RBA to cut interest rates by 0.25% in July; Insolvencies continue to plateau at elevated levels

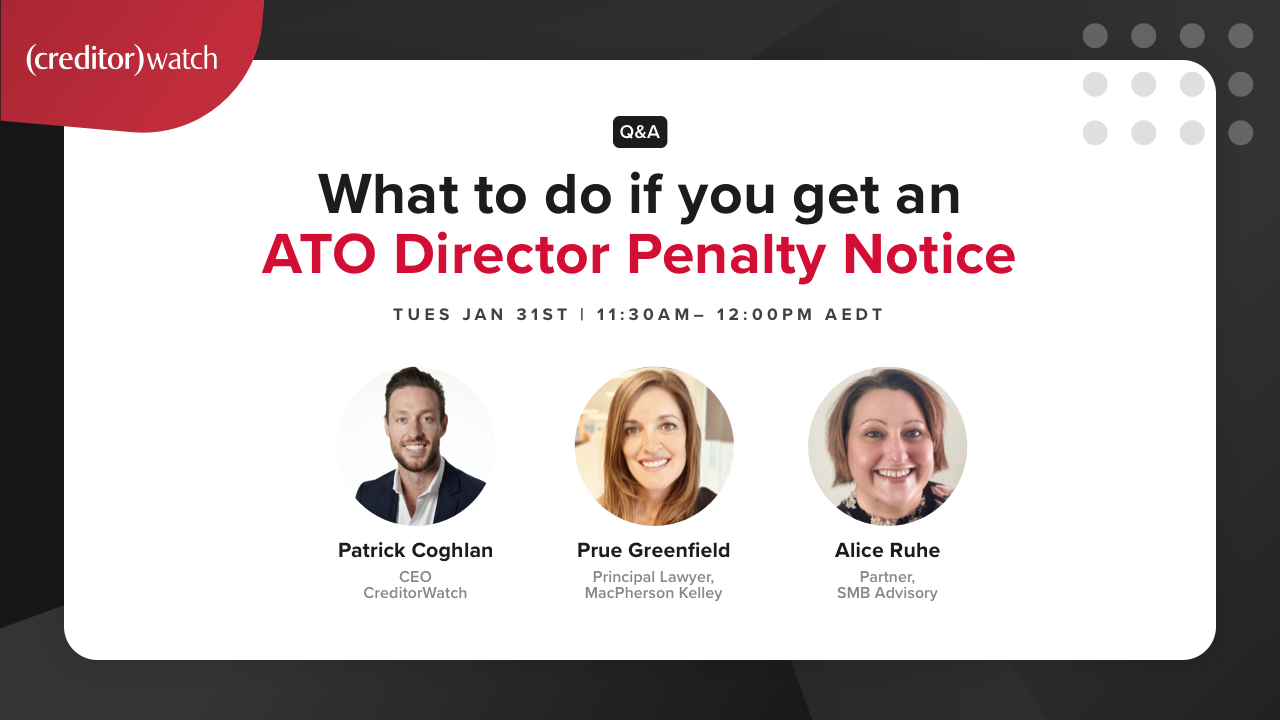

Tariff-related uncertainties and gyrations in markets took a back seat to a significant step up in geopolitical tensions and military conflict in the Middle East in June. Like the April tariff announcements, which were relatively quickly reversed or paused temporarily, the hostilities between Iran and Israel also relatively quickly de-escalated into a ceasefire following the US‘s targeted attacks on Iran’s nuclear facilities.

Jun 30, 2025