By Anneke Thompson, Chief Economist, CreditorWatch

In April we continue to see the impact of inflationary pressures in our Business Risk Index (BRI) data. Those industries that are price setters – i.e., that can adjust their prices quickly to offset their increasing costs – remain the lowest risk sectors. That is, healthcare and social assistance, agriculture, forestry and fishing and manufacturing.

Manufacturing is an interesting sector as prior to COVID, the Australian based manufacturing sector found it difficult to compete with offshore competitors. Now, however, with the cost and difficulty of transportation, local manufacturers can move in to ‘price setting’ mode, and thus the risk in this sector from a creditor point of view remains low.

At the other end of the spectrum, we have industries that are both known as ‘price takers’, where they have a lot of inputs where prices are rising but the ability to set the price higher to offset this is more constrained. Food and beverage services remain the highest risk sector. It is difficult for operators in this industry to be real price setters as there is so much competition, and it is a discretionary sector, so customers can choose to go without. Whilst there have absolutely been price increases in this sector, whether they are enough to fully offset the increase in costs is probably unlikely. Therefore, the risk to creditors remains elevated.

What impact do we expect the monetary policy tightening cycle to have?

In early May, the Reserve Bank of Australia (RBA), finally put Australia in what is known as a monetary policy tightening cycle. The cash rate target was increased by 25 basis points, and there is little doubt that there are more increases to come. The RBA does this to curb demand in the economy and push down inflation from the demand side.

However, in the current inflationary cycle, prices are being pushed higher by both strong demand (particularly in the construction sector), and limited supply. Unfortunately, cash rate rises do little to alleviate supply side-driven cost increases, and therefore is a lot of uncertainty around how inflation will behave even as the cash rate rises. This is a problem for small, medium and large businesses, that will have to confront both rising prices and rising interest rates over 2022.

Any sector that has difficulty passing on price increases to customers will see their probability of default rise. This is particularly true for the construction sector, which currently has a relatively low probability of default, at 3.8 per cent. Most construction contracts are entered in to on a fixed price basis, and many of those contracts signed even as little as three months ago, when inflation was relatively benign, will quickly be in a position where profit margins may be wiped out due to rising input costs. Add to this the rising cost of debt that most businesses have, and many in this sector will be stuck in somewhat of a pincer grip.

Another factor that could influence default rates going forward is the housing market. Interest rate rises tend to have a direct impact on house prices, and we are already seeing evidence of house prices stagnating, particularly in Sydney and Melbourne. Many small business operators secure their business loans against their house, so any change in house prices could impact their LVR, and place further credit strain on them.

Lowest and highest risk sectors

The April 2022 Business Risk Index shows that the three industries with the highest probability of payment default over the next 12 months are:

| 1. Food and Beverage Services: 7.1% (down from 7.2%) |

| 2. Arts and Recreation Services: 4.8% (down from 4.9%). |

| 3. Transport, Postal and Warehousing: 4.7% (down from 4.8%). |

While the risk of these sectors dropped slightly from the previous month, this data will continue to be impacted by high inflation and higher interest rates.

Another factor to consider is the upcoming minimum wage decision by the Fair Work Commission. Already, the ACTU has increased their submission for pay rises from five per cent to 5.5 per cent in response to the high March inflation figure. While the final figure is unlikely to be this high (to avoid a dreaded wage-price spiral), it will be substantial compared to previous years.

All these sectors are big employers, and will see their wage costs increase, both because of the Fair Work Commissions decision, and the strong competition for workers in the sector also forcing up wages.

The lowest risk sectors will also see an impact to their costs because of higher wages, although as already discussed, they are more able to pass on these costs to the end user. These low-risk industries also tend to be dominated by larger operators and will be less exposed to any fluctuations in the Australian housing market.

The April 2022 Business Risk Index shows that the three industries with the lowest probability of payment default over the next 12 months are:

| 1. Health Care and Social Assistance: 3.3% (steady at 3.3%) |

| 2. Agriculture, Forestry and Fishing: 3.6% (steady at 3.6%). |

| 3. Manufacturing: 3.7% (steady at 3.7%). |

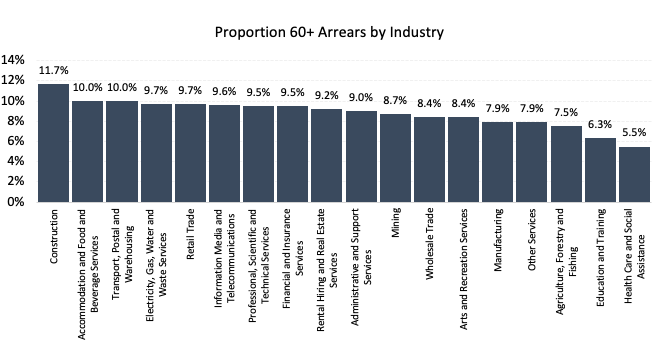

Payment arrears data remains relatively unchanged month to month, with the construction industry, at 11.7 per cent of the sector in 60 days or more arrears, still easily the worst performer. We would expect that payment arrears may start to increase as credit becomes more expensive.

Source: CreditorWatch BRI April 2022