Construction giant, Probuild, recently entered voluntary administration, leaving more than 750 jobs at risk and around 2,300 creditors chasing payment. This has created a massive shockwave throughout the building and construction industry, which has been under significant pressure over the past two years due to COVID-related supply chain disruptions, cost blowouts and labour shortages. Probuild’s collapse could be just the beginning; more construction firms may soon follow them into administration. So, what can subcontractors do if a debtor enters voluntary administration?

What is voluntary administration?

Voluntary administration is an insolvency procedure typically initiated by a company’s directors to allow them time to restructure the company and address debts. They will appoint an external administrator, who assumes control of the company and helps determine the best course of action for the future.

The voluntary administrator conducts investigations, reviews options, provides a report to creditors and recommends a plan for the business. This could involve executing a Deed of Company Arrangement (i.e., an arrangement between the company and its creditors on how the company’s affairs will be dealt with), ending the voluntary administration, or liquidating the company.

The voluntary administrator may consider continuing the business as a going concern. However, a trade-on of a construction company or building company in voluntary administration is very difficult because building regulations and licencing requirements vary from state to state. A more realistic scenario would be that its building licence gets suspended immediately, leading to its cancellation.

What can subcontractors do when a debtor collapses?

We spoke to Chris Baskerville, Queensland Managing Partner for Jirsch Sutherland and member of the Insolve Panel of Independent Liquidators. He shares the following tips for subcontractors.

1. Seek legal advice immediately

A debtor’s collapse could have serious consequences for your business. The first thing to do is to seek legal advice from a qualified insolvency expert, such as an insolvency lawyer or registered liquidator, to discuss your specific position and explore all your options.

2. Subcontractors’ charge

A subcontractors’ charge helps you to secure payments owed to you by someone higher in the contractual chain.

You have three months to serve this charge after completion of works and will have to file court proceedings within one month of serving the charge. You will need to wait for the outcome of the voluntary administration before being able to commence proceedings. To pursue this route, seek legal advice immediately as there may be various hurdles to overcome.

Note that if you lodge a subcontractors’ charge, you cannot pursue the adjudication process under the Building and Construction Industry Security of Payment Act to resolve your payment dispute. You will need to pick one or the other. The Security of Payment Act (which varies between states and territories) may be irrelevant in this case, as you cannot commence proceedings against a company in voluntary administration without leave of the court, but it could result in obtaining a subcontractor’s charge, if followed. This process may also result in a judgement debt, which provides a liquidated sum (including interest and costs) without protracted legal costs and time being spent.

3. Retention of title and the PPSR

Have you registered your materials and equipment on the PPSR? The PPSR protects your security interests if a debtor becomes insolvent. You should seek independent legal advice as to how you enforce your security interest to collect the items you’ve supplied under retention of title claims if they have been properly registered on the PPSR.

4. Personal guarantees

If you have personal guarantees, this is the time to consider pursuing them. Having said that, while the company is subject to voluntary administration, you cannot enforce personal guarantees, but you should get legal advice on how you may lodge caveats on directors’ properties if you have a charging clause in your terms of trade, contract or guarantee agreement. Again, it is important to seek legal advice on this.

5. Lodge proof of debt

During a voluntary administration, you can lodge a POD for all outstanding debt, without impacting any of your security interests. This changes if the company goes into liquidation – in that scenario, you may only prove for the shortfall in your security interests, otherwise, you may lose all your security.

Lodging a POD makes you a registered creditor. This means you will be allowed to participate in the creditors’ meetings, vote and receive the voluntary administrator’s report. This enables you to check in with the administrator’s team, ask questions and keep updated on the progress of the administration.

6. Secure cash flow through alternative means

Find immediate sources of income to survive and keep your family fed. Any monies to fall out of voluntary administration, DOCA or liquidation scenarios may take several months or even years to resolve. Do not count on that cash coming in for your day-to-day survival.

How can subcontractors protect themselves in advance?

There are ways to proactively mitigate your risk exposure before having to implement recovery measures.

Issue invoices promptly

Many businesses, especially those in building and construction, often leave administrative and accounting matters to the last minute. Protect yourself by issuing your invoices sooner. Delaying the issuance of invoices is a major cause of business failure. It leaves you at the back of the queue as a creditor and gives you no view of your cash flow when a major client goes down. Consider using an accounting software to help automate this process.

Perform due diligence to avoid working with risky companies

The Probuild collapse was not unexpected – there were clear warning signs indicating that it was in financial distress. Subcontractors could’ve avoided this mess by monitoring clients and debtors to identify red flags ahead of time.

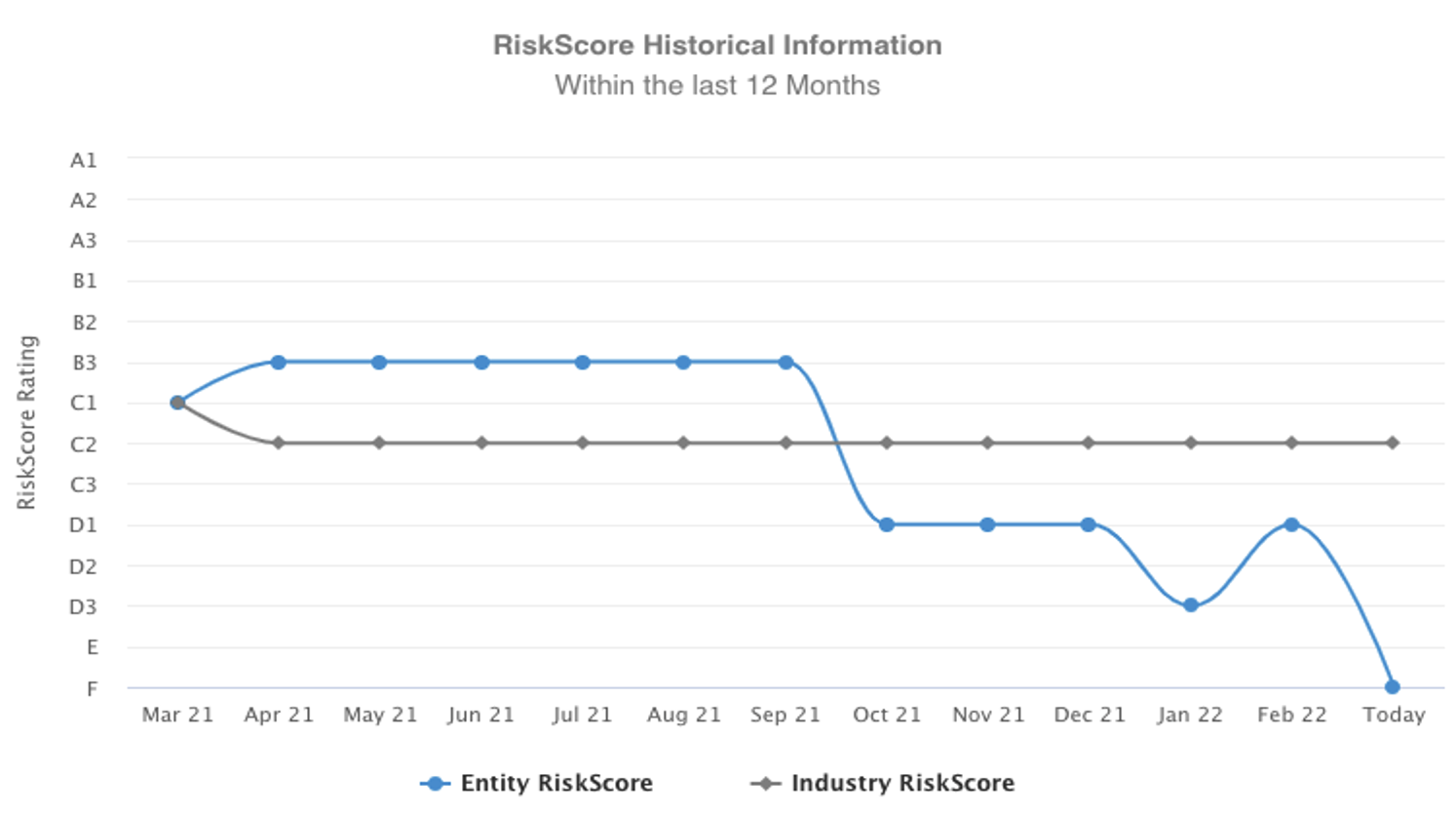

CreditorWatch gave Probuild a D1 or D2 Risk Score rating in October 2021, indicating it was at high risk of default or insolvency. This score was based on a variety of factors, including a rapid increase in credit enquiries, spike in average repayment times and numerous court actions lodged against them.

CreditorWatch helps subcontractors, sole traders and businesses of all sizes mitigate credit risk. Our unique data helps construction subcontractors avoid doing business with companies that are in danger of collapsing. We have the latest risk insights for all industries across all regions in Australia, empowering individuals and businesses to proactively mitigate risk and make more informed business decisions. To find out more about using CreditorWatch to protect your business, get in touch with us today.