What are high risk businesses?

To be considered a high risk business, an entity will typically display a high risk of financial failure, reflected in its credit score, and/or operate in a high-risk industry. When engaging with new trading partners or suppliers, it is crucial to identify their level of credit risk, and how to mitigate any risk to cash flow, prior to signing any contracts.

How to identify a high-risk business

Every business operator seeks to ensure their invoices are paid on time and their client base follows responsible payment behaviour. As part of performing essential due diligence on new clients, it is prudent to assess whether you want to engage with any entities that fall into the high-risk category.

The financial risk level of a business is formally assessed by a credit reporting agency, such as CreditorWatch. This can form part of a strategy of ongoing analysis of a company’s creditworthiness, making decisions on the relationship determined by company credit history and credit score. There is a range of credit risk drivers that can determine business risk factors, including:

- Poor payment history – The business has adverse events in its credit file, such as late payments, defaults, ATO tax debt default, court judgments, bankruptcies and insolvencies.

- Ownership structure unclear – The business does not make transparent who the business owners, shareholders or beneficiaries are.

- Limited assets – A business seeking a line of credit with limited assets could be less likely to service this debt than one with more substantial assets.

- High level of debt – The more debt a high-risk business is already servicing, the less cash flow it has to pay creditors.

Keep in mind that any business in any industry may be deemed high risk if it satisfies one or more of the above criteria. However, there are some industries that intrinsically carry a greater risk of default, insolvency, fraud and more.

Consider utilising a risk assessment tool, such as CreditorWatch’s RiskScore, that indicates an individual business’ creditworthiness, and its likelihood of default over the next 12 months. Companies are given a score between 0-850, with a higher score indicating a lower risk to your business. This way, if you need to engage with a business in a high risk industry, you can do it in a data-driven way so you make a more informed decision.

High-risk business list

Generally speaking, the following industries in Australia may be more likely to feature high risk businesses:

- Construction – Facing unprecedented supply chain delays and materials shortages, resulting in rising external administrations. This sector also has a long history of non-transparent ownership structures and illegal phoenixing.

- Financial Services – Features heightened exposure to data breaches and cybercrime, as well as its association with money laundering, terrorism funding, and involvement with risky third parties.

- Food and Beverage – The damage done to this industry by the pandemic has been unprecedented. Even before this, businesses in the sector needed high capital to survive, particularly now they face higher overheads from supply delays and shortages, rising rents, and skills shortages.

To create a more comprehensive picture, a business owner may choose to use information provided by a credit agency, such as CreditorWatch, to make an individual assessment of another business’ risk level prior to engagement. This can be particularly useful if you require the products or services offered from one of these high-risk industries, as not all businesses can be painted with the same brush.

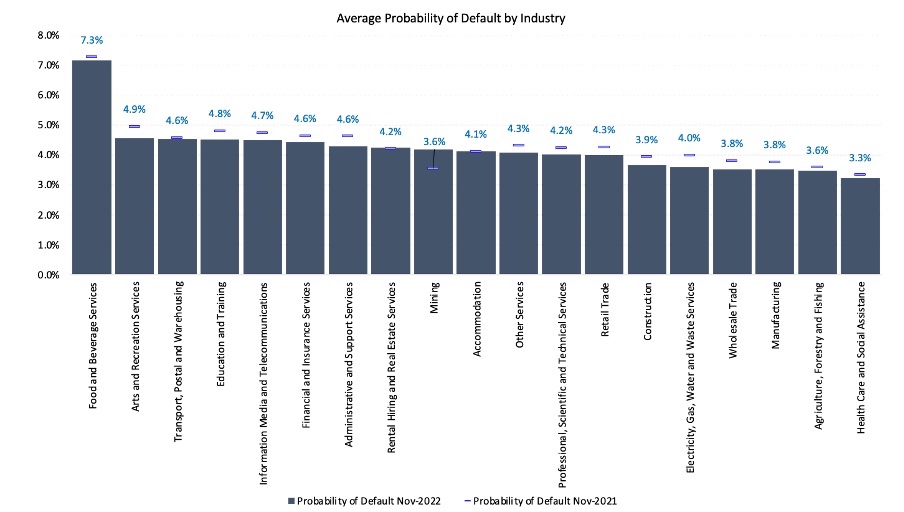

CreditorWatch’s Business Risk Index also analyses complex industry data to illustrate the average probability of default by industry each month. At the time of writing, the most at-risk industry for default in the next 12 months was the Food and Beverage sector.

According to the Business Risk Index, the industries containing the businesses with the highest probability of default in the next 12 months are:

- Food and Beverages

- Arts and Recreation Services

- Education and Training

- Transport, Postal and Warehousing

- Financial Services

Source: CreditorWatch Business Risk Index, November 2022. Learn more at our Business Risk Index hub and discover what is the risk classification used.

What does being high risk mean for a business?

If a business is considered high risk, some of the consequences may include:

- It may be harder to obtain credit approval – Gaining approval to credit may be harder, as lenders may be less certain the business can meet repayments. This may include business loans or business credit cards, further impacting the potential growth of the business.

- Higher chance of payment default and loss of customers – Due to the volatility surrounding the business or its industry, it may be more likely that a high-risk business will not be able to meet its ongoing expenses, such as regular invoices. If a business is considered high risk, another company may consider not engaging with them as a potential partner or supplier.

Why is it important to know if a company is high risk?

Unfortunately, you cannot rely on just a handshake and goodwill to be sure that your invoices will be paid on time, or that a new client is in a financially healthy position. If you are a creditor and money is owed by a high-risk entity, there is an increased likelihood that these funds could be paid late, or not at all.

Through the ability to identify high-risk companies, your business will be in a stronger position to safeguard its cash flow, and reduce its risk exposure. When you discover the RiskScore of a business through the CreditorWatch platform, or run a company credit report on a new or existing entity, you’ll gain crucial insights into the payment behaviour of those entities. This data is invaluable in assisting high-level decision making, such as whether to speed up a payment cycle for a high risk company, or proceed with lodging a payment default. You may also determine if a new business is worth engaging with at all, or if the risk to your cash flow is too great.

If you are involved in the hiring and rental of assets, by knowing a business is high risk, you can better protect your financial interest in these goods. Ensuring your assets are secured and registered on the PPSR should mean that you do not have to compete for your unpaid funds with unsecured creditors.

What are some of the ways you can avoid high-risk business status yourself?

When seeking credit for your business, you will be far more likely to gain approval if you are in the category of low risk industries. While you cannot choose to opt out of your industry, if your business operates in a high-risk sector there are still ways that you can reduce these risk factors so you are not ‘tarred with the same brush’ as delinquent businesses.

Pay your bills and invoices on time

Good payment behaviour is likely to increase the credit score and credit history of a business, and help ensure that it does not go down. Having a healthy company credit score can go a long way towards reducing your risk level, as well as increasing your likelihood for credit approval.

Choose your clients carefully

Ensure you do your due diligence when it comes to the risk exposure that new customers, trading partners and suppliers pose to your business. Protecting the financial health of your business is essential to avoiding the high-risk label. This may involve utilising credit-risk tools, such as credit reports, or CreditorWatch’s RiskScores and Payment Ratings.

Once you know a company’s payment history, and likelihood of default in the next 12 months, you can make much more informed decisions around whether to engage with it or implement measures such as COD (cash-on-delivery).

Implement 24/7 monitoring to protect your cash flow

If your highest-value client was to declare insolvency tomorrow, would you be prepared? Better yet, would you know how to identify the warning signs? Consider using business credit monitoring tools, such as CreditorWatch’s 24/7 monitoring and alerts, to secure your cash flow and avoid falling into the high-risk business category.

You’ll be notified immediately as soon as CreditorWatch detects adverse events and pertinent information changes concerning your client base, including court actions against them, non-payments to other suppliers or voluntary administrations.

Comply with AUSTRAC reporting obligations

AUSTRAC’s AML/CTF laws prevent corruption, tax evasion, theft and other crimes. If your business provides credit to individuals that could fall into the category of high risk customers, it is essential that you comply with know your customer (KYC) and anti-money laundering (AML) legislation.

This may be particularly relevant for those operating in the financial services sector, particularly those engaging in the open banking space, or offering high risk products or high risk transactions. By demonstrating that you comply with these reporting obligations, you’ll reduce your risk exposure and increase your brand trust with potential customers.

Identify and monitor high-risk businesses with advanced tools from CreditorWatch

Speak to our team of experts at CreditorWatch today to discover how our suite of high risk business monitoring and debtor management tools could assist in protecting your business and its cash flow.

Get started with CreditorWatch today

Take your credit management to the next level with a 14-day free trial.