SYDNEY, Thursday 20 January – Santa went missing! The December 2022 CreditorWatch Business Risk Index (BRI) has revealed that Australia’s trading activity was at its lowest point since the pandemic began due to the impacts of the Omicron variant.

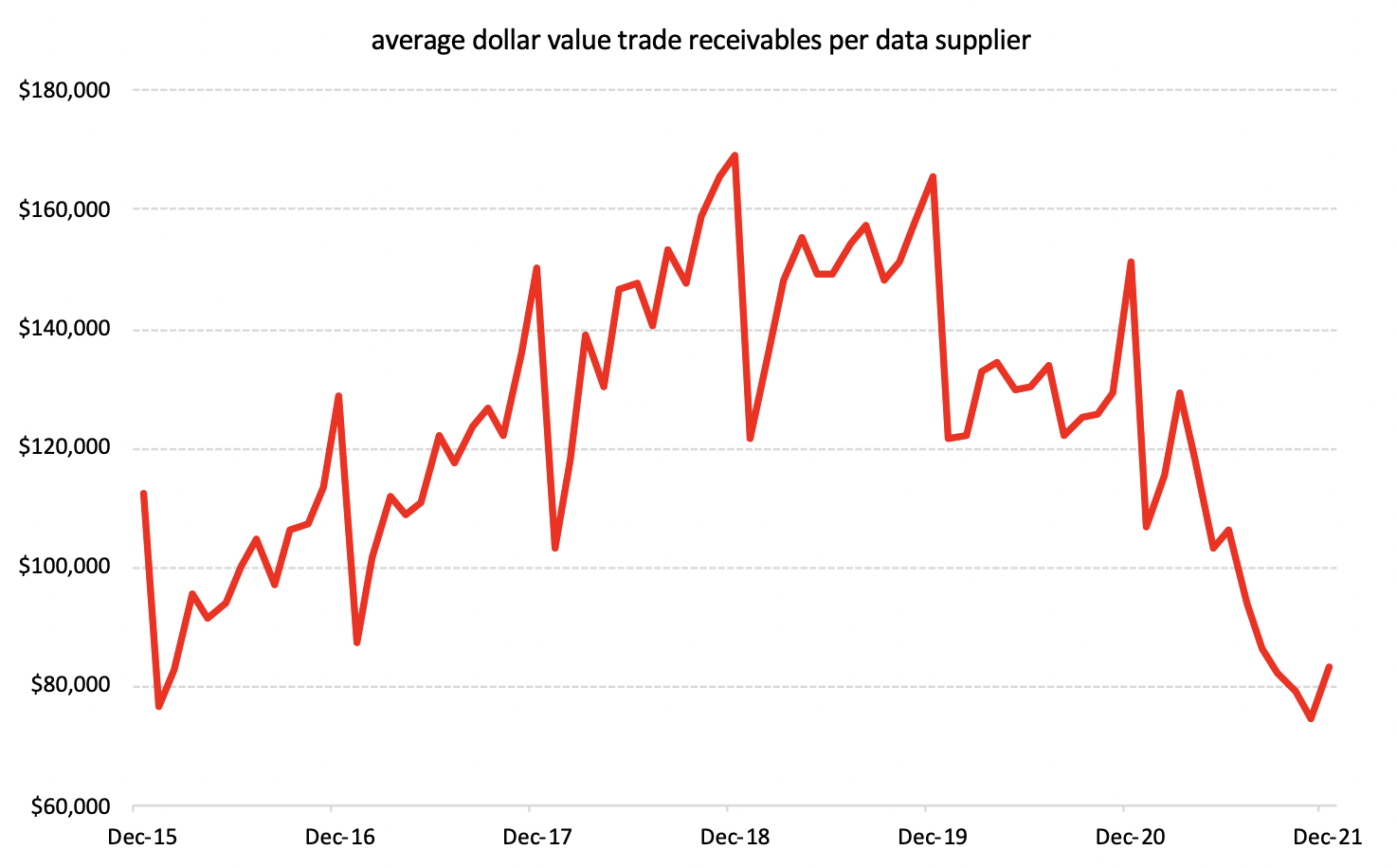

Trade receivables for December 2021 were down a massive 45 per cent on December 2020 figures.

Omicron conspired to ruin Christmas for many businesses through a combination of staff shortages, supply chain disruptions and consumers choosing to stay at home rather than go out and risk contracting COVID.

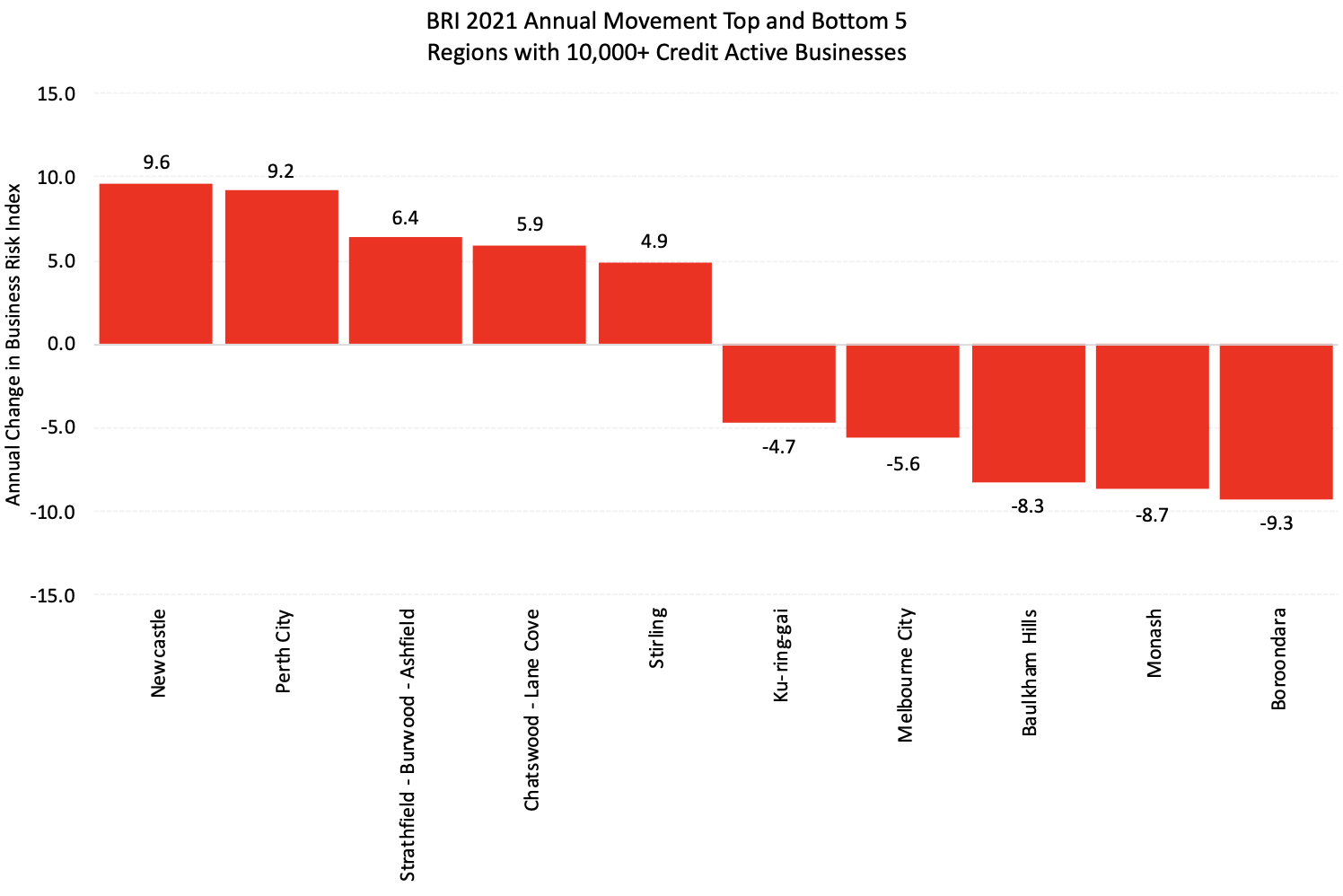

CreditorWatch’s data also showed that Newcastle and Perth are the two metropolitan centres bouncing back strongest from the pandemic, while Melbourne continues to struggle to recover from its period of extended lockdowns in 2021.

The data also showed a dip in defaults, external administrations, payment arrears and court actions from November to December (see below). Credit enquiries were also down after a 17 per cent jump from October to November, although this was due to seasonality more than anything else.

The nationality probability of default for December stands at 5.7 per cent, down slightly from 5.79 per cent in November.

The CreditorWatch Business Risk Index predicts the likelihood of businesses defaulting over the next 12 months across more than 300 regions around the country. The index utilises CreditorWatch’s proprietary data, combined with data the Australian Securities and Investments (ASIC) collects on more than a million local private businesses, among other variables.

“Everyone was expecting that the rapid spread of Omicron would have a significant adverse impact on Christmas trade, but few would have predicted it to be this extreme,” says CreditorWatch CEO Patrick Coghlan.

“You can’t blame people for wanting to stay at home. We can only hope that the peak arrives soon, and the business community can get back on its feet.

“Our Business Risk Index data next month will give us a good indication of how bad the damage from Omicron will be over the long term.”

Key Business Risk Index insights for December:

- Christmas trading activity the lowest on record due to impacts of Omicron. Down 45 per cent on December 2020.

- We expect trade activity to continue to slide over H1 2022.

- WA continues to be the best performing state as a function of its economy continuing to operate throughout 2021 while many other states were in lockdown.

- Queensland and Victoria are struggling to recover from a decline in the tourism trade and extended lockdowns respectively.

- Newcastle was the biggest improver among metropolitan areas as its two largest industries, manufacturing and construction, continued to operate unaffected by Omicron in December.

- Meanwhile Melbourne continues to decline on the Business Risk Index as the hangover from extended lockdowns remains.

- Defaults, external administrations, payment arrears and court actions have dropped. This is typically the case in December so we will be keenly watching the January data for the size of the bounce.

Christmas trading activity at all-time low

The December Business Risk Index data revealed that small and medium sized businesses in Australia failed to receive their traditional injection of revenue during the December festive season, largely due to the impacts of the Omicron variant.

Supply chain disruptions, staff shortages and lack of foot traffic all contributed to a 45 per cent drop in trade receivables from December 2020 to December 2021.

This was reflected in ANZ’s consumer spending data from the first week of January, which showed consumer spending was at its lowest level since the Delta variant emerged.

Source: CreditorWatch

Newcastle and Perth recovering while Melbourne struggles

The Business Risk Index December results showed that Newcastle was the biggest improving metropolitan centre from December 2020 to December 2021.

The steel city’s two largest industries, manufacturing and construction, continued to operate throughout December while other large population centres suffered under the spread of Omicron. Its strong resources base also contributed.

Perth, one of the most isolated cities in the world, was also a strong performer as a legacy of its economy continuing to operate throughout last year while many cities endured protracted lockdowns. As we emerge from the peak of Omicron and confront the aftermath, plus any fresh COVID variants that may appear, Perth and WA may well end up being a bellwether for economic and credit conditions in 2022.

At the other end of the scale, Melbourne showed that suffering the longest lockdowns in the world will take some time to recover from. Melbourne City, Monash and Boorondara all made the list of worst performers.

Source: CreditorWatch

Probability of default by region

The top five regions at least risk of default are:

- Murray River – Swan Hill VIC: 3.66%

- Glenelg – Southern Grampians VIC: 3.69%

- Limestone Coast SA: 3.72%

- Grampians VIC: 3.72%

- Murray and Mallee SA: 3.92%

Top five areas at most risk of default are:

- Merrylands – Guildford NSW: 7.79%

- Bringelly – Green Valley NSW: 7.74%

- Gold Coast – North QLD: 7.69%

- Canterbury NSW: 7.66%

- Springfield – Redbank QLD: 7.44%

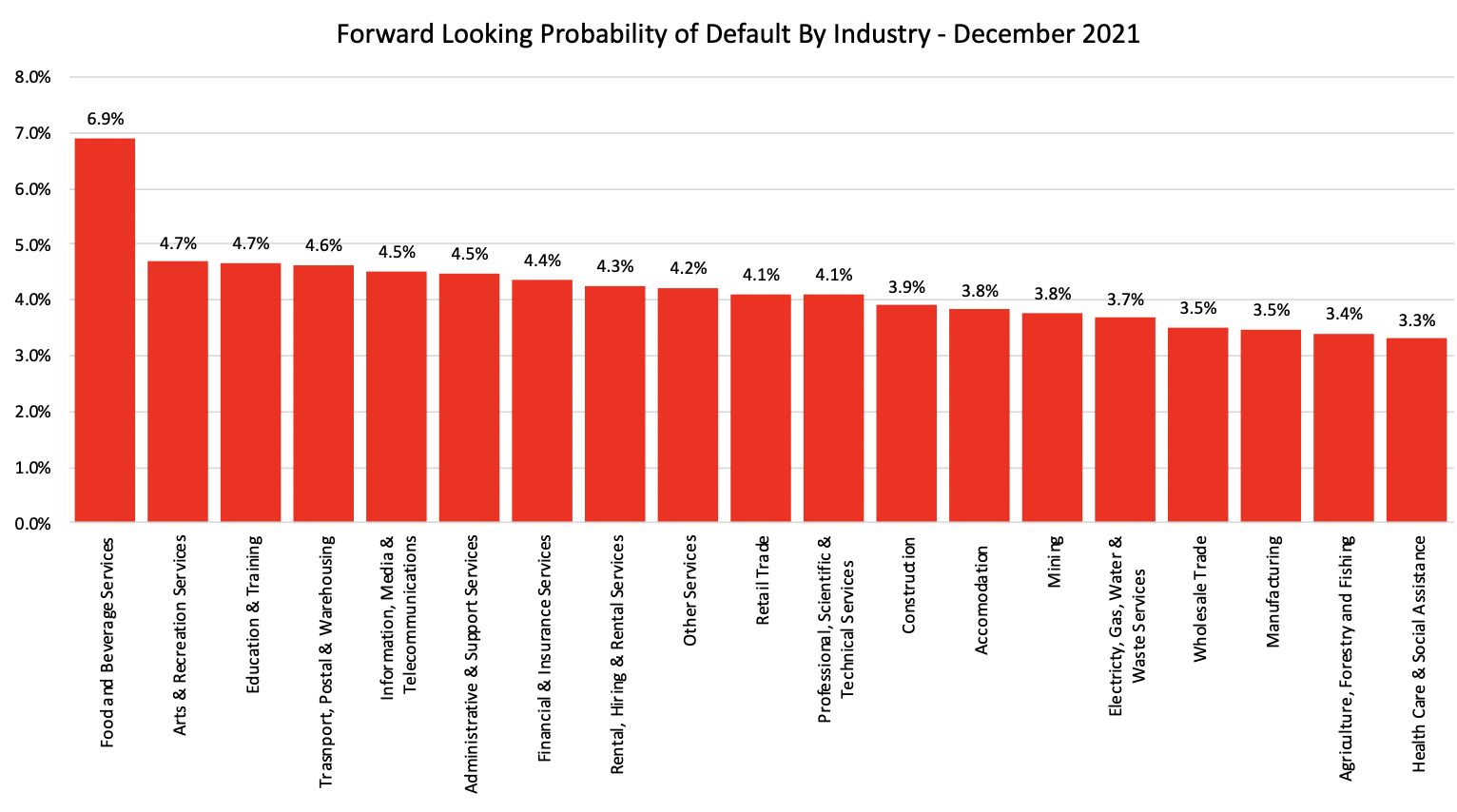

Probability of default by industry

Highest

- Accommodation and Food Services: 6.9%

- Arts and recreation services: 4.7%

- Education and training: 4.7%

Lowest

- Manufacturing: 3.5%

- Wholesale Trade: 3.5%

- Electricity, Gas, Water & Waste Services: 3.7%

Defaults

The number of defaults fell sharply in December 2021. That is hardly surprising given a spike of 53 per cent in November!

Throughout 2021 the number of defaults averaged far lower than in 2020. Taking the last data points, defaults fell by 5.1 per cent in the December 2021 quarter compared to the September quarter. That is an artificial result. Businesses are still being protected by a relative degree of leniency still being afforded them by financial institutions and creditors. How that dynamic plays out in 2022 will tell us a great deal about the shape of Australia’s economic recovery against the backdrop of the uncertainty everybody faces.

Source: CreditorWatch

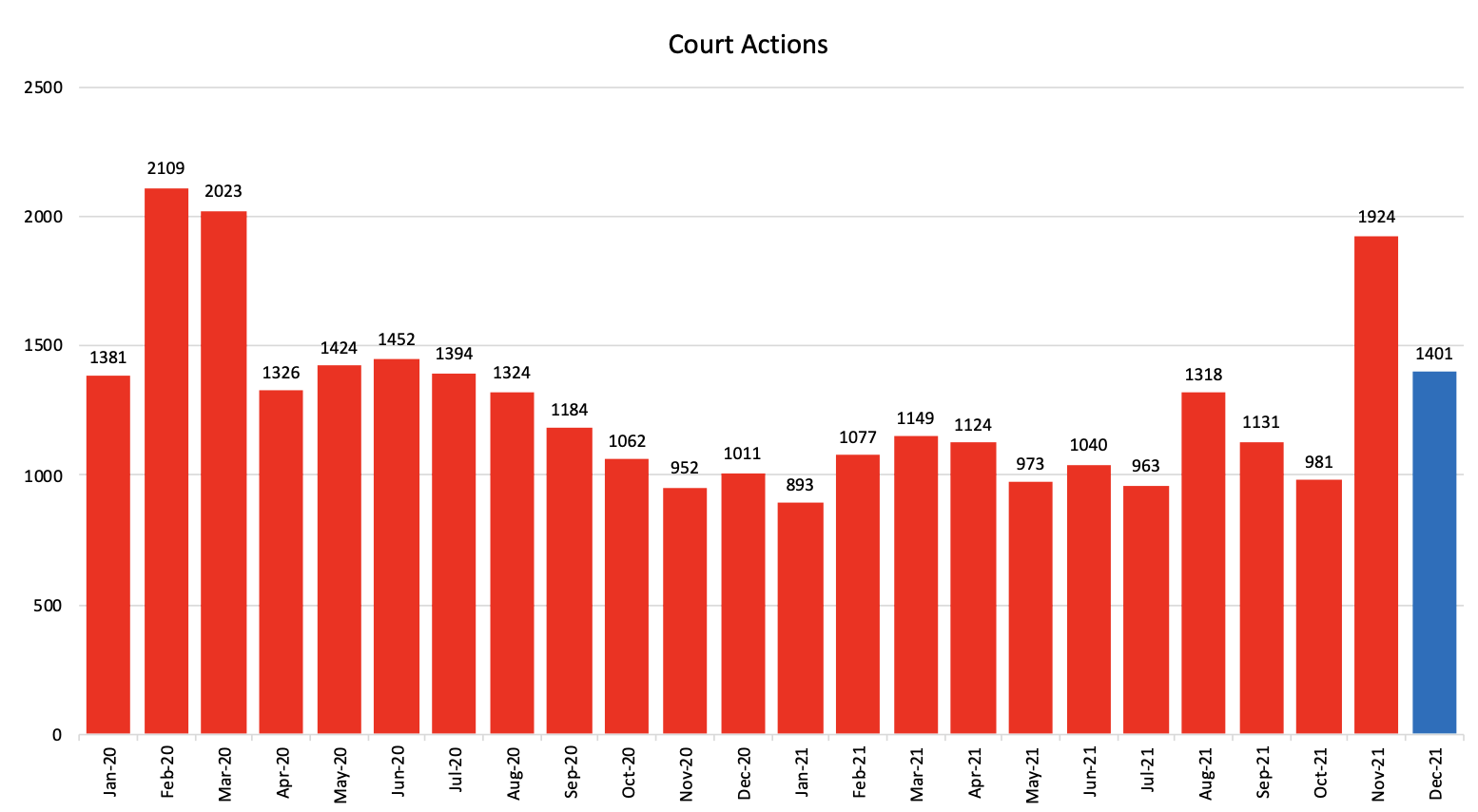

Court actions

The number of court actions spiked by 85 per cent in November 2021, although that result wasn’t seasonally adjusted. Then there was an unsurprising dip in December. In the December 2021 quarter court actions still increased by 26 per cent to be up by 42 per cent compared to the December quarter of 2020.

CreditorWatch has previously noted that the number of court actions is higher than it has been for some time. The lack of ability to appear in person due to COVID did supress court numbers, but the system has adjusted and that is why average numbers are probing higher. Expect to see rising court actions in 2022.

Source: CreditorWatch

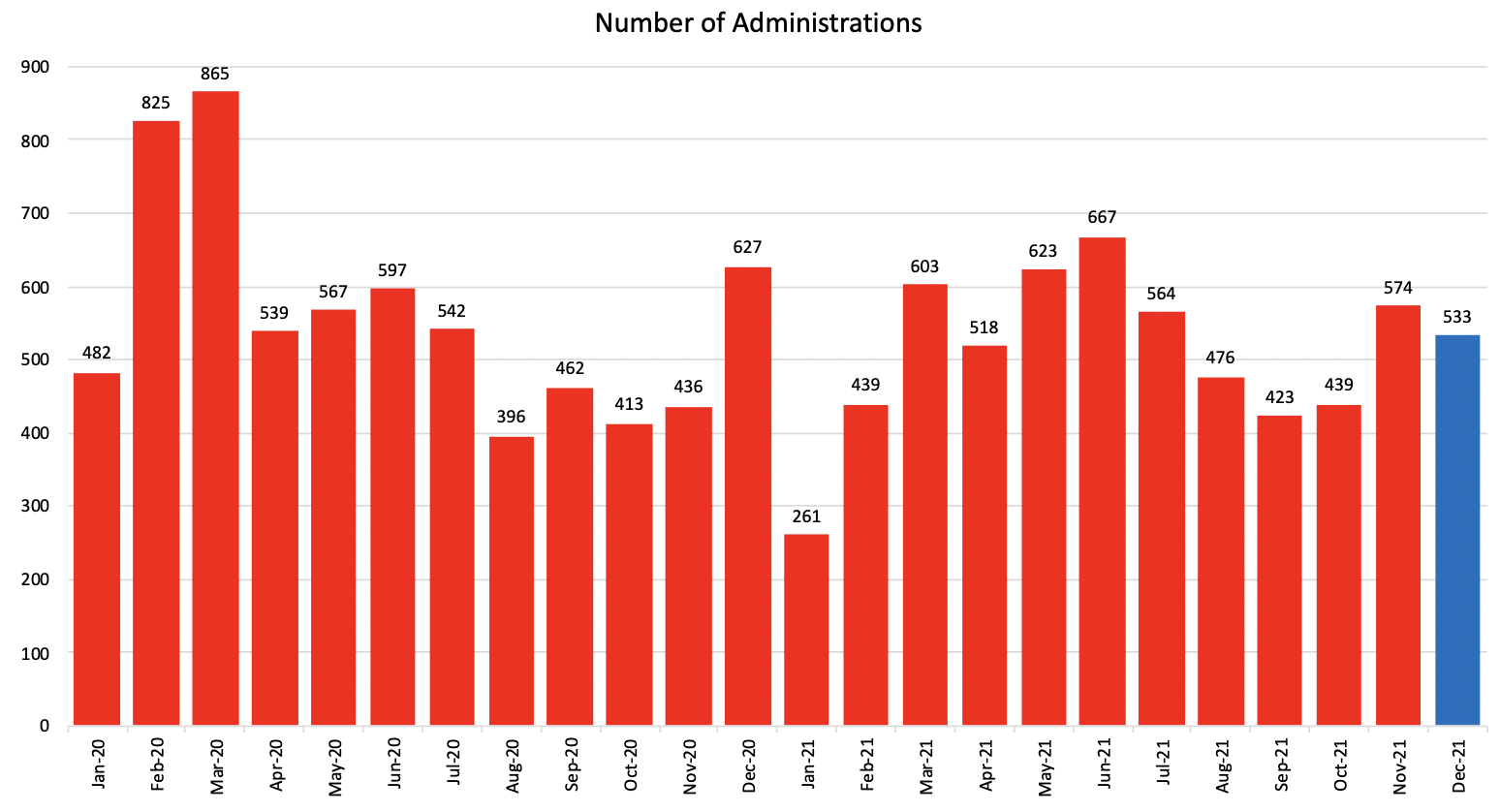

External administrations

The number of external administrations fell slightly in December 2021. No big thing, really. The number increased by six per cent over the December 2021 quarter – a far more reliable metric to assess. External administrations increased by five per cent when compared to the December 2020 quarter.

Overall, you’d have to say that the number of external administrations is displaying great signs of resistance against confronting economic times. That may well not last in 2022.

Source: CreditorWatch

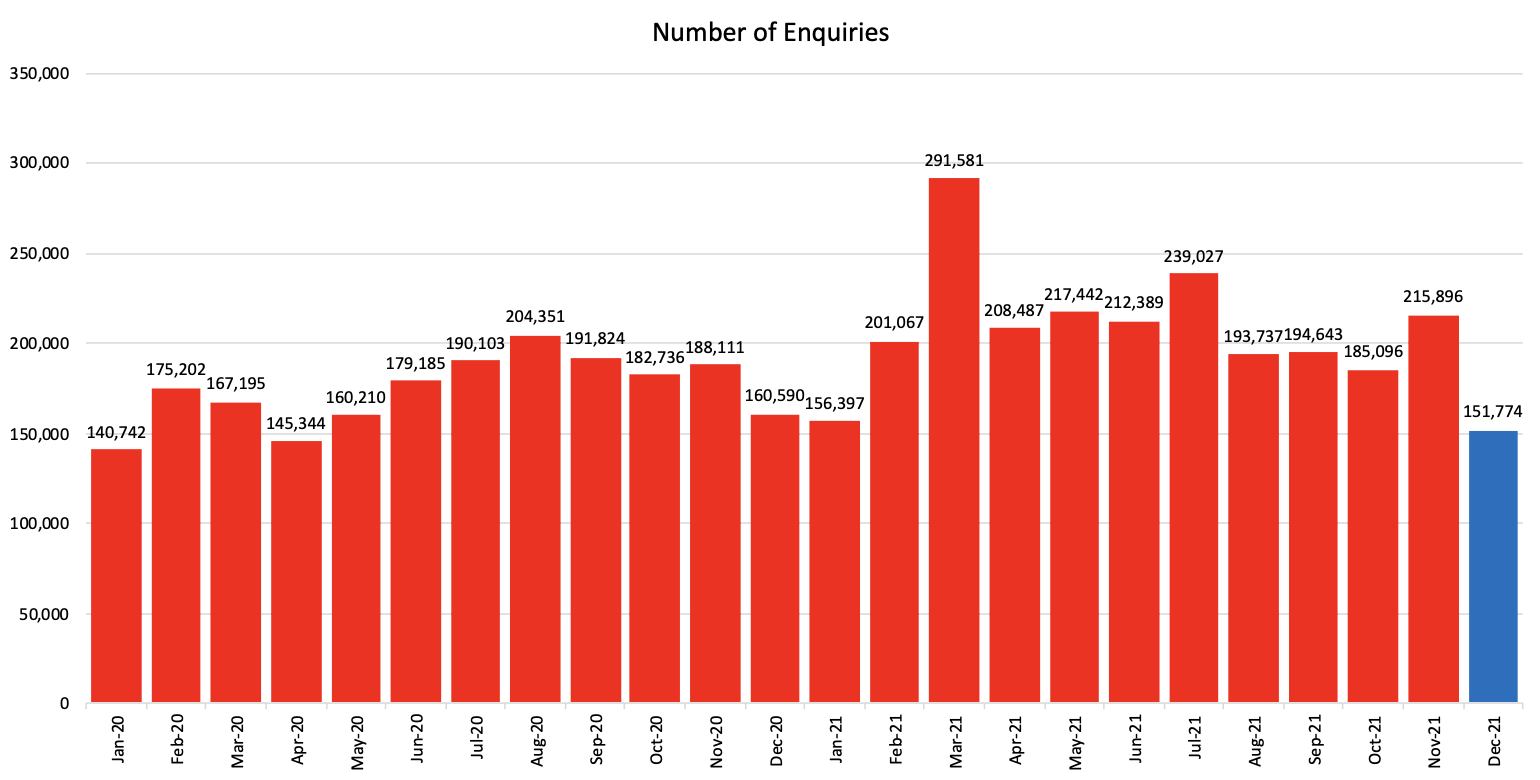

Credit enquiries

The number of credit enquiries dipped in December following a hefty jump in November – which represented the largest monthly increase since March 2021. Credit enquiries fell by five per cent in the December 2021 quarter, although that still left this key metric up by 12 per cent compared to the December 2020 quarter.

Any sustained improvement in credit enquiries would provide a key leading indication of brighter business activity and consequently overall economic drive. It will be important to keep an eye on a range of industries in terms of how they look to be faring in early 2022, including retail, wholesale and distribution, and hospitality.

Source: CreditorWatch

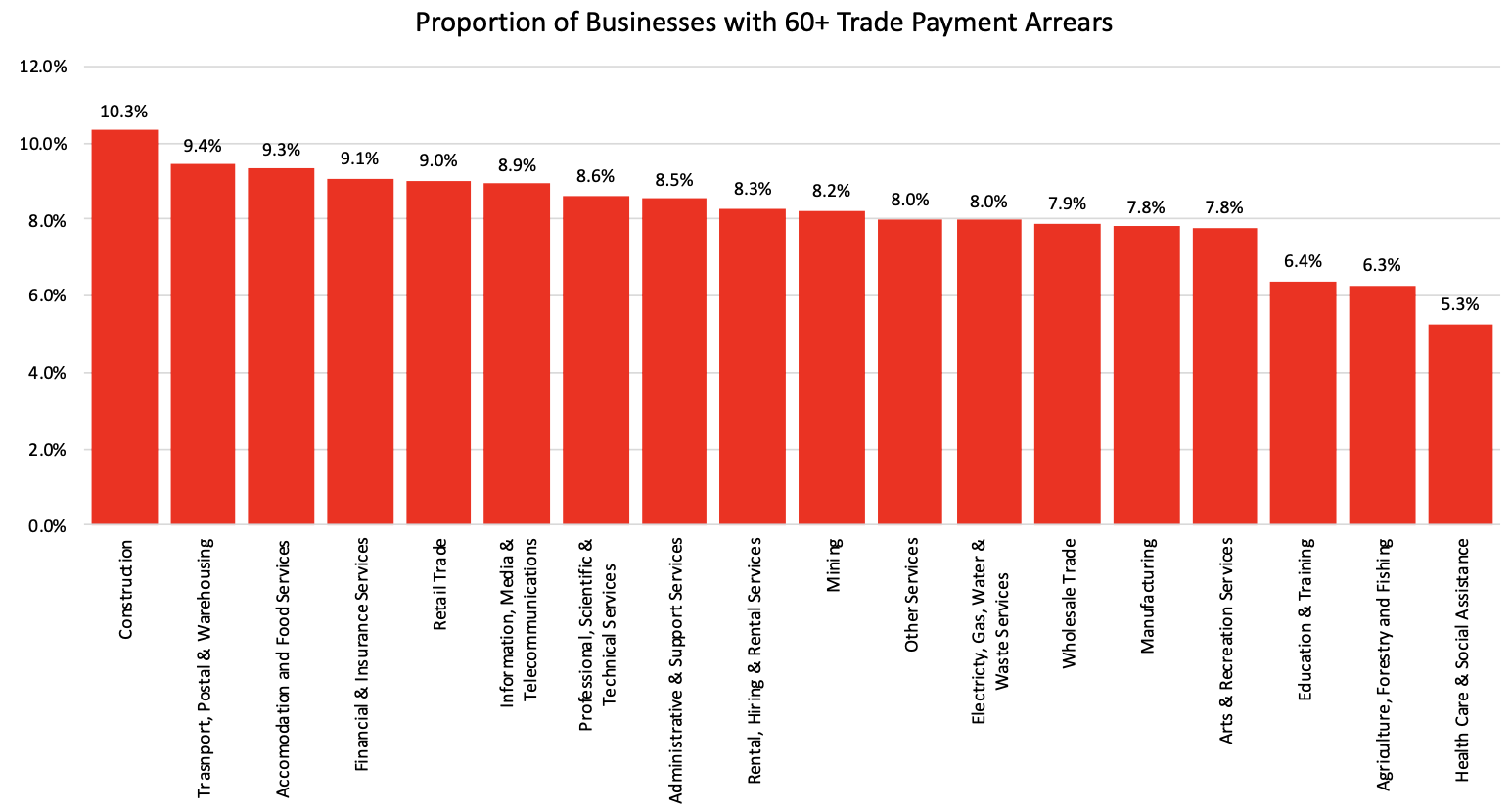

Payment Arrears

The gong for the number of businesses with a proportion of payment arrears of 60 days or more belongs to the construction industry. Commercial activity has suffered in key areas such as offices. On the residential front, COVID has been no friend to a sector reliant on progressive payments.

Transport, postal and warehousing comes in next with an arrears rate of 9.4 per cent compared to 10.3 per cent for construction. Supply constraints, COVID cases among workers and resulting strike action crippled this industry in late 2021.

Accommodation and food services is an industry where 9.3 per cent of businesses are 60 days or more behind payments. Once lockdown restrictions eased in late 2021 there was so much promise for so many SMEs in this space. Then the combination of the Omicron variant and a slow policy response to the fresh challenge struck these businesses.

Source: CreditorWatch

Outlook

The Australian economy undoubtedly bounced back in the December 2021 quarter and carries some momentum into 2022 but is enduring a bumpy ride as Omicron bites. With such high vaccination rates we will push through, but many SMEs have been hit hard. The promise of a relatively strong start to 2022 for areas such as retail and wholesale trade, together with food and hospitality simply hasn’t materialised.

‘Shadow COVID’, where the Australian public goes into self-imposed lockdown, and is reticent to engage in social activities such as going on a holiday or heading out for dinner has been quite dominant.

Contact

Mitchy Koper

GM Communications and Marketing, CreditorWatch

mitchy.koper@creditorwatch.com.au

0417 771 778

ABOUT THE BUSINESS RISK INDEX

The Business Risk Index is a predictive economic indicator to help guide businesses when making future growth plans and inform public policy. It is a new credit rating that ranks more than 300 Australian geographies by relative insolvency risk, providing unique insights into the health of Australian businesses by region.

Each region is ranked from best to worst in terms of the potential for businesses in it to become insolvent. The index can also measure the potential for insolvency risk at a national, state and individual business level.

Regions are ranked on a scale from zero to 100, where 100 represents the best credit quality regions, that is, the lowest risk of insolvency, and zero represents the weakest credit quality regions, that is, the highest insolvency risk.

The index is calibrated by data from approximately 1.1 million ASIC-registered, credit-active businesses. It combines these insights with CreditorWatch’s proprietary data, previously published as the monthly Business Risk Review.

Subscribe to the Business Risk Index to be the first to receive our monthly updates.