Learn how to manage your customer risk with DebtorLogic

Deteriorating payment behaviour is a leading indicator that an entity is experiencing financial difficulty. COVID-19 and its associated economic difficulties have proven how vital it is to stay on top of your customer risk management and work proactively to prevent bad debt.

CreditorWatch’s trade program, DebtorLogic, is the ideal tool to identify your risky debtors.

What is DebtorLogic?

DebtorLogic allows you to assess the payment behaviour of your customers, prioritise your collections and identify high-risk debtors with one easy-to-use interface.

Every time you upload your ATB, DebtorLogic generates an extensive management report and delivers the most relevant data to help you make the best decisions for your business.

DebtorLogic is a game changer during any economic climate. If you’re new to DebtorLogic, please check out our website for more information and contact your account manager for a free demonstration.

In this blog post, we will focus on two ways you can enhance your customer risk management with DebtorLogic.

Click on the ‘View Latest ATB Detail’ widget in DebtorLogic to get started.

Customer Insights

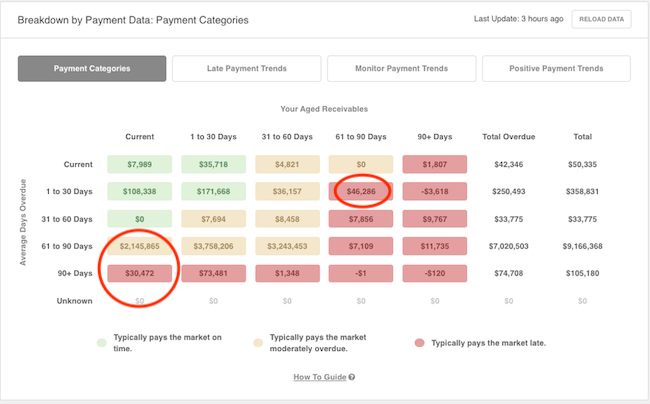

The Customer Insights tab reveals how your customers pay you in comparison to the rest of the market. It isn’t a crystal ball per se, but it can make some recommendations based on the early warning signs and indicators of cash flow problems within your ledger.

As you can see below, there is a significant amount outstanding in the customers paying in the 61-90 days range ($46,286, circled), whereas we can see the customers in this bracket are paying others in the 1-30 days bucket.

This should be a priority for your collections team. These customers are paying other bills, why not yours? It should also give your team the confidence to chase this debt, because you know the funds are there and the company is in a position to pay you.

This is why CreditorWatch created DebtorLogic: to help you get that 46k back in the bank.

Are you a critical supplier?

There is some interesting data in the customers that are paying you ‘current’ but everyone else in the 61-90 and 90+ days buckets (circled in the bottom left of the image above).

These customers aren’t paying their bills elsewhere, meaning you could be a considered a critical (tier-1) supplier to these entities. These customers should be your priority to mitigate credit risk to prevent creating a domino effect.

This is also a good time to think about lodging a PPSR registration or checking your registration is valid. At CreditorWatch, we have in-house PPSR experts that can help do this for you. Please ask your account manager or get in touch with us here.

Statistics show that secured creditors on average receive approximately 60 cents on the dollar, as opposed to an unsecured creditor who receives, on average, 1 cent on the dollar. This is prime preferential payment territory.

Risk Analysis

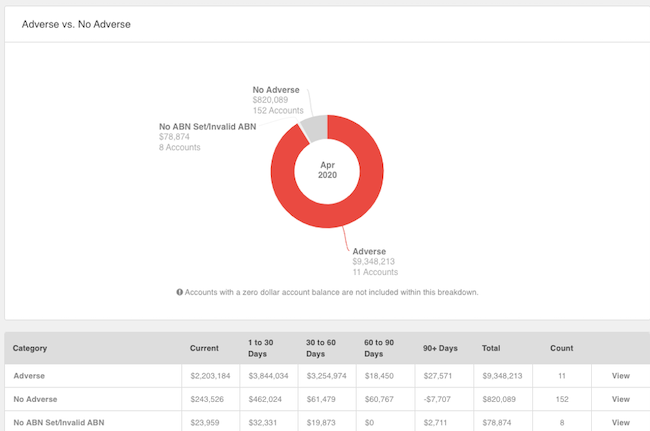

DebtorLogic‘s Risk Analysis tab also reveals hidden truths about your ledger. In the image below, you can see there is a large portion of the ATB with adverse data present.

Use this information to prioritise your collections and target your most collectable adverse accounts arranged by $ value. From here, you can create your own customer lists and measure the impact on your DSO (Days Sales Outstanding) by exporting this to a CSV file.

We’re here to help improve your customer risk management

Our customers are everything to us, so we’re always happy to help.

Please don’t hesitate to ask your account manager for the DebtorLogic How-To Guide or contact us with your questions on how to get the most out of DebtorLogic for your business.

If you liked this article, you’ll also enjoy: Our New DebtorLogic: More Features, More Data.