Customer Stories

“Live information comes through constantly and alerts me to issues other companies might have.”

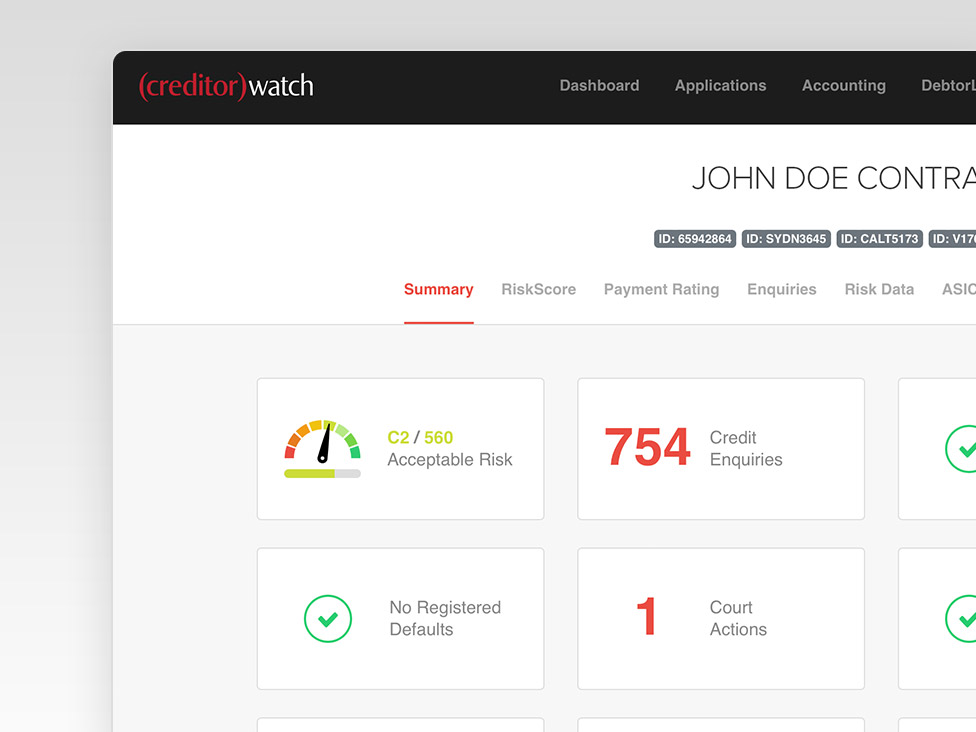

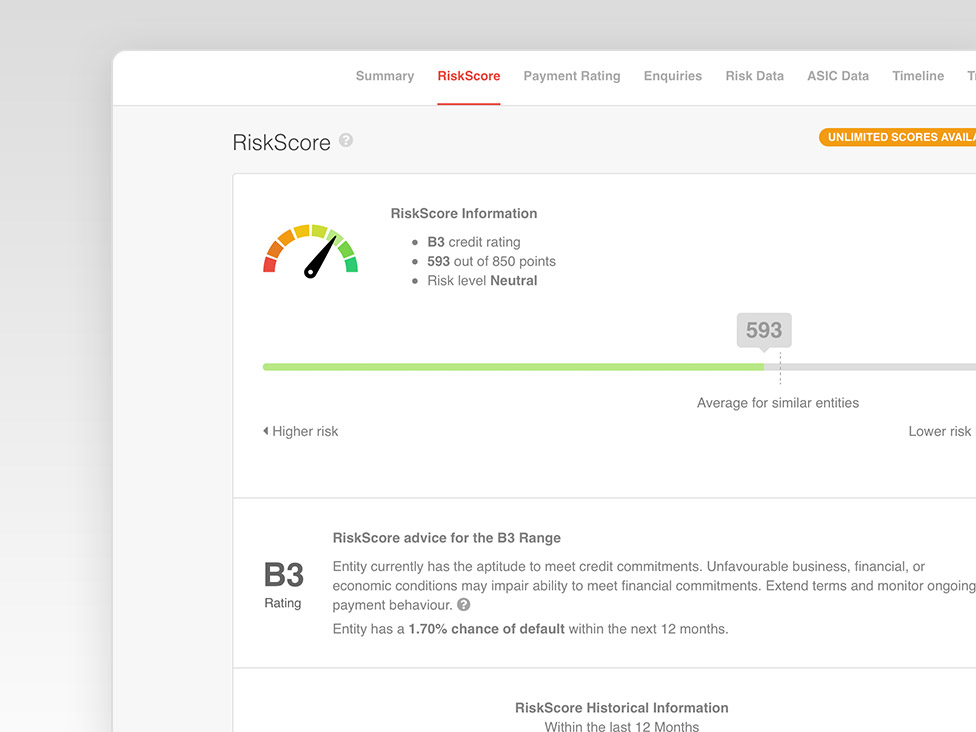

Bris Aluminium’s accounts team has been using CreditorWatch’s alerts and monitoring since 2019 to stay informed about adverse customer information, particularly payment defaults and cross-directorships.

Lyn

Bris Aluminium