How to Flatten the Insolvency Curve

Even if it seemed like time stood still during the past few months of COVID-19, we’re only 100 days away from the end of the temporary relief legislation offered to businesses by the Morrison government.

The statutory demand limits, insolvency and safe harbour measures that have been a life raft for Australian businesses during the pandemic will abruptly end on 24 September 2020. This has the means to drown some companies that have essentially been treading water this entire time.

Administrations are set to rise

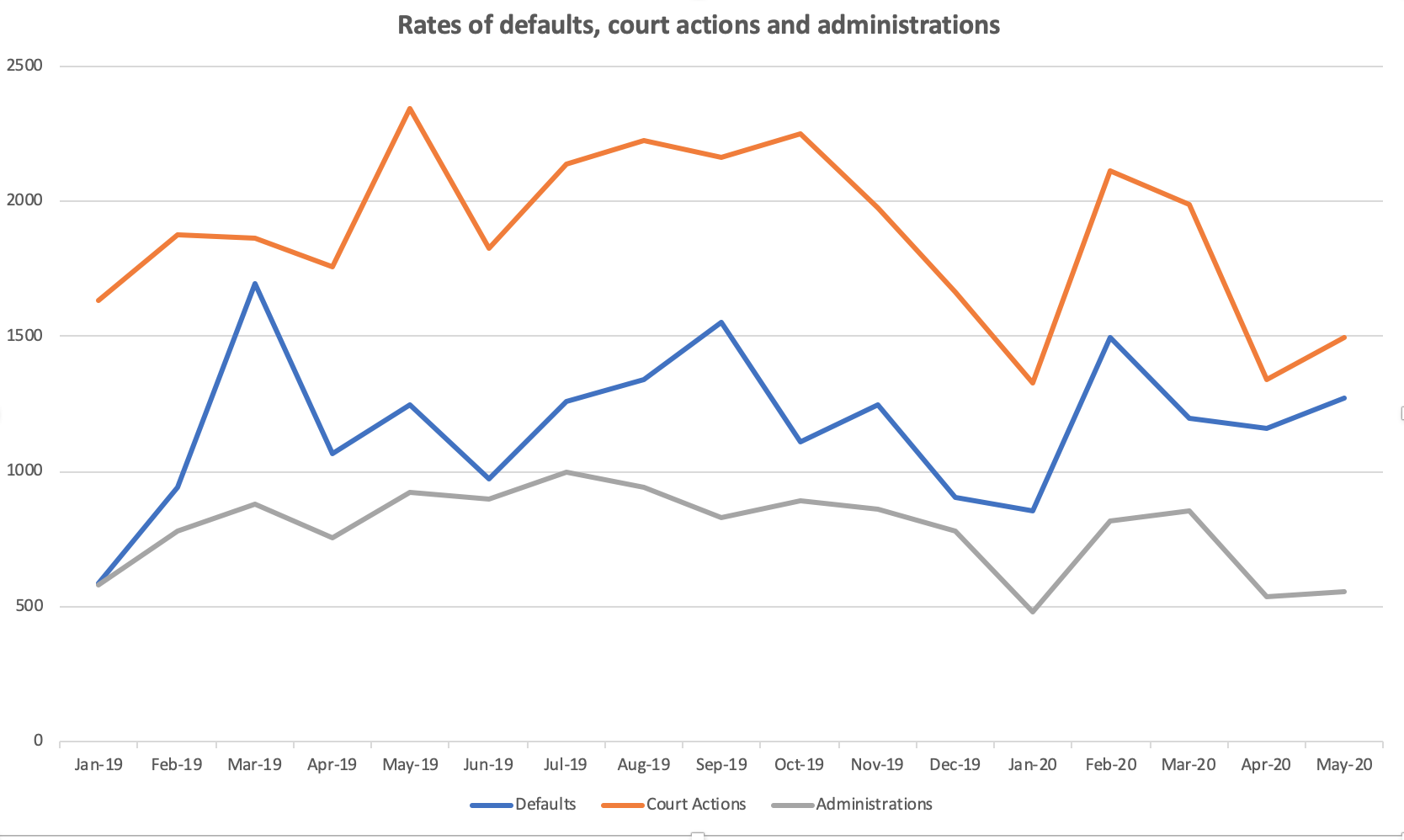

According to CreditorWatch unique data insights for May, a 9.5% increase in defaults was recorded. Court actions and administrations also recorded an uptick at 11.5% and 3.9% respectively.

“The uptick in SME defaults is a warning sign that insolvencies will also increase,” says CreditorWatch’s CEO Patrick Coghlan.

Administrations in April and May were 36% and 34.1% percent below the average for 2019, indicating that approximately 300 companies per month have stayed in business that would have otherwise folded in more normal conditions.

These ‘zombie companies’ are in addition to the inevitable increase of business closures this year as a result of the economic recession.

The AFR reported the insolvency sector is “ill-equipped to deal with the tsunami of insolvencies” that will inevitably ravage the economy after relief packages cease.

Patrick Coghlan also raised his concerns that the sudden end of these relief packages will need some relief of their own. “I’m calling on the government to create an administration service and consider lifting safe harbour measures gradually to flatten the insolvency curve.”

Creditors’ leniency dims as they fight to keep their own lights on

CreditorWatch’s data also showed a decline in payment defaults in March and April by 20% and 3% respectively. Creditors have heeded an unspoken call of solidarity with fellow businesses. They’ve been more inclined to give the benefit of the doubt – until now. From April to May, payment defaults have increased by 9.5% and the likelihood is they will continue to do so. Payment defaults are one of the early warning signs of a business on the road to administration.

Court actions have also recorded an 11.5% increase in May after a lull in March and April. Patrick Coghlan says, “Companies have held off taking customers to court on defaulting payments due to the exceptional circumstances. Since Safe Harbour has increased the bankruptcy debt limit from $5,000 to $20,000, businesses are surviving without the cashflow to cover their outgoings.”

Business owners and directors are waking up to a harsh new reality

For another three months, company directors are exempt from personal liability for trading insolvent. Ignorance is bliss for now, but decisions will eventually need to be made as to whether or not their business is still financially viable.

Our best advice? Don’t delay. Reach out to insolvency and business restructuring experts for tailored advice now rather than wait until it’s too late.

ASIC, Australia’s corporate, markets and financial services regulator, also has useful advice for SMEs that are struggling financially during COVID-19.