The Foreign Investment Review Board (FIRB) has been criticised in several quarters for helping to trigger last month’s collapse of Probuild through its refusal to approve a $300 million takeover of the company by state-owned China State Construction Engineering Corp on national security grounds.

But would this takeover have actually saved Probuild? Not likely, according to Ginette Muller, who acted as liquidator in the 2017 $9.2 million collapse of Queensland-based Rimfire Constructions. She says the writing was well and truly on the wall for Probuild.

“Rimfire was in a similar situation to Probuild, where there were numerous jobs under water and some good ones about to start,” she says. “In Rimfire’s case the portfolio was cherry picked, so bad jobs stayed and Rimfire went into liquidation while the good jobs found their way to a new company.

“Looking at the Probuild situation, it was widely reported that the company’s major Brisbane project at 443 Queen Street was already struggling. Industry action group Subbies United pessimistically told its members that expectations of any recovery in the business’s fortunes were low.”

Muller says the fundamental reasons for Probuild’s failure are the same as they always are, although some, but certainly not all, blame can be attributed to COVID.

“The usual reasons are under capitalisation and underquoting with both labour and supplies,” she says. “Add to those the supply chain going to hell in a hand basket.”

Could sub-contractors and suppliers to Probuild have avoided this mess?

In a word, yes.

Probuild, like many other operators in the construction industry, was struggling to survive a perfect COVID storm of supply chain disruptions, cost blowouts, temporary worksite closures and increased worker absenteeism.

Of course, the challenge for sub-contractors is if they are mid-way through a project with a construction company like Probuild. It is practically impossible to unwind your position when you are so committed and therefore preferable to avoid becoming involved in such a predicament the first place.

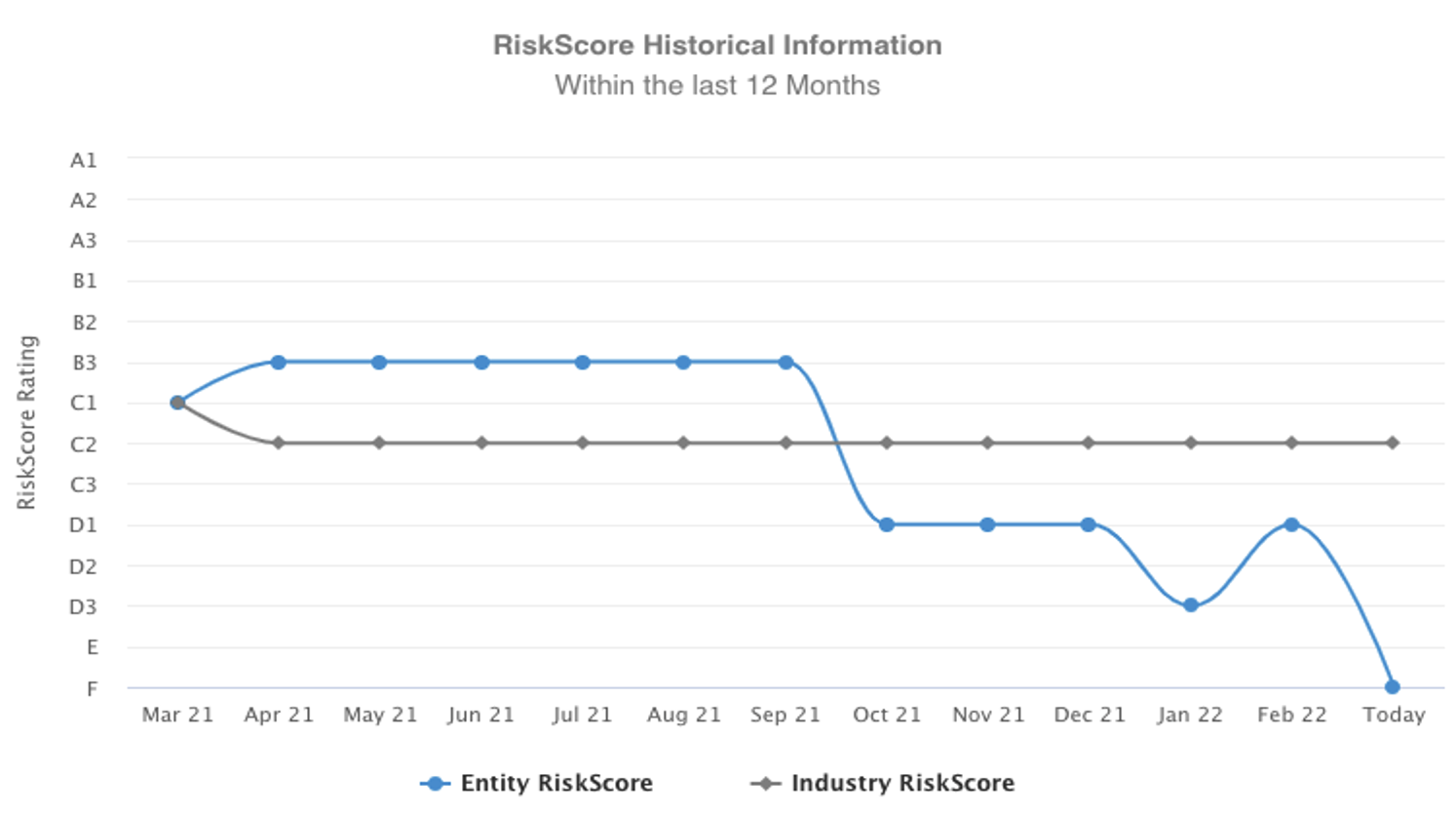

CreditorWatch downgraded Probuild to a D1 RiskScore Rating from October 2021, with its risk of default or insolvency significantly higher than the average Australian business, and well above the industry average. This rating dropped significantly due a few key factors including deteriorating payment behaviour, adverse credit activity and amplified credit risk in the construction industry.

CreditorWatch CEO Patrick Coghlan says, “the data underlines just how crucial it can be for businesses to monitor the vital signs of their stakeholders and to identify those suppliers and debtors that could be at risk of default, in order to adequately assess their credit risk”.

Probuild’s average invoice repayment time increased substantially in 2021, rising from just under 28 days in March 2021 to 58 days in February 2022.

Another red flag was a court action lodged against Probuild in October. This marked Probuild as ‘high risk’ on CreditorWatch.

Is the Probuild collapse just the tip of the iceberg?

Probuild is the largest casualty of Australia’s increasingly pressured construction industry but is not the first major construction business to fail in recent years. Melbourne-based ABD Group went into liquidation in 2017 with creditors believed to be owed $50-$80 million. Brisbane-based Privium went into voluntary administration in late 2021 with estimated debits of $28 million. Prior to collapse, both companies had CreditorWatch RiskScore Ratings of C1 and D1 respectively.

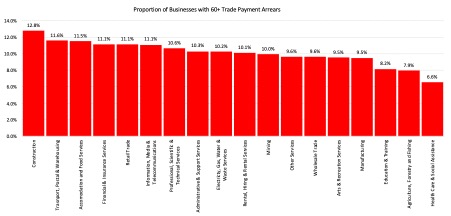

The collapse of three major players since the start of 2022 aligns with findings from CreditorWatch’s January Business Risk Index, which found the number of businesses with the largest proportion of payment in arrears by 60 days or more belonged to the construction industry at 12.8 per cent, driven by the industry’s unique payment structures which are contributing to a high rate of arrears.

According to James Flaherty, Convenor at Insolve “the Probuild collapse shows we are past the ‘canary in the coal’ mine stage of impending trouble in the sector. There will not only be a knock-on effect from other businesses being taken down by this collapse, but it’s also indicative of a broader problem in the construction industry”.

What can subcontractors do if they find themselves embroiled in a voluntary administration (VA) event like that of Probuild?

According to Chris Baskerville, Partner at insolvency solutions provider, Jirsch Sutherland, there are several key considerations for sub-contractors if they are in a contract with a construction company that goes into voluntary administration:

- Seek immediate legal advice about your specific position.

- Subcontractor Charge – Seek immediate legal advice as there are many hurdles to overcome and it is very technical claim.

- Subbies have three months to serve the charge of completing the works and file court proceedings within one month of serving the charge.

- Subbies in a VA must wait for the status of the VA as VA is a ‘wait and see’ approach and typically, the one month notice of commencing proceedings, does not begin until the VA ends.

- The opportunity cost of a Subcontractors Charge is that you cannot follow the adjudication process under the Building and Construction Industry Payments Act (BCIPA) to resolve the payment dispute – you need to pick one or the other. BCIPA in a VA may be irrelevant as you cannot commence proceedings against a company in VA, without leave of the court and, in the end, it results in a judgement debt that can be enforced (which in VA is simply lodge a Proof of Debt).

- Collecting materials you have supplied under retention of title claims (registered on the PPSR).

- Pursue personal guarantees (if you have them).

- Lodging caveats on directors’ properties, as long as you have a charging clause in your terms and conditions of trade, or a personal guarantee (seek immediate legal advice on this, again very technical).

- During VA, you can lodge a Proof of Debt for all the outstanding debt, and it will not impact any security you may have. It is a different position if the company goes into liquidation (if in liquidation, only prove for the shortfall in your security (if you have any), otherwise, you may lose all your security).

- Lodging a POD makes the VA recognise you as a creditor – you are allowed to participate in the First and Second Meetings of Creditors and have your vote count. You also get the VA’s 439A report (the big and important report).

- Check in with the VA’s team, to keep up to date on the progress of the VA and you can ask questions of the VA (as a registered creditor).

- Find immediate other sources of income with which to survive and keep your family fed.

- Any monies to fall out of the VA/DOCA/Liquidation scenarios may take several months to years to resolve. Do not count on that cash coming in for your day-to-day survival.

- If your business cannot survive the fallout from a collapse such as Probuild, seek legal advice as to your options and talk to a qualified insolvency professional (i.e., a registered liquidator)

Read our article on how sub-contractors can protect themselves in advance from becoming embroiled in voluntary administration.