Follow these tips to improve your credit score

When it comes to your credit score, first impressions matter. Your company credit score helps other businesses quickly evaluate whether to do business with you. A low credit score signals that your business is a risk and that trading should be done with caution – or not at all. That’s why it’s so important to improve your credit score.

It’s easy, especially for time-poor small businesses, to overlook the importance of a credit score, but it shouldn’t be underestimated. Your credit score is a key factor in securing the finances you need to build your business.

We’re often asked ‘how long does it take for a credit score to improve?’ Unfortunately, you can’t boost your credit score overnight.

Building creditworthiness is a long-term process, and although you won’t see results right away, there are achievable ways to improve your credit score to help secure your business’ future.

Pay bills on time

It goes without saying, continually paying your bills on time is the best way to improve your credit score. It’s easy to fall into the bad habit of repaying your customers late, but this is going to negatively affect your credit score, not to mention cause your business relationships to deteriorate.

Reach out for help when you’re struggling to make payments

If you’re overwhelmed by an influx of bills and can’t keep up, explain the situation and ask for your payment terms to be extended. And if you do get an overdue payment notice, act immediately. Nip a late bill in the bud and you’ll avoid the ill effects of defaults, mercantile enquires and court actions in the future.

Monitor your own customers

Your company’s credit score isn’t just reliant on your actions. Keep a watchful eye on your customers and learn to spot red flags, like late payments, payment defaults and adverse director behaviour. One of your customer’s problems can eventually become one of yours if you’re not careful, and this can cause your credit score to plummet.

Keep tabs on your business’ credit report

You delve deep into your customers’ credit reports, but how often to look at your own? Make it a habit to check your own company’s credit report with a credit reporting bureau like CreditorWatch. You can check that it’s free from errors and you’ll gain a better understanding of the adverse information that could negatively affect your score.

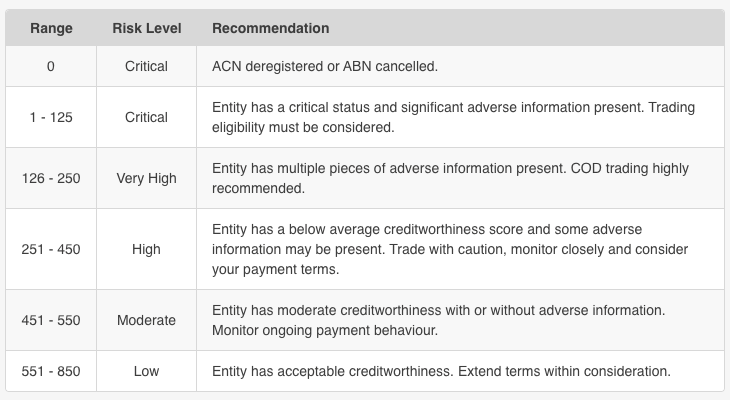

What does your credit score mean?

Your credit score will be a number between 0-850. Check the table below to find out what your number means. Would you do business with a company that has a critical or high score? If you would run for the hills, it’s likely your creditors would too.

Check your own credit score

You can find out your company credit score for free, and that of your customers. Join CreditorWatch’s community of 50,000+ customers for a free 14-day trial and discover a suite of credit risk management tools that will help you keep your credit score healthy.