cash rate decision was announced on 3 May, many households will have started to think where they can cut back. Cooking at home more, cancelling subscriptions and entertaining at home are some of the simplest things that people can do to reduce spending. The transport sector, on the other hand, continues to be impacted by high fuel costs.

The industries with the lowest probability of default over the next 12 months are: –

- Health Care and Social Assistance: 3.3 per cent

- Agriculture, Forestry and Fishing: 3.5 per cent

- Manufacturing: 3.6 per cent

Industries that are deemed as necessities will always present as lowest risk, and healthcare and food production obviously fit this category. Manufacturing continues to benefit from global supply chain issues, and many local businesses trying to source more inputs made locally.

Source: CreditorWatch Business Risk Index

Outlook

Economic uncertainty is still the key theme this month. We await with interest both wage price data and the upcoming decision of the Fair Work Commission on the minimum wage increase. This will give us more of an idea of just how stressed households are going to be as we work through both the inflation and monetary policy tightening cycles.

While household balance sheets are strong, debt is higher than it has ever been, and savings could quickly run down through the year if inflation takes some time to fall back. All this presents increasing risks to businesses, as strong demand conditions could start to falter.

Contacts

Mitchy Koper

GM Communications and Marketing, CreditorWatch

mitchy.koper@creditorwatch.com.au

0417 771 778

Hayley Schubert

Senior Account Manager

hayleyschubert@slingstone.com

0431 651 418

ABOUT THE BUSINESS RISK INDEX

The Business Risk Index is a predictive economic indicator to help guide businesses when making future growth plans and inform public policy. It is a new credit rating that ranks more than 300 Australian geographies by relative insolvency risk, providing unique insights into the health of Australian businesses by region.

Each region is ranked from best to worst in terms of the potential for businesses in it to become insolvent. The index can also measure the potential for insolvency risk at a national, state and individual business level.

Regions are ranked on a scale from zero to 100, where 100 represents the best credit quality regions, that is, the lowest risk of insolvency, and zero represents the weakest credit quality regions, that is, the highest insolvency risk.

The index is calibrated by data from approximately 1.1 million ASIC-registered, credit-active businesses. It combines these insights with CreditorWatch’s proprietary data, previously published as the monthly Business Risk Review.

Subscribe to the Business Risk Index to be the first to receive our monthly updates.