Prepare for March 2021 by registering on the PPSR

Most government stimulus packages like JobKeeper are due to end on 28 March 2021, but it’s impossible to predict if they will be extended and for how long. If they do end in March as intended, businesses will suddenly be required to pay employee salaries, suppliers, overhead costs… all without assistance.

Many businesses are trading on the brink of insolvency without a turnaround plan. Zombie companies that have been artificially propped up by stimulus packages will fall over.

As a supplier or creditor, if your customers enter administration with your stock on hand, you’d likely lose your goods and/or payment without the PPSR in place.

Registering on the PPSR is crucial for manufacturers, wholesalers, any business supplying goods based on retention of title, and companies providing finance to other businesses. With the expected rise of insolvencies in mid-2021 and beyond, the PPSR is an important way to protect your business from the flow-on effects of your customers’ defaults.

Why register now?

As of 1 January 2021, statutory demands have reverted to pre-COVID positions, ceasing the relief that commenced on 25 March 2020. The only exceptions are businesses that have declared their eligibility for temporary restructuring relief.

This means:

- The statutory minimum has changed from $20,000 back to $2,000; and

- The statutory period to respond to the demand has changed from 6 months back to 21 days after the date of service of the statutory demand.

So, if a customer has an outstanding debt of at least $2,000, suppliers can issue a statutory demand and consider commencing winding up proceedings if the debt is not paid within 21 days. This means more and more businesses will be entering administration this year – your customers included.

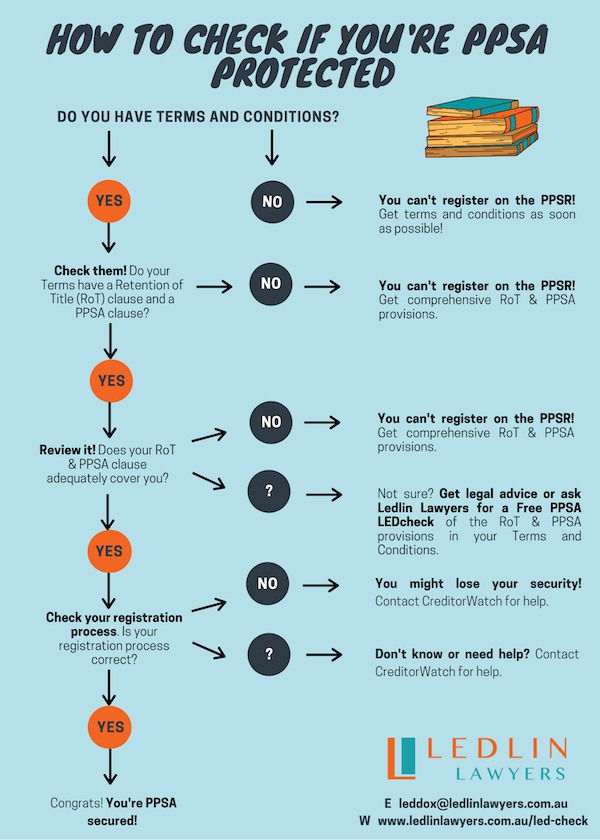

Natalie Ledlin from Ledlin Lawyers says, “Many businesses do not understand how the Personal Property Securities Act (the PPSA) can protect them when a customer suffers financial distress. We developed this easy to follow flow chart to show what is needed”.

Knowing what you should do and knowing how to do it are two sides of the same PPSA coin.

“We see many common errors that can affect the validity of a PPSA registration, including PPSA clauses that are incomplete, that do not include a claim for proceeds, that are badly drafted and that have been cut and pasted from another set of terms because they ‘looked OK to me'”, says Natalie.

To help your business further, you can also obtain a free PPSA LEDcheck of your clause to tell you if it is lacking in any way or could be improved.

Warning signs that your customers may be in financial distress

Start watching out for red flags that businesses are at risk of falling over once government stimulus ends. For example, your customers might:

- Slow down their payment habits – e.g. they’re requesting extensions and reducing the quantity and/or frequency of their transactions.

- Act evasive when you try to contact them.

- Take up accounts with your competitors – you can tell this is happening if you start getting trade reference calls from their potential suppliers.

Not sure if it’s worth the extra cost to register on the PPSR?

The economy in the next 12-18 months will continue to be unpredictable as government assistance tapers off. In this volatile climate, the key to survival is to have as much protection in place as possible.

If one of your larger clients falls over, the PPSR will help you recover your stock and pay itself back. A cost vs benefit analysis will show that registering on the PPSR could be the key to saving your business.

To protect your security interests, register on the PPSR now. Learn more about how the PPSR is saving firms from the zombie company apocalypse in this whitepaper.

CreditorWatch’s award-winning product PPSRLogic is a simple and cost effective way to get started and manage your registrations. If you’d like more information on PPSRLogic or want to know if the PPSR is necessary for your business, please get in touch with me at paul.mead@creditorwatch.com.au.

Paul Mead

Paul Mead

Senior PPSR Consultant

With over fifteen years’ experience in financial services, and over seven years’ experience with the Personal Property Securities Register (PPSR), Paul has an abundance of knowledge assisting clients to mitigate their credit risk and minimise the risk of potential losses from insolvent clients.

As the PPSR specialist at CreditorWatch, Paul works with a wide range of businesses from small independent companies through to the largest corporates in Australia, to assist them with their PPSR requirements and ensure their processes are correct and as efficient as possible.

Outside of work, Paul enjoys running, hiking, golf and spending time with his young family.

Connect with Paul on LinkedIn.