Economic recovery calls for further means tests on stimulus measures

Further means tests are warranted on government stimulus programs given better-than-expected trade payments data and strong economic growth.

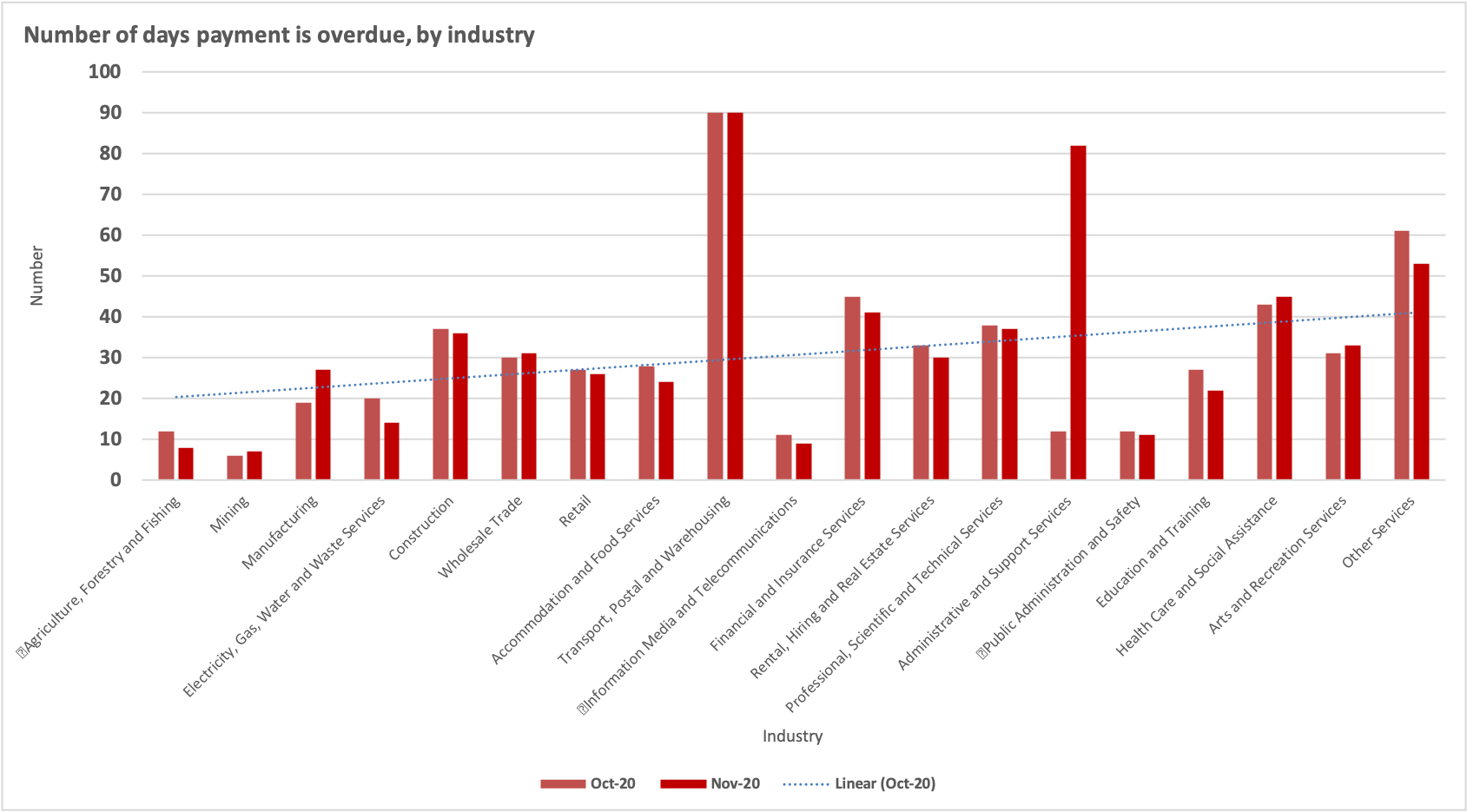

Our latest Business Risk Review shows the number of days debtors were late paying their bills in November was, on average 33, versus 16 days in November 2019. The number of days businesses were late paying their bills peaked in June at 47, with this figure subsequently improving.

“The recovery in payments data is a clear indication the economy is on the way back, supported by better-than-expected GDP numbers for the September quarter, with economic growth sitting at 3.3 per cent,” says CreditorWatch CEO Patrick Coghlan.

“As a result, there’s potential for the federal government to consider introducing further means tests for economic stimulus programs such as JobKeeper, to reduce pressure on the public purse and allow economic conditions to normalise.”

“Similarly, we believe the temporary moratorium on trading while insolvent should end on 31 December as planned. Extending this provision risks causing damage to the economy as solvent firms could be extending credit to insolvent firms, potentially creating a domino effect down the track if insolvent firms are allowed to continue to operate.”

CreditorWatch Chief Economist Harley Dale noted consistent credit inquiries during the pandemic also indicate the economy is tracking well.

“There was a small spike in credit inquiries in June and July, a flow-on effect from straightened conditions during lockdowns. But credit inquiries fell in September and October, with a small rise in November. This is evidence business conditions are returning to pre-COVID levels.”

“The good news is the number of delayed payment times is down in every state and territory in November 2020 when compared to a year earlier. New South Wales and Western Australia are the best-performing states.”

Industry specific payment times: best performing sectors

It’s pleasing the agriculture, forestry and fishing sector has shown the best month-on-month improvement from October to November and also the best annual improvement after a decade of drought and other natural disasters such as floods affecting payment times.

It’s also gratifying businesses in the education sector are starting to pay their bills more promptly, given this was one of the sectors hardest-hit by the pandemic with many full fee paying international students have not been able to take their places in local courses.

It’s to be expected payment times in information media and telecommunications are improving, given demand for products and services in this sector has been heightened as people continue to work from home.

Payment times trending down month-on-month in accommodation and food services is also good news for a sector that was decimated during lockdowns due to forced closures.

Industry specific payment times: worst performing sectors

The continuing poor performance of payment times in administrative and support services almost certainly reflects businesses are yet to return to normal office working conditions, with most staff still working from home. Therefore demand for services that help offices to run smoothly remains diminished, which is echoed in payment times from this sector.

While payment times from businesses in the arts sector are still rising, the month-on-month percentage increase is only small. This is likely to indicate customers are returning as patrons of arts businesses such as sporting and music venues. These numbers will only further improve as COVID-related restrictions continue to ease.

Similarly, health businesses were affected through the middle of the pandemic as demand for non-COVID services such as elective surgery dramatically reduced. This has also turned around as COVID case numbers have reduced, allowing health services businesses to get back to their regular business.

Industry-specific payment times: of special note

Payment times in financial services are likely still high given experts in this sector have a good understanding of mechanisms such as delaying payment to manage cash flow in times of economic uncertainty.

In the real estate sector payment times are improving, which is a reflection of the turnaround in the housing market.

| Annual % change | Month % change | |||||

| Industries | Oct-19 | Oct-20 | Nov-19 | Nov-20 | ||

| Agriculture, Forestry and Fishing | 16 | 12 | 18 | 8 | -56% | -33% |

| Electricity, Gas, Water and Waste Services | 9 | 20 | 15 | 14 | -7% | -30% |

| Education and Training | 8 | 27 | 11 | 22 | 100% | -19% |

| Information Media and Telecommunications | 9 | 11 | 10 | 9 | -10% | -18% |

| Accommodation and Food Services | 30 | 28 | 37 | 24 | -35% | -14% |

Worst performing sectors

| Annual % change | Month % change | |||||

| Industries | Oct-19 | Oct-20 | Nov-19 | Nov-20 | ||

| Administrative and Support Services | 19 | 12 | 23 | 82 | 257% | 583% |

| Manufacturing | 14 | 19 | 15 | 27 | 80% | 42% |

| Mining | 10 | 6 | 11 | 7 | -36% | 17% |

| Arts and Recreation Services | 13 | 31 | 16 | 33 | 106% | 6% |

| Health Care and Social Assistance | 10 | 43 | 11 | 45 | 309% | 5% |

Of special note

| Annual % change | Month % change | |||||

| Industries | Oct-19 | Oct-20 | Nov-19 | Nov-20 | ||

| Transport, Postal and Warehousing | 16 | 90 | 16 | 90 | 463% | 0% |

| Financial and Insurance Services | 11 | 45 | 13 | 41 | 215% | -9% |

| Rental, Hiring and Real Estate Services | 14 | 33 | 19 | 30 | 58% | -9% |

Credit inquiry numbers

| Month | Total inquiries | Monthly % changes | Annual % change |

| 2020-05 | 160210 | 10.2% | -11.3% |

| 2020-06 | 179185 | 11.8% | 12.4% |

| 2020-07 | 190103 | 6.1% | 3.3% |

| 2020-08 | 204351 | 7.5% | 14.3% |

| 2020-09 | 191824 | -6.1% | -39.7% |

| 2020-10 | 182736 | -4.7% | 3.2% |

| 2020-11 | 188111 | 2.9% | 8.2% |

Quick November stats

- Credit enquiries up 2.9% compared to October 2020

- Court actions down 27.8% compared to October 2020

- External administrations down 9.6% compared to October 2020

Data in this blog post is accurate as of 3 December 2020

“December will prove to be a watershed month for what has been a tumultuous year in 2020.

At the beginning of December, we received the Gross Domestic Product (GDP) result for the September 2020 quarter. It showed that economic activity expanded by 3.3 per cent (admittedly following a fall of 7.0 per cent in the June quarter). During the nadir of adverse economic consequences attributable to COVID-19 in June and July, no one thought a positive result was possible.

The latest CreditorWatch Business Risk Review confirms the unexpected early pace of recovery. Results for November 2020, both in a geographic and industry sense, paint a considerably brighter credit picture than was evident in the middle of the year.

That is not to say we are out of the woods or that an on-going recovery will be a smooth one. It is widely expected, including by CreditorWatch, that the economic recovery will take time and will look patchy and bumpy. CreditorWatch expects that our monthly Business Risk Review (BRR) will reveal a similar experience, especially as federal and state support for businesses is unwound.

The BRR will, at the same time, reveal crucial insights into how Australia’s business community is emerging from the crunch provided by COVID. Updates in the first quarter of 2021 will be vital in providing policy makers and analysts with a starting roadmap for how strong the economic recovery will be next year. The first CreditorWatch BRR for 2021 is due out on Wednesday 13th January.

Australia also has other issues on its plate, most notably the trade stoushes with China. Sectors such as barley, wine, beef and cotton have been targeted, although the impact on export volumes remains lower than implied in general commentary. The key is 2021 because as the current year draws to a close, tensions are escalating rather than receding.

CreditorWatch data for November 2020 highlights a significant improvement in overdue payment times for the Agriculture, Forestry and Fishing industry compared to the first eight months of the year. It will be important to watch data such as payment times for any sign of a return to a deteriorating trend due to any on-going trade spat.

The CreditorWatch BBR for November 2020 revealed a few highlights.

Every state and territory showed falling payment times in November. New South Wales and Western Australia were the best performing states when compared to November 2019. Across industries, there were significant improvements in payment times for: Mining; Accommodation and Food Services; and Information and Media Services.

That second result of the three highlights the benefits to many small and medium sized businesses (SMEs) stemming from Australia ‘re-opening’ the doors of businesses to customers who are cashed up due to government support and months where they could not get out and about and spend much, or indeed hardly get out at all.

The CreditorWatch data also suggests that many SMEs are faring better in late November 2020 than many feared would be the case. This confirms that it is appropriate that the Safe Harbour provisions end this year and that a more targeted approach is appropriate towards JobKeeper payments, as opposed to a blanket cover.”

– Harley Dale, CreditorWatch Chief Economist