When you apply for any credit products, sign up to a utility provider, or consider working with a new business partner, it’s likely a credit enquiry will be performed on you or your business. Hard credit inquiries, or credit checks, will be reflected on your individual or company credit file. Each credit enquiry may stay on the credit report for up to five years. However, it shouldn’t impact your credit score too significantly, unless you have multiple credit inquiries at once.

Both individuals and companies will have their unique financial history and information recorded in a credit file, which helps to influence your credit score. A credit score helps to determine the creditworthiness of a person or business, which is particularly relevant for banks and lenders when assessing whether to approve a loan or credit.

Whenever an individual or a company seeks to apply for a credit product, such as a personal loan or business loan, open a new credit card, or even register for gas and electricity, the provider must determine that you can responsibly service your repayments. This is where credit inquiries come in.

What is a credit enquiry?

A credit enquiry is another name for the process by which a bank, lender, or company looks at an individual or business’ credit score and credit report.

This information is used to determine their creditworthiness and likelihood of meeting repayments for credit products. For businesses, it can also be conducted by potential new clients, trading partners, or suppliers to ensure your company is likely to pay invoices and other costs on time. A credit enquiry will show those that are enquiring crucial data pertaining to the entity in question.

For individuals, this may show:

- Your name

- Date of birth

- Address history

- Gender

- Employer

- Records of credit accounts (credit cards, personal loans etc.)

- Repayment history

- Number of credit inquiries

- Adverse events, such as overdue payments, defaults, court judgements or bankruptcies

For companies, this may show:

- Company name

- ASIC registered company information, such as ABN/ACN, business structure, shareholders, registered address, and date of incorporation.

- Credit information, such as defaults, court judgements, insolvency, number of credit inquiries, court actions, ATO tax defaults, ASIC notices published against the business.

Are all credit inquiries listed on your credit reports?

Every credit enquiry performed on an individual or a company will be listed on your credit report. Credit inquiries can stay on a credit file for up to five years.

A credit enquiry by definition is just the act of looking into an individual or company’s credit file and assessing its credit score. Therefore, all credit inquiries are the same for persons and businesses.

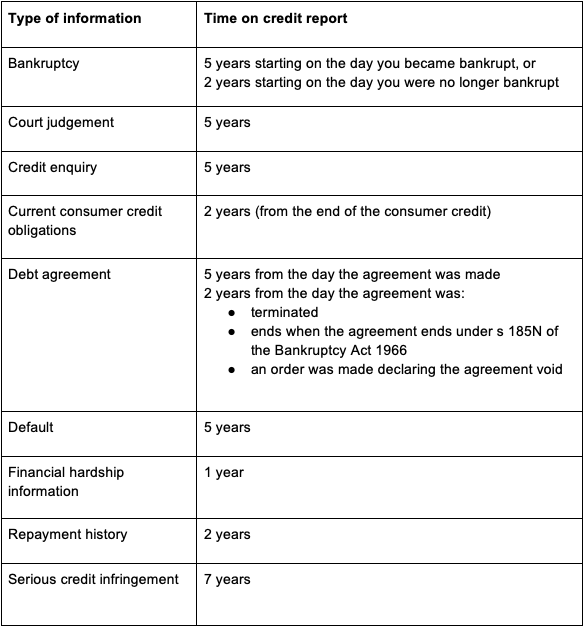

According to the OAIC, the following information will stay on a credit report for this amount of time:

What’s the difference between a ‘soft enquiry’ and a ‘hard enquiry’?

You may have come across the terms ‘soft enquiry’ and ‘hard enquiry’ when either looking to apply for some credit products, or access your own credit score. Put simply:

- A soft enquiry, or soft credit check is a request of your credit history that will not impact your credit score or be reflected on your credit file. It’s generally performed by creditors looking to provide pre-approval for loans, or even just to view your individual credit score through a third-party website.

- A hard enquiry, or hard credit check, is one that will be reflected on a credit file and can affect a credit score. It is typically conducted by banks and other lenders when you apply for credit or a loan.

While a soft enquiry can occur without your knowledge, a hard enquiry must have your approval before being performed. This is typically agreed to in the terms and conditions when an individual or company submits an application for a credit product, such as a loan or a credit card.

Is it bad to have lots of inquiries on your credit report?

Unfortunately, having multiple hard credit inquiries on a credit report can be detrimental to a credit score, and hurt your likelihood of approval for any products or services. When a bank, lender, or potential new partner business sees that you’ve had several inquiries into a credit report, this can make you or the business appear ‘credit hungry’.

For example, it is a common misconception to assume that applying for multiple home loans at once will boost your chances of being approved by one of them. In fact, if a lender sees that you’ve applied for several home loans at once, it can showcase a level of poor financial responsibility. It is more likely that you will be rejected for the application – which will further reduce your credit score.

What is considered a normal amount of credit inquiries?

As a rule of thumb, it is recommended that an individual or business does not apply for more than one credit product, with one provider, at any given time.

For example, if you’re seeking to open a new business credit card, it’s better to read over the card issuers’ terms and conditions first to ensure you meet the eligibility requirements, then make one application with one issuer and await your confirmation of approval or rejection. If you are rejected for a credit product, it may be worthwhile waiting a little bit to apply for another product. The credit score may have been lowered, and you may need to work to improve it before you can gain approval from another lender.

You may even reach out to the card issuer and request information as to why your application was rejected, so you may work on improving this issue. Once a financial position has improved, you may then apply for another business credit card.

Can you remove inquiries from a credit report?

Generally speaking, you may only remove an enquiry from a credit report if it has occurred without authorisation or in error. A legitimate credit enquiry will stay on a credit file for up to five years, after which it will be removed.

Keep in mind that mistakes can occur with credit reporting, and you may have incorrect information added to your personal or business credit file, such as a company with a near identical name having its payment behaviour added to your company credit file. If you notice an incorrect or unauthorised credit enquiry on a credit file, submit a request, or file a dispute with a bureau or reporting agency, for information removal. This can help ensure a clear credit score with only relevant information included.

Do the same rules apply in all countries?

You may be wondering how long do credit inquiries stay on your credit report in other countries outside of Australia? Different countries have their own rules and regulations around how long credit inquiries last on a credit file.

For example, a credit enquiry may last anywhere from 12 months to five years in different countries, such as:

- USA – up to 2 years

- UK – up to 12 months

- Canada – up to 36 months

- New Zealand – up to 5 years

—

For a detailed look into the credit reports of your current client base, or do your due diligence on new clients, trading partners or suppliers, consider utilising CreditorWatch’s comprehensive Credit Reports.

Save time and money on customer screening through our market-leading credit reports. Our reports will provide you with the most essential information to better inform your business decisions, including:

- Default risk – from A1 to F.

- Number of credit inquiries.

- Defaults registered against the company.

- ATO tax defaults.

- Court actions.

- Cross directorship information.

- Other important adverse data.

Reach out to our helpful customer service team today and find out how Credit Reports can reduce your business’ exposure to the risk of credit default.

Get started with CreditorWatch today

Take your credit management to the next level with a 14-day free trial.